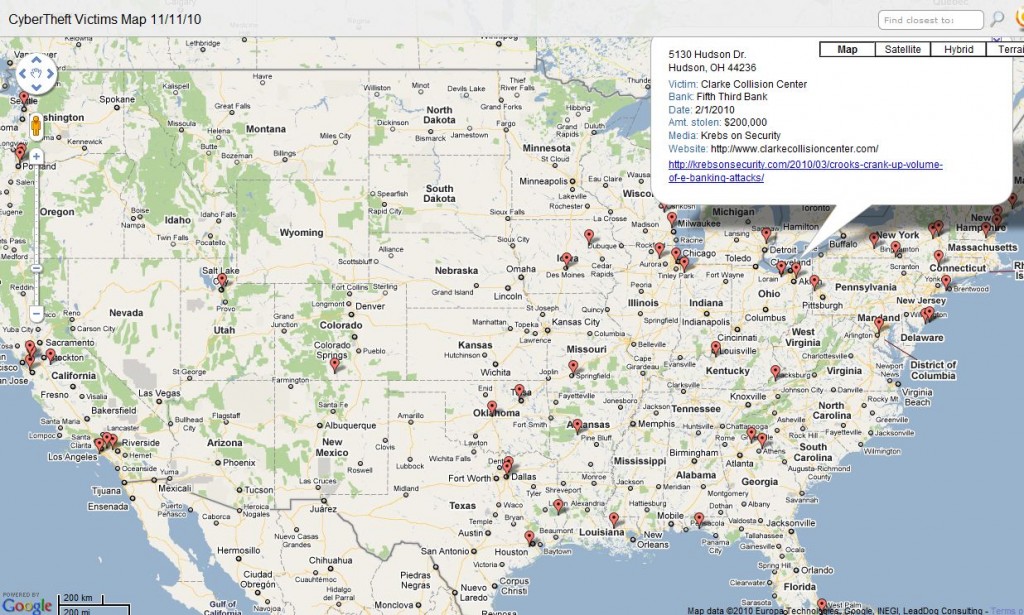

An escrow firm in Missouri is suing its bank to recover $440,000 that organized cyber thieves stole in an online robbery earlier this year, claiming the bank’s reliance on passwords to secure high-dollar transactions failed to measure up to federal e-banking security guidelines.

The attack against Springfield, Mo. based title insurance provider Choice Escrow and Land Title LLC began late in the afternoon on St. Patrick’s Day, when hackers who had stolen the firm’s online banking ID and password used the information to make a single unauthorized wire transfer for $440,000 to a corporate bank account in Cyprus.

The following day, when Choice Escrow received a notice about the transfer from its financial institution — Tupelo, Miss. based BancorpSouth Inc. — it contacted the bank to dispute the transfer. But by the close of business on March 18, the bank was distancing itself from the incident and its customer, said Jim A. Payne, director of business development for Choice Escrow.

“They said, ‘We’re going to get back to you, we’re working on it’,” Payne said. “What they really were doing is contacting their legal department and figuring out what they were going to say to us. It took them until 5 p.m. to call us back, and they basically said, ‘Sorry, we can’t help you. This is your responsibility.'”

A spokesman for BancorpSouth declined to discuss the bank’s security measures or the specifics of this case, saying the institution does not comment on ongoing litigation.

According to documents filed today with the Circuit Court of Greene County, Mo., BancorpSouth’s most secure option for Internet-based authentication requires the customer to have one user ID and password to approve a wire transfer and another user ID and password to release the same wire transfer. The other option — if the customer waives or does not choose dual control — requires one user ID and password to both approve and release a wire transfer.

Choice Escrow’s lawyers argue that because BancorpSouth allowed wire or funds transfers using two options which were both password-based, its commercial online banking security procedures fell short of 2005 guidance from the Federal Financial Institutions Examination Council (FFIEC), which warned that single-factor authentication as the only control mechanism is inadequate for high-risk transactions involving the movement of funds to other parties.

“BancorpSouth should have, and could have, offered a commercially reasonable multifactor authentication method, since it had ample time (more than four years, October 2005 to March 2010) and knowledge of the need and requirement to provide its customers with secure authentication methods, as evidenced from the numerous documents it received, and/or knew about or should have known about, from the FFIEC and FDIC,” the complaint charges.