Two former security employees at Intuit — the makers of the popular tax preparation software and service TurboTax — allege that the company has made millions of dollars knowingly processing state and federal tax refunds filed by cybercriminals. Intuit says it leads the industry in voluntarily reporting suspicious returns, and that ultimately it is up to the Internal Revenue Service to develop industry-wide requirements for tax preparation firms to follow in their fight against the multi-billion dollar problem of tax refund fraud.

Last week, KrebsOnSecurity published an exclusive interview with Indu Kodukula, Intuit’s chief information security officer. Kodukula explained that customer password re-use was a major cause of a spike this tax season in fraudulent state tax refund requests. The increase in phony state refund requests prompted several state revenue departments to complain to their state attorneys general. In response, TurboTax temporarily halted all state filings while it investigated claims of a possible breach. The company resumed state filing shortly after that pause, saying it could find no evidence that customers’ TurboTax credentials had been stolen from its network.

Kodukula noted that although the incidence of hijacked, existing TurboTax accounts was rapidly growing, the majority of refund scams the company has to deal with stem from “stolen identity refund fraud” or SIRF. In SIRF, the thieves gather pieces of data about taxpayers from outside means — through phishing attacks or identity theft services in the underground, for example — then create accounts at TurboTax in the victims’ names and file fraudulent tax refund claims with the IRS.

Kodukula cast Intuit as an industry leader in helping the IRS identify and ultimately deny suspicious tax returns. But that portrayal only tells part of the story, according to two former Intuit employees who until recently each held crucial security positions helping the company identify and fight tax fraud. Both individuals described a company that has intentionally dialed back efforts to crack down on SIRF so as not to lose market share when fraudsters began shifting their business to Intuit’s competitors.

Robert Lee, a security business partner at Intuit’s consumer tax group until his departure from the company in July 2014, said he and his team at Intuit developed sophisticated fraud models to help Intuit quickly identify and close accounts that were being used by crooks to commit massive amounts of SIRF fraud.

But Lee said he was mystified when Intuit repeatedly refused to adopt some basic policies that would make it more costly and complicated for fraudsters to abuse the company’s service for tax refund fraud, such as blocking the re-use of the same Social Security number across a certain number of TurboTax accounts, or preventing the same account from filing more than a small number of tax returns.

“If I sign up for an account and file tax refund requests on 100 people who are not me, it’s obviously fraud,” Lee said in an interview with KrebsOnSecurity. “We found literally millions of accounts that were 100 percent used only for fraud. But management explicitly forbade us from either flagging the accounts as fraudulent, or turning off those accounts.”

The allegations surface just days after Senate Finance Committee Chairman Orrin Hatch (R., Utah) said his panel will be holding hearings on reports about a spike in fraudulent filings through TurboTax and elsewhere. The House Ways and Means Committee is reportedly looking into the matter and has held bipartisan staff-level discussions with the IRS and Intuit.

The Federal Trade Commission (FTC) said it received 332,646 identity theft complaints in the calendar year 2014, and that almost one-third of them — the largest portion — were tax-related identity theft complaints. Tax identity theft has been the largest ID theft category for the last five years.

According to a recent report (PDF) from the U.S. Government Accountability Office (GAO), the IRS estimated it prevented $24.2 billion in fraudulent identity theft refunds in 2013. Unfortunately, the IRS also paid $5.8 billion that year for refund requests later determined to be fraud. The GAO noted that because of the difficulties in knowing the amount of undetected fraud, the actual amount could far exceed those estimates.

SQUEEZING THE BALLOON

Lee said the scammers who hijack existing TurboTax accounts most often will use stolen credit cards to pay the $25-$50 TurboTax fee for processing and sending the refund request to the IRS.

But he said the crooks perpetrating SIRF typically force the IRS — and, by extension, U.S. taxpayers — to cover the fee for their bogus filings. That’s because most SIRF filings take advantage of what’s known in the online tax preparation business as a ‘refund transfer’, which deducts TurboTax’s filing fee from the total amount of the fraudulent refund request. If the IRS then approves the fraudulent return, TurboTax gets paid.

“The reason fraudsters love this system is because they don’t even have to use stolen credit cards to do it,” Lee said. “What’s really going on here is that the fraud business is actually profitable for Intuit.”

Lee confirmed Kodukula’s narrative that Intuit is an industry leader in sending the IRS regular reports about tax returns that appear suspicious. But he said the company eventually scaled back those reports after noticing that the overall fraud the IRS was reporting wasn’t decreasing as a result of Intuit’s reporting: Fraudsters were simply taking their business to Intuit’s competitors.

“We noticed the IRS started taking action, and because of this, we started to see not only our fraud numbers but also our revenue go down before the peak of tax season a couple of years ago,” Lee recalled. “When we stopped or delayed sending those fraud numbers, we saw the fraud and our revenue go back up.”

Lee said that early on, the reports on returns that Intuit’s fraud teams flagged as bogus were sent immediately to the IRS.

“Then, there was a time period where we didn’t deliver that information at all,” he said. “And then at one point there was a two-week delay added between the time the information was ready and the time it was submitted to the IRS. There was no technical reason for that delay, but I can only speculate what the real justification for that was.”

KrebsOnSecurity obtained a copy of a recording made of an internal Intuit conference call on Oct. 14, 2014, in which Michael Lyons, TurboTax’s deputy general counsel, describes the risks of the company being overly aggressive — relative to its competitors — in flagging suspicious tax returns for the IRS.

