The New York Times last week ran an interview with several young men who claimed to have had direct contact with those involved in last week’s epic hack against Twitter. These individuals said they were only customers of the person who had access to Twitter’s internal employee tools, and were not responsible for the actual intrusion or bitcoin scams that took place that day. But new information suggests that at least two of them operated a service that resold access to Twitter employees for the purposes of modifying or seizing control of prized Twitter profiles.

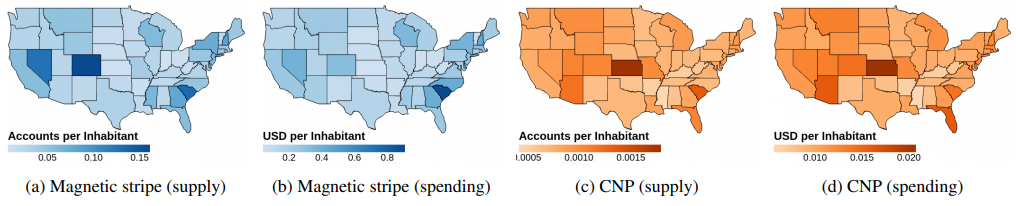

As first reported here on July 16, prior to bitcoin scam messages being blasted out from such high-profile Twitter accounts @barackobama, @joebiden, @elonmusk and @billgates, several highly desirable short-character Twitter account names changed hands, including @L, @6 and @W.

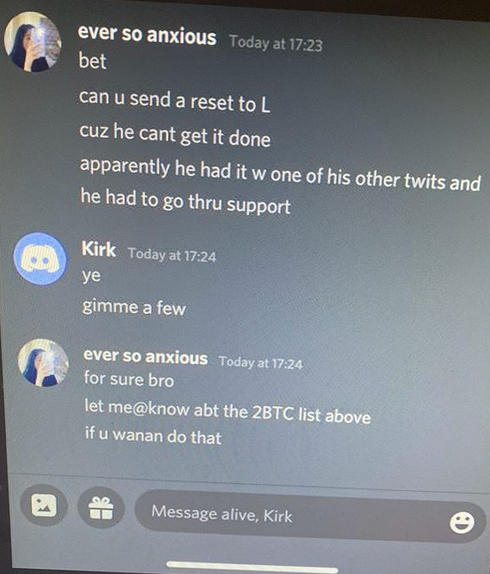

