Most Internet users are familiar with the concept of updating software that resides on their computers. But this past week has seen alerts about an unusual number of vulnerabilities and attacks against some important and ubiquitous hardware devices, from consumer-grade Internet routers, data storage and home automation products to enterprise-class security solutions.

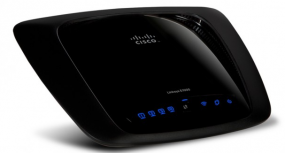

Last week, the SANS Internet Storm Center began publishing data about an ongoing attack from self-propagating malware that infects some home and small-office wireless routers from Linksys. The firewall built into routers can be a useful and hearty first line of protection against online attacks, because its job is to filter out incoming traffic that the user behind the firewall did not initiate. But things get dicier when users enable remote administration capability on these powerful devices, which is where this malware comes in.

Last week, the SANS Internet Storm Center began publishing data about an ongoing attack from self-propagating malware that infects some home and small-office wireless routers from Linksys. The firewall built into routers can be a useful and hearty first line of protection against online attacks, because its job is to filter out incoming traffic that the user behind the firewall did not initiate. But things get dicier when users enable remote administration capability on these powerful devices, which is where this malware comes in.

The worm — dubbed “The Moon” — bypasses the username and password prompt on affected devices. According to Ars Technica’s Dan Goodin, The Moon has infected close to 1,000 Linksys E1000, E1200 and E2400 routers, although the actual number of hijacked devices worldwide could be higher and is likely to climb. In response, Linksys said the worm affects only those devices that have the Remote Management Access feature enabled, and that Linksys ships these products with that feature turned off by default. The Ars Technica story includes more information about how to tell whether your router may be impacted. Linksys says it’s working on an official fix for the problem, and in the meantime users can block this attack by disabling the router’s remote management feature.

Similarly, it appears that some ASUS routers — and any storage devices attached to them — may be exposed to anyone online without the need of login credentials if users have taken advantage of remote access features built into the routers, according to this Ars piece from Feb. 17. The danger in this case is with Asus router models including RT-AC66R, RT-AC66U, RT-N66R, RT-N66U, RT-AC56U, RT-N56R, RT-N56U, RT-N14U, RT-N16, and RT-N16R. Enabling any of the (by-default disabled) “AiCloud” options on the devices — such as “Cloud Disk” and “Smart Access” — opens up a potentially messy can of worms. More details on this vulnerability are available at this SecurityFocus writeup.

ASUS reportedly released firmware updates last week to address these bugs. Affected users can find the latest firmware updates and instructions for updating their devices by entering the model name/number of the device here. Alternatively, consider dumping the stock router firmware in favor of something more flexible, less buggy amd most likely more secure (see this section at the end of this post for more details).

YOUR LIGHTSWITCH DOES WHAT?

Outfitting a home or office with home automation tools that let you control and remotely monitor electronics can quickly turn into a fun and addictive (if expensive) hobby. But things get somewhat more interesting when the whole setup is completely exposed to anyone on the Internet. That’s basically what experts at IOActive found is the case with Belkin‘s WeMo family of home automation devices.

According to research released today, multiple vulnerabilities in these WeMo Home Automation tools give malicious hackers the ability to remotely control the devices over the Internet, perform malicious firmware updates, and access an internal home network. From IOActive’s advisory (PDF):