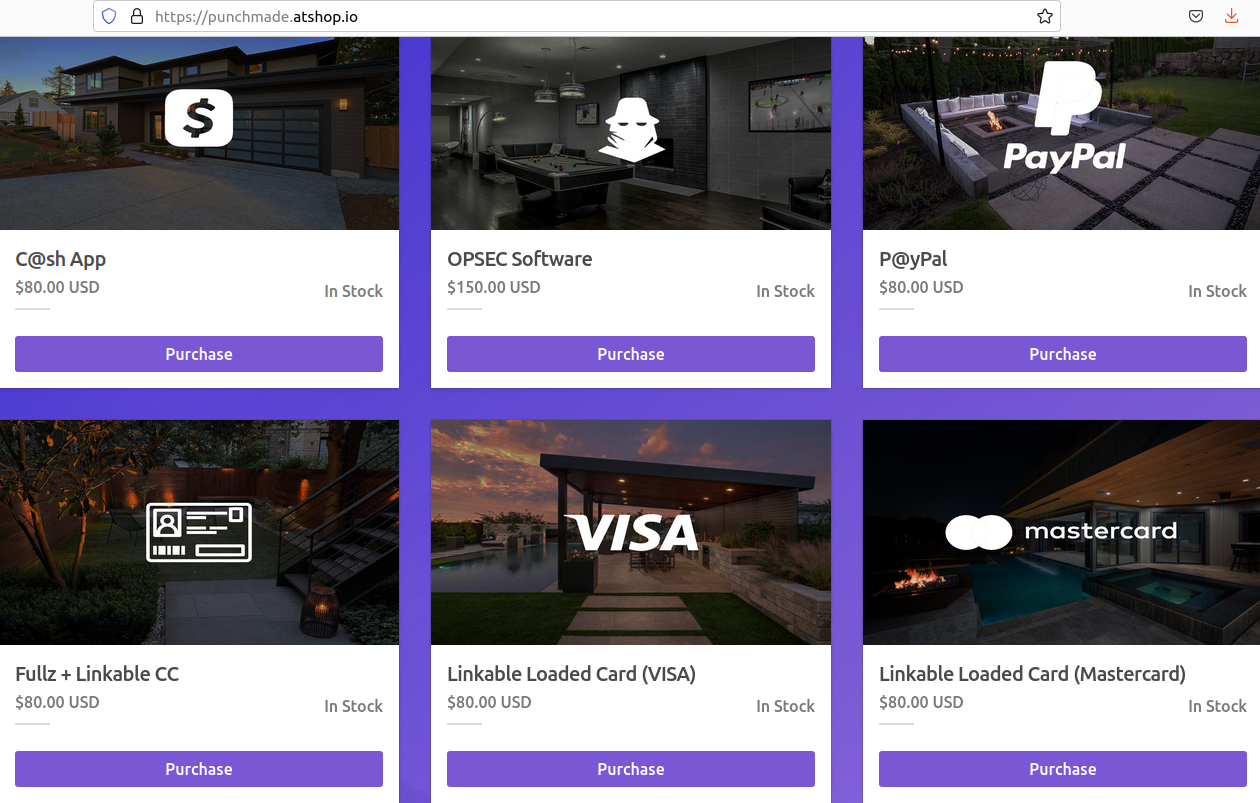

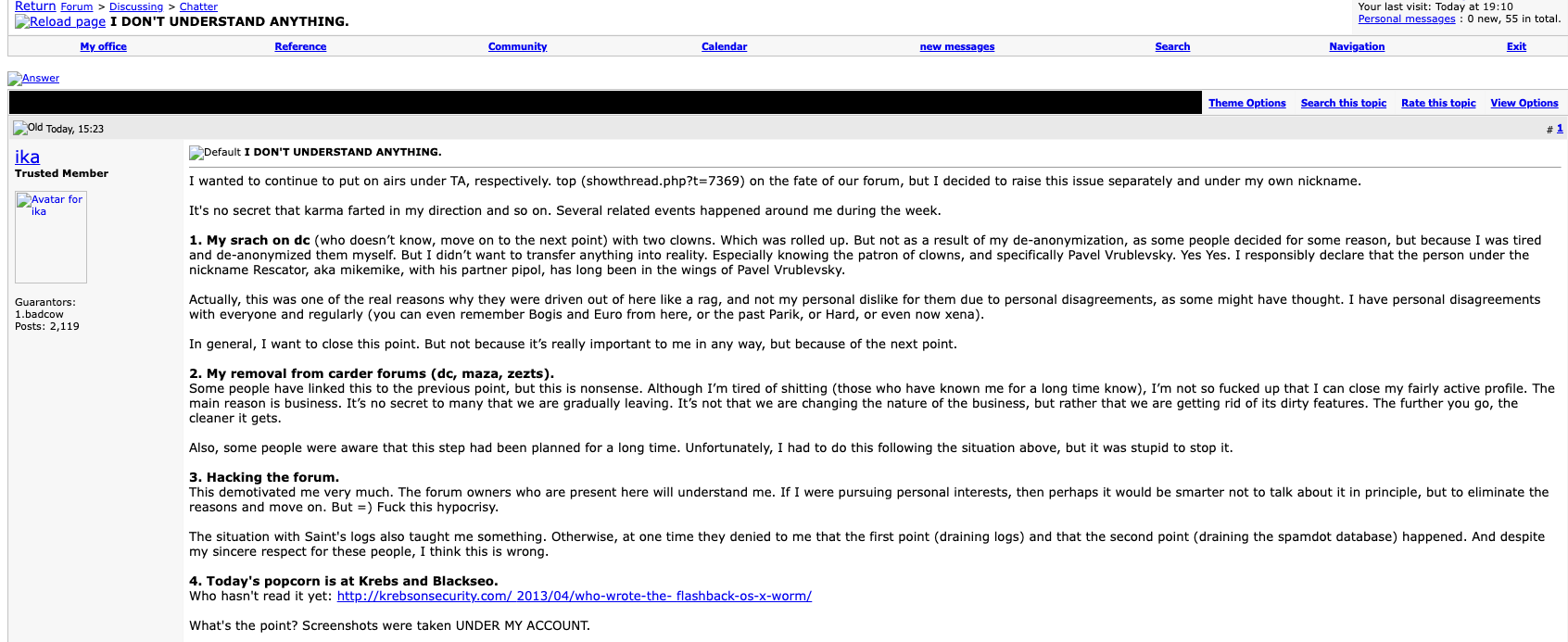

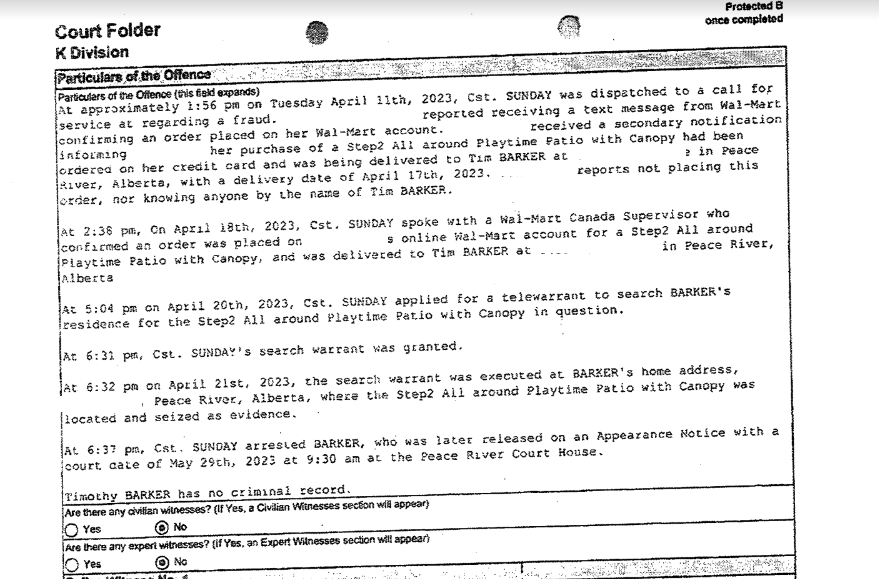

A Canadian man who says he’s been falsely charged with orchestrating a complex e-commerce scam is seeking to clear his name. His case appears to involve “triangulation fraud,” which occurs when a consumer purchases something online — from a seller on Amazon or eBay, for example — but the seller doesn’t actually own the item for sale. Instead, the seller purchases the item from an online retailer using stolen payment card data. In this scam, the unwitting buyer pays the scammer and receives what they ordered, and very often the only party left to dispute the transaction is the owner of the stolen payment card.

Triangulation fraud. Image: eBay Enterprise.

Timothy Barker, 56, was until recently a Band Manager at Duncan’s First Nation, a First Nation in northwestern Alberta, Canada. A Band Manager is responsible for overseeing the delivery of all Band programs, including community health services, education, housing, social assistance, and administration.

