The COVID-19 epidemic has brought a wave of email phishing attacks that try to trick work-at-home employees into giving away credentials needed to remotely access their employers’ networks. But one increasingly brazen group of crooks is taking your standard phishing attack to the next level, marketing a voice phishing service that uses a combination of one-on-one phone calls and custom phishing sites to steal VPN credentials from employees.

According to interviews with several sources, this hybrid phishing gang has a remarkably high success rate, and operates primarily through paid requests or “bounties,” where customers seeking access to specific companies or accounts can hire them to target employees working remotely at home.

And over the past six months, the criminals responsible have created dozens if not hundreds of phishing pages targeting some of the world’s biggest corporations. For now at least, they appear to be focusing primarily on companies in the financial, telecommunications and social media industries.

“For a number of reasons, this kind of attack is really effective,” said Allison Nixon, chief research officer at New York-based cyber investigations firm Unit 221B. “Because of the Coronavirus, we have all these major corporations that previously had entire warehouses full of people who are now working remotely. As a result the attack surface has just exploded.”

TARGET: NEW HIRES

A typical engagement begins with a series of phone calls to employees working remotely at a targeted organization. The phishers will explain that they’re calling from the employer’s IT department to help troubleshoot issues with the company’s virtual private networking (VPN) technology.

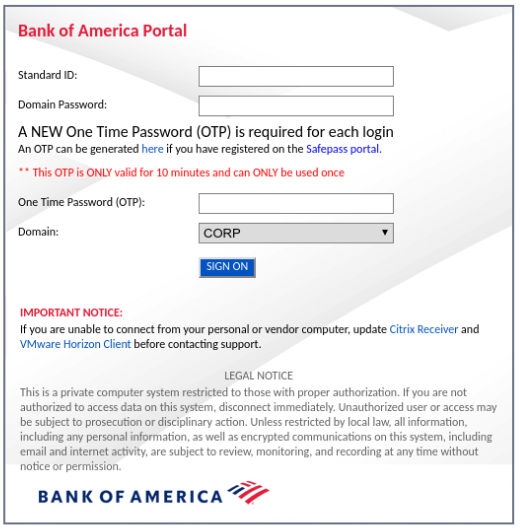

The employee phishing page bofaticket[.]com. Image: urlscan.io

The goal is to convince the target either to divulge their credentials over the phone or to input them manually at a website set up by the attackers that mimics the organization’s corporate email or VPN portal.

Zack Allen is director of threat intelligence for ZeroFOX, a Baltimore-based company that helps customers detect and respond to risks found on social media and other digital channels. Allen has been working with Nixon and several dozen other researchers from various security firms to monitor the activities of this prolific phishing gang in a bid to disrupt their operations.

Allen said the attackers tend to focus on phishing new hires at targeted companies, and will often pose as new employees themselves working in the company’s IT division. To make that claim more believable, the phishers will create LinkedIn profiles and seek to connect those profiles with other employees from that same organization to support the illusion that the phony profile actually belongs to someone inside the targeted firm.

“They’ll say ‘Hey, I’m new to the company, but you can check me out on LinkedIn’ or Microsoft Teams or Slack, or whatever platform the company uses for internal communications,” Allen said. “There tends to be a lot of pretext in these conversations around the communications and work-from-home applications that companies are using. But eventually, they tell the employee they have to fix their VPN and can they please log into this website.”

SPEAR VISHING

The domains used for these pages often invoke the company’s name, followed or preceded by hyphenated terms such as “vpn,” “ticket,” “employee,” or “portal.” The phishing sites also may include working links to the organization’s other internal online resources to make the scheme seem more believable if a target starts hovering over links on the page.

Allen said a typical voice phishing or “vishing” attack by this group involves at least two perpetrators: One who is social engineering the target over the phone, and another co-conspirator who takes any credentials entered at the phishing page and quickly uses them to log in to the target company’s VPN platform in real-time.

Time is of the essence in these attacks because many companies that rely on VPNs for remote employee access also require employees to supply some type of multi-factor authentication in addition to a username and password — such as a one-time numeric code generated by a mobile app or text message. And in many cases, those codes are only good for a short duration — often measured in seconds or minutes.

But these vishers can easily sidestep that layer of protection, because their phishing pages simply request the one-time code as well.

Allen said it matters little to the attackers if the first few social engineering attempts fail. Most targeted employees are working from home or can be reached on a mobile device. If at first the attackers don’t succeed, they simply try again with a different employee.

And with each passing attempt, the phishers can glean important details from employees about the target’s operations, such as company-specific lingo used to describe its various online assets, or its corporate hierarchy.

Thus, each unsuccessful attempt actually teaches the fraudsters how to refine their social engineering approach with the next mark within the targeted organization, Nixon said.

“These guys are calling companies over and over, trying to learn how the corporation works from the inside,” she said. Continue reading

At least 17 of the bugs squashed in August’s patch batch address vulnerabilities Microsoft rates as “critical,” meaning they can be exploited by miscreants or malware to gain complete, remote control over an affected system with little or no help from users. This is the sixth month in a row Microsoft has shipped fixes for more than 100 flaws in its products.

At least 17 of the bugs squashed in August’s patch batch address vulnerabilities Microsoft rates as “critical,” meaning they can be exploited by miscreants or malware to gain complete, remote control over an affected system with little or no help from users. This is the sixth month in a row Microsoft has shipped fixes for more than 100 flaws in its products.

The leaked Blacklist customer database points to various companies you might expect to see using automated calling systems to generate business, including real estate and life insurance providers, credit repair companies and a long list of online advertising firms and individual digital marketing specialists.

The leaked Blacklist customer database points to various companies you might expect to see using automated calling systems to generate business, including real estate and life insurance providers, credit repair companies and a long list of online advertising firms and individual digital marketing specialists.