Recently, I found a guy on an exclusive online scammer forum who has been hawking a variety of paraphernalia used in ATM skimmers, devices designed to be stuck on the outside of cash machines and to steal ATM card and PIN data from bank customers. I wasn’t sure whether I could take this person seriously, but his ratings on the forum — in which buyers and sellers leave feedback for each other based on positive or negative experiences from previous transactions — were good enough that I figured he must be one of the few people on this particular forum actually selling ATM skimmers, as opposed to just lurking there to scam fellow scammers.

Also, this seller’s profile showed that he was a longtime member, and had been vouched for as a “verified” vendor. This meant that forum administrators had vetted him by checking his reputation on other fraud forums, and that he’d paid a fee to use its escrow service if any potential buyers insisted.

Anyway, I wasn’t looking to purchase his skimmers, just to check out his wares. I chatted him up on ICQ, and he said he only sold the plastic housings for the skimmer devices, but that he could show me pictures and videos of what some of his customers had done with them. Above is a video of the seller demonstrating how one of his card skimmer housings fits over the mouth of the card slot on a working Diebold Aptiva ATM.

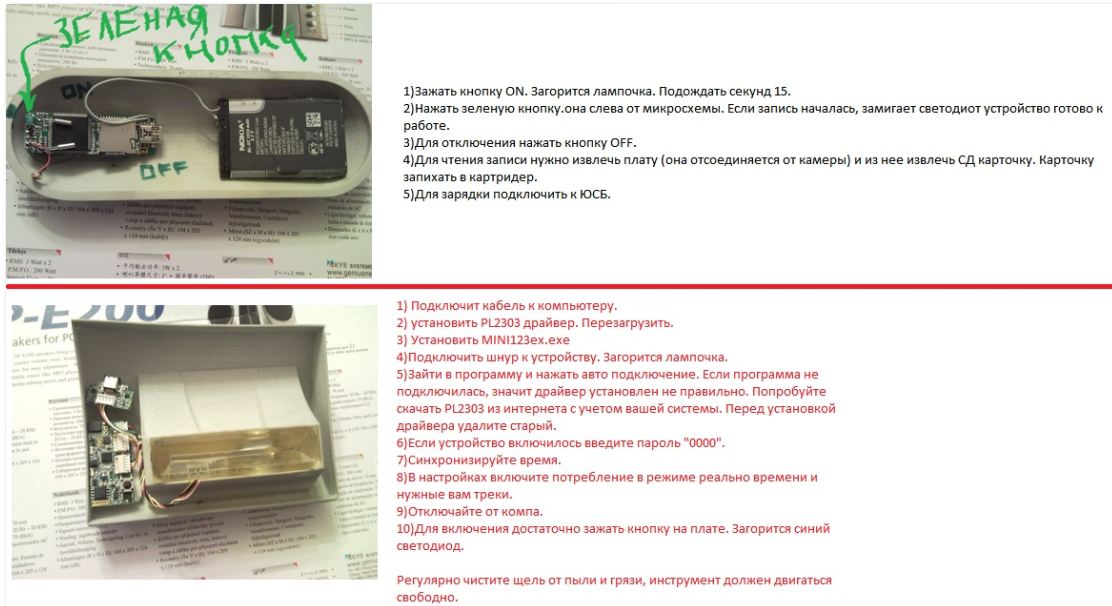

Below are images he sent that demonstrate two very different skimmers made with his housings. The device on the top in the picture below is a flash-based spy camera nested in a beige plastic molding meant to be attached directly above the ATM PIN pad to steal the customer’s personal identification number. The image on the bottom is the skimmer itself. To the right of each are instructions for configuring the skimmer devices and for harvesting the stolen data stored on them.