Barker told KrebsOnSecurity that during the week of March 31, 2023 he and the director of the Band’s daycare program discussed the need to purchase items for the community before the program’s budget expired for the year.

“There was a rush to purchase items on the Fiscal Year 2023 timeline as the year ended on March 31,” Barker recalled.

Barker said he bought seven “Step2 All Around Playtime Patio with Canopy” sets from a seller on Amazon.ca, using his payment card on file to pay nearly $2,000 for the items.

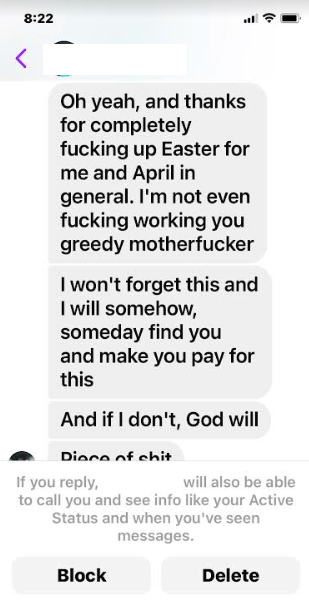

On the morning of April 7, Barker’s Facebook account received several nasty messages from an Ontario woman he’d never met. She demanded to know why he’d hacked her Walmart account and used it to buy things that were being shipped to his residence. Barker shared a follow-up message from the woman, who later apologized for losing her temper.

One of several messages from the Ontario woman whose Walmart account was used to purchase the goods that Barker ordered from Amazon.

“If this is not the person who did this to me, I’m sorry, I’m pissed,” the lady from Ontario said. “This order is being delivered April 14th to the address above. If not you, then someone who has the same name. Now I feel foolish.”

On April 12, 2023, before the Amazon purchases had even arrived at his home, Barker received a call from an investigator with the Royal Canadian Mounted Police (RCMP), who said Barker urgently needed to come down to the local RCMP office for an interview related to “an investigation.” Barker said the officer wouldn’t elaborate at the time on the nature of the investigation, and that he told the officer he was in Halifax for several days but could meet after his return home.

According to Barker, the investigator visited his home anyway the following day and began questioning his wife, asking about his whereabouts, his work, and when he might return home.

On April 14, six boxes arrived to partially fulfill his Amazon order; another box was delayed, and the Amazon.ca seller he’d purchased from said the remaining box was expected to ship the following week. Barker said he was confused because all six boxes came from Walmart instead of Amazon, and the shipping labels had his name and address on them but carried a contact phone number in Mexico.

Three days later, the investigator called again, demanding he submit to an interview.

“He then asked where my wife was and what her name is,” Barker said. “He wanted to know her itinerary for the day. I am now alarmed and frightened — this doesn’t feel right.”

Barker said he inquired with a local attorney about a consultation, but that the RCMP investigator showed up at his house before he could speak to the lawyer. The investigator began taking pictures of the boxes from his Amazon order.

“The [investigator] derisively asked why would anyone order so many play sets?” Barker said. “I started to give the very logical answer that we are helping families improve their children’s home life and learning for toddlers when he cut me off and gave the little speech about giving a statement after my arrest. He finally told me that he believes that I used someone’s credit card in Ontario to purchase the Walmart products.”

Eager to clear his name, Barker said he shared with the police copies of his credit card bills and purchase history at Amazon. But on April 21, the investigator called again to say he was coming to arrest Barker for theft.

“He said that if I was home at five o’clock then he would serve the papers at the house and it would go easy and I wouldn’t have to go to the station,” Barker recalled. “If I wasn’t home, then he would send a search team to locate me and drag me to the station. He said he would kick the door down if I didn’t answer my phone. He said he had every right to break our door down.”

Barker said he briefly conferred with an attorney about how to handle the arrest. Later that evening, the RCMP arrived with five squad cars and six officers.

“I asked if handcuffs were necessary – there is no danger of violence,” Barker said. “I was going to cooperate. His response was to turn me around and cuff me. He walked me outside and stood me beside the car for a full 4 or 5 minutes in full view of all the neighbors.”

Barker believes he and the Ontario woman are both victims of triangulation fraud, and that someone likely hacked the Ontario woman’s Walmart account and added his name and address as a recipient.

But he says he has since lost his job as a result of the arrest, and now he can’t find new employment because he has a criminal record. Barker’s former employer — Duncan’s First Nation — did not respond to requests for comment.

“In Canada, a criminal record is not a record of conviction, it’s a record of charges and that’s why I can’t work now,” Barker said. “Potential employers never find out what the nature of it is, they just find out that I have a criminal arrest record.” Continue reading