“As you can imagine, the bad guys being smart and savvy, they saw this and noticed it, they just went somewhere else,” Lyons said in the recording. “The amount of fraudulent activity didn’t change. The landscape didn’t change. It was like squeezing a balloon. They recognized that TurboTax returns were getting stopped at the door. So they said, ‘We’ll just go over to H&R Block, to TaxSlayer or TaxAct, or whatever.’ And all of a sudden we saw what we call ‘multi-filer activity’ had completely dropped off a cliff but the amount that the IRS reported coming through digital channels and through their self reported fraud network was not changing at all. The bad guys had just gone from us to others.”

That recording was shared by Shane MacDougall, formerly a principal security engineer at Intuit. MacDougall resigned from the company last week and filed an official whistleblower complaint with the U.S. Securities and Exchange Commission, alleging that the company routinely placed profits ahead of ethics. MacDougall submitted the recording in his filing with the SEC.

“Complainant repeatedly raised issues with managers, directors, and even [a senior vice president] of the company to try to rectify ongoing fraud, but was repeatedly rebuffed and told Intuit couldn’t do anything that would ‘hurt the numbers’,” MacDougall wrote in his SEC filing. “Complainant repeatedly offered solutions to help stop the fraud, but was ignored.”

NO RULES OF THE ROAD

For its part, Intuit maintains that it is well out in front of its competitors in voluntarily reporting to the IRS refund requests that the company has flagged as suspicious. The company also stresses that it has done so even though the IRS still has not promulgated rules that require TurboTax and its competitors to report suspicious returns — or even how to report such activity. Intuit executives say they went to the IRS three years ago to request specific authority to share that information. The IRS did not respond to requests for comment.

Intuit officials declined to address Lyons’ recorded comments specifically, although they did confirm that a company attorney led an employee WebEx meeting on the date the recording was made. But David Williams, Intuit’s chief tax officer, said what’s missing from the recorded conversation excerpted above is that Intuit has been at the forefront of asking the IRS to propose industry standards that every industry player can follow — requests that have so far gone unheeded.

“We have led the industry in making suspicious activity reports, and I’d venture to say that virtually all of the returns that Mr. Lee is quoted as referring to appear in our suspicious activity reports and are stopped by the IRS,” Williams said. “Whatever else Mr. Lee may have seen, I’m not buying the premise that somehow there was a profit motive in it for us.”

Robert Lanesey, Inuit’s chief communications officer, said Intuit doesn’t make a penny on tax filings that are ultimately rejected by the IRS.

“Revenue that comes from reports included in our suspicious activity reports to the IRS has dropped precipitously as we have changed and improved our reporting mechanisms,” Lanesey said. “When it comes to market share, it doesn’t count toward our market share unless it’s a successful return. We’ve gotten better and we’ve gotten more accurate, but it’s not about money.”

Williams added that it is not up to Intuit to block returns from being filed, and that it is the IRS’s sole determination whether to process a given refund request.

“We will flag them as suspicious, but we do not get to determine if a return is fraud,” Williams said. “It’s the IRS’s responsibility and ultimately they make that decision. What I will tell you is that of the ones we report as suspicious, the IRS rejects a very high percentage, somewhere in the 80-90 percent range.”

Earlier this month, Intuit CEO Brad Smith sent a letter to the commissioner of the IRS, noting that while Intuit sends reports to the IRS when it sees patterns of suspicious behavior, the government has been limited in the types of information it can share with parties, including tax-preparation firms.

“The IRS could be the convener to bring the States together to help drive common standards adoption,” Smith wrote, offering the assistance of Intuit staff members “to work directly with the IRS and the States in whatever ways may be of assistance…as the fight against fraud goes forward.”

ZERO FALSE POSITIVES

Lee and MacDougall both said Intuit’s official approach to fighting fraud is guided by a policy of zero tolerance for so-called “false positives” — the problem of incorrectly flagging a legitimate customer refund request as suspicious, and possibly incurring the double whammy of a delay in the customer’s refund and an inquiry by the IRS. This is supported by audio recordings of conference calls between Intuit’s senior executives that were shared with KrebsOnSecurity.

“We protect the sanctity of the customer experience and hold it as inviolate,” Intuit’s General

Counsel Michael Lyons can be heard saying on a recorded October 2014 internal conference call. “We do everything we can to organize the best screening program we can, but we avoid false positives at all costs. Because getting a legitimate taxpayer ensnared in the ‘you’re a bad guy’ area with the IRS is hell. Once your return gets flagged as suspicious, rejected and the IRS starts investigating, you’re not in a good place. More than 50 percent of people out there are living paycheck to paycheck, and when this is the biggest paycheck of the year for them, they can’t afford to get erroneously flagged as fraud and have to prove to the IRS who they are so that they can get that legitimate refund that they were expecting months ago.”

On the same conference call, MacDougall can be heard asking Lyons why the company wouldn’t want to use security as a way to set the company apart from its competitors in the online tax preparation industry.

Continue reading →

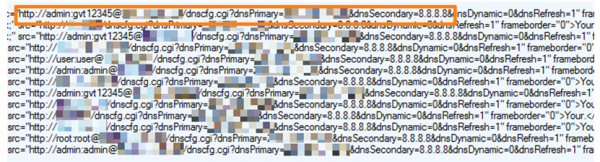

The government alleges the defendants made more than $2 million blasting out spam to more than one billion email addresses stolen from several email service providers (ESPs), companies that manage customer email marketing on behalf of major corporate brands. The indictments further allege that the men sent the junk missives by hijacking the email servers used by these ESPs.

The government alleges the defendants made more than $2 million blasting out spam to more than one billion email addresses stolen from several email service providers (ESPs), companies that manage customer email marketing on behalf of major corporate brands. The indictments further allege that the men sent the junk missives by hijacking the email servers used by these ESPs.