In a win for Internet trolls and teenage cybercriminals everywhere, a Finnish court has decided not to incarcerate a 17-year-old found guilty of more than 50,000 cybercrimes, including data breaches, payment fraud, operating a huge botnet and calling in bomb threats, among other violations.

As the Finnish daily Helsingin Sanomat reports, Julius Kivimäki — a.k.a. “Ryan” and “Zeekill” — was given a two-year suspended sentence and ordered to forfeit EUR 6,558.

Kivimaki vaulted into the media spotlight late last year when he claimed affiliation with the Lizard Squad, a group of young hooligans who knocked offline the gaming networks of Microsoft and Sony for most of Christmas Day.

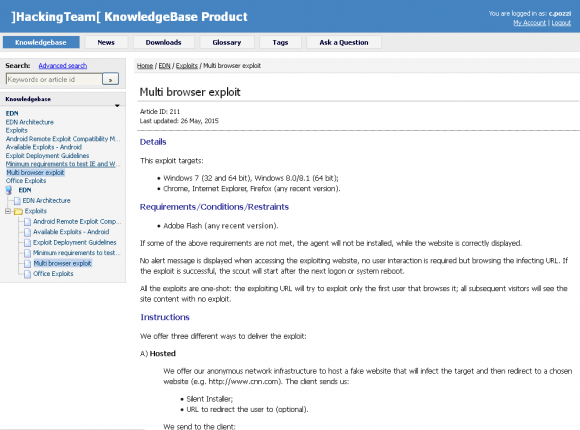

According to the BBC, evidence presented at Kivimaki’s trial showed that he compromised more than 50,000 computer servers by exploiting vulnerabilities in Adobe’s Cold Fusion web application software. Prosecutors also said Kivimaki used stolen credit cards to buy luxury goods and shop vouchers, and participated in a money laundering scheme that he used to fund a trip to Mexico.

Kivimaki allegedly also was involved in calling in multiple fake bomb threats and “swatting” incident — reporting fake hostage situations at an address to prompt a heavily armed police response to that location. DailyDot quotes Blair Strater, a victim of Kivimaki’s swatting and harassment, who expressed disgust at the Finnish ruling.

Speaking with KrebsOnSecurity, Strater called Kivimaki “a dangerous sociopath” who belongs behind bars.

Although it did not factor into his trial, sources close to the Lizard Squad investigation say Kivimaki also was responsible for making an August 2014 bomb threat against former Sony Online Entertainment President John Smedley that grounded an American Airlines plane. That incident was widely reported to have started with a tweet from the Lizard Squad, but Smedley and others say it started with a call from Kivimaki.

In a phone interview, Smedley said he was disappointed that the judicial system in Finland didn’t do more.

“I personally got to listen to a recording of him calling in to American Airlines, and I know it was him because I talked to him myself,” Smedley said. “He’s done all kinds of bad stuff to me, including putting all of my information out on the Internet. He even attempted to use my credit numerous times. The harassment literally just did not stop.”

In an online interview with KrebsOnSecurity, Kivimaki denied involvement with the American Airlines incident, and said he was not surprised by the leniency shown by the court in his trial.

“During the trial it became apparent that nobody suffered significant (if any) damages because of the alleged hacks,” he said.

The danger in a decision such as this is that it emboldens young malicious hackers by reinforcing the already popular notion that there are no consequences for cybercrimes committed by individuals under the age of 18.

Case in point: Kivimaki is now crowing about the sentence; He’s changed the description on his Twitter profile to “Untouchable hacker god.” The Twitter account for the Lizard Squad tweeted the news of Kivimaki’s non-sentencing triumphantly: “All the people that said we would rot in prison don’t want to comprehend what we’ve been saying since the beginning, we have free passes.” Continue reading