In March 2020, KrebsOnSecurity alerted Swedish security giant Gunnebo Group that hackers had broken into its network and sold the access to a criminal group which specializes in deploying ransomware. In August, Gunnebo said it had successfully thwarted a ransomware attack, but this week it emerged that the intruders stole and published online tens of thousands of sensitive documents — including schematics of client bank vaults and surveillance systems.

The Gunnebo Group is a Swedish multinational company that provides physical security to a variety of customers globally, including banks, government agencies, airports, casinos, jewelry stores, tax agencies and even nuclear power plants. The company has operations in 25 countries, more than 4,000 employees, and billions in revenue annually.

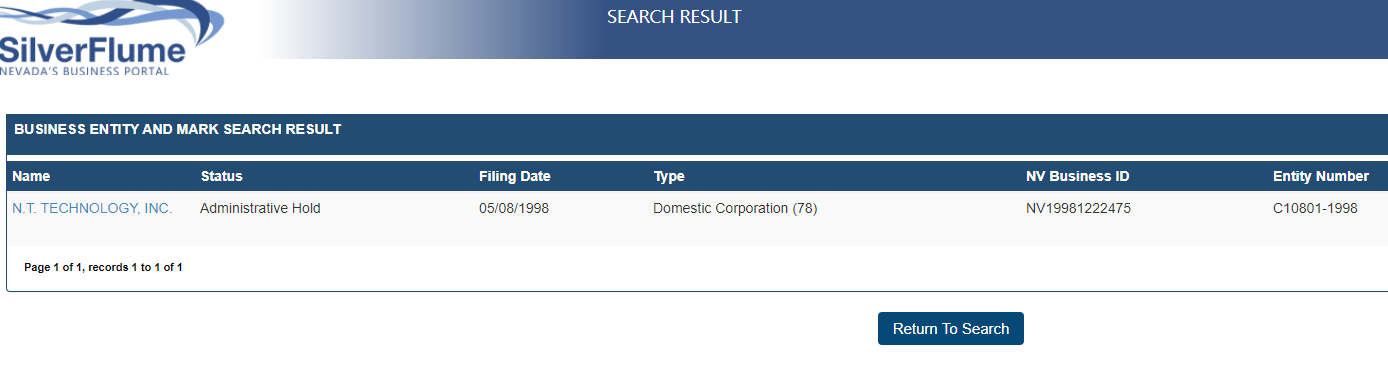

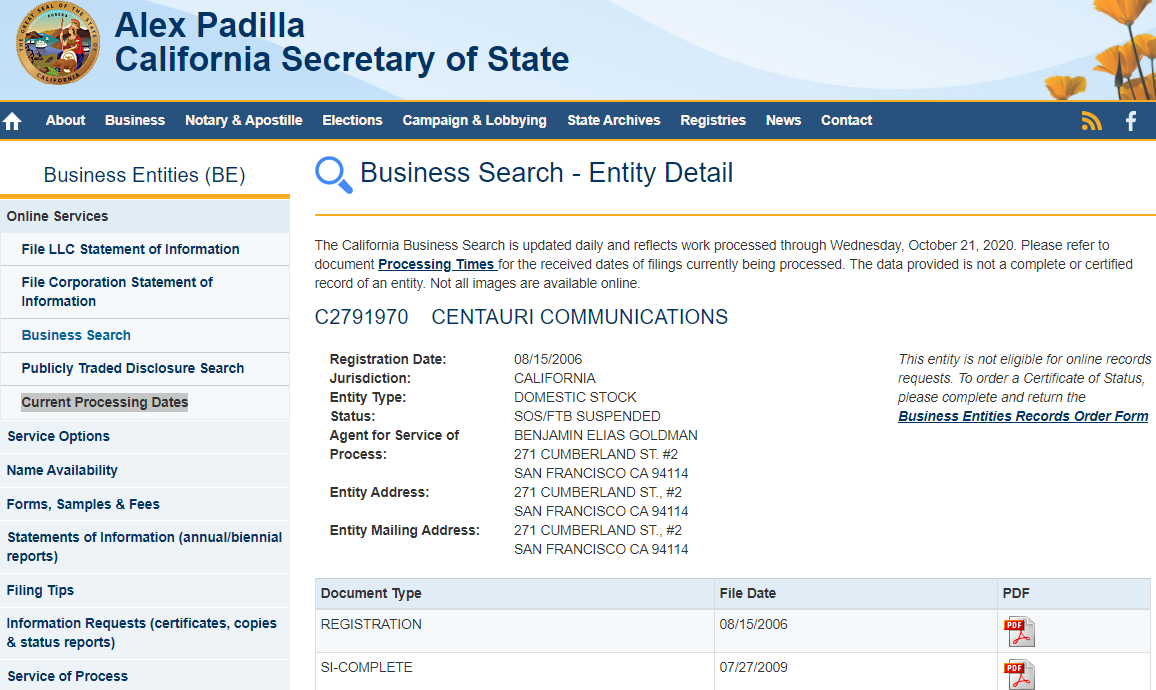

Acting on a tip from Milwaukee, Wis.-based cyber intelligence firm Hold Security, KrebsOnSecurity in March told Gunnebo about a financial transaction between a malicious hacker and a cybercriminal group which specializes in deploying ransomware. That transaction included credentials to a Remote Desktop Protocol (RDP) account apparently set up by a Gunnebo Group employee who wished to access the company’s internal network remotely.

Five months later, Gunnebo disclosed it had suffered a cyber attack targeting its IT systems that forced the shutdown of internal servers. Nevertheless, the company said its quick reaction prevented the intruders from spreading the ransomware throughout its systems, and that the overall lasting impact from the incident was minimal.

Earlier this week, Swedish news agency Dagens Nyheter confirmed that hackers recently published online at least 38,000 documents stolen from Gunnebo’s network. Linus Larsson, the journalist who broke the story, says the hacked material was uploaded to a public server during the second half of September, and it is not known how many people may have gained access to it.

Larsson quotes Gunnebo CEO Stefan Syrén saying the company never considered paying the ransom the attackers demanded in exchange for not publishing its internal documents. What’s more, Syrén seemed to downplay the severity of the exposure.

“I understand that you can see drawings as sensitive, but we do not consider them as sensitive automatically,” the CEO reportedly said. “When it comes to cameras in a public environment, for example, half the point is that they should be visible, therefore a drawing with camera placements in itself is not very sensitive.”

It remains unclear whether the stolen RDP credentials were a factor in this incident. But the password to the Gunnebo RDP account — “password01” — suggests the security of its IT systems may have been lacking in other areas as well.

After this author posted a request for contact from Gunnebo on Twitter, KrebsOnSecurity heard from Rasmus Jansson, an account manager at Gunnebo who specializes in protecting client systems from electromagnetic pulse (EMP) attacks or disruption, short bursts of energy that can damage electrical equipment.

Jansson said he relayed the stolen credentials to the company’s IT specialists, but that he does not know what actions the company took in response. Reached by phone today, Jansson said he quit the company in August, right around the time Gunnebo disclosed the thwarted ransomware attack. He declined to comment on the particulars of the extortion incident.

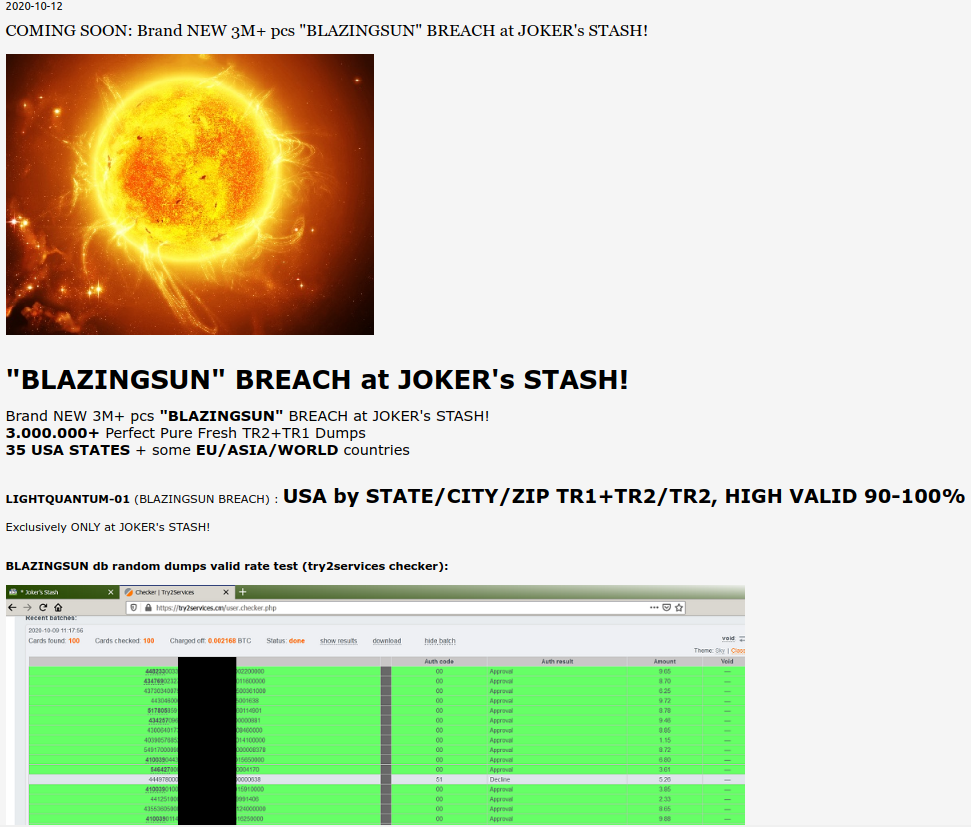

Ransomware attackers often spend weeks or months inside of a target’s network before attempting to deploy malware across the network that encrypts servers and desktop systems unless and until a ransom demand is met.

That’s because gaining the initial foothold is rarely the difficult part of the attack. In fact, many ransomware groups now have such an embarrassment of riches in this regard that they’ve taken to hiring external penetration testers to carry out the grunt work of escalating that initial foothold into complete control over the victim’s network and any data backup systems — a process that can be hugely time consuming.

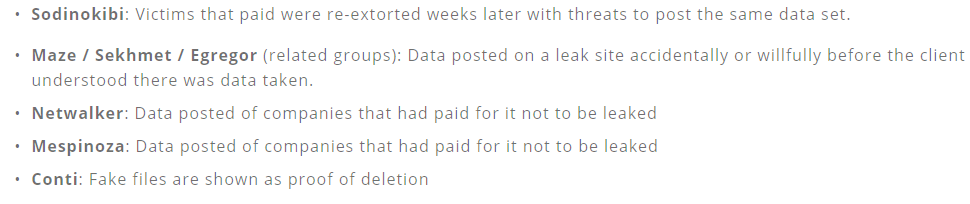

But prior to launching their ransomware, it has become common practice for these extortionists to offload as much sensitive and proprietary data as possible. In some cases, this allows the intruders to profit even if their malware somehow fails to do its job. In other instances, victims are asked to pay two extortion demands: One for a digital key to unlock encrypted systems, and another in exchange for a promise not to publish, auction or otherwise trade any stolen data. Continue reading →