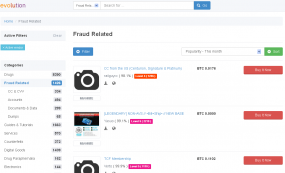

The Evolution Market, an online black market that sells everything contraband — from marijuana, heroin and ecstasy to stolen identities and malicious hacking services — appears to have vanished in the last 24 hours with little warning. Much to the chagrin of countless merchants hawking their wares in the underground market, the curators of the project have reportedly absconded with the community’s bitcoins — a stash that some Evolution merchants reckon is worth more than USD $12 million.

Reachable only via the Tor network (a.k.a. the “dark web” or “darknet”), Evolution Market quickly emerged as the go-to online bazaar for buyers and sellers of illicit goods following the shutdown of the infamous Silk Road marketplaces in 2013 and again late last year.

Evolution operates on an escrow system, allowing buyers and sellers to more confidently and successfully consummate sales of dodgy goods. But that means the market’s administrators at any given time have direct access to a tempting amount of virtually untraceable currency.

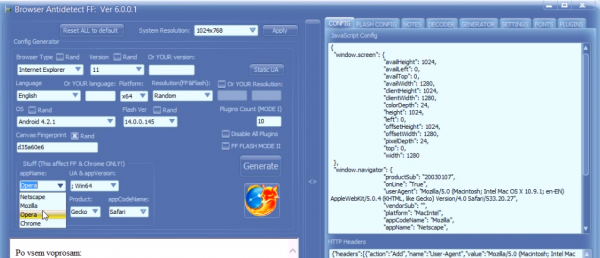

Denizens of the darkweb community say the moderators in charge of Evolution (known as just “Evo” by vendors and buyers alike) had in the past few days instituted long delays in responding to and processing withdrawal requests from the marketplace’s myriad vendors.

According to chatter from the Evolution discussion page on Reddit, Evo’s administrators — who go by the handles “Kimble” and “Verto” — initially blamed the delays on an unexpected influx of huge withdrawal requests that the community’s coffers could not satisfy all at once. The administrators assured anxious vendors that the issue would be resolved within 24 hours.

But before that 24 hours could elapse, the Evo community — its marketplace and user discussion forum — went offline. Now, volunteer moderators from those communities are posting to Reddit that the administrators have “exit scammed,” — essentially taken all the money and run. Continue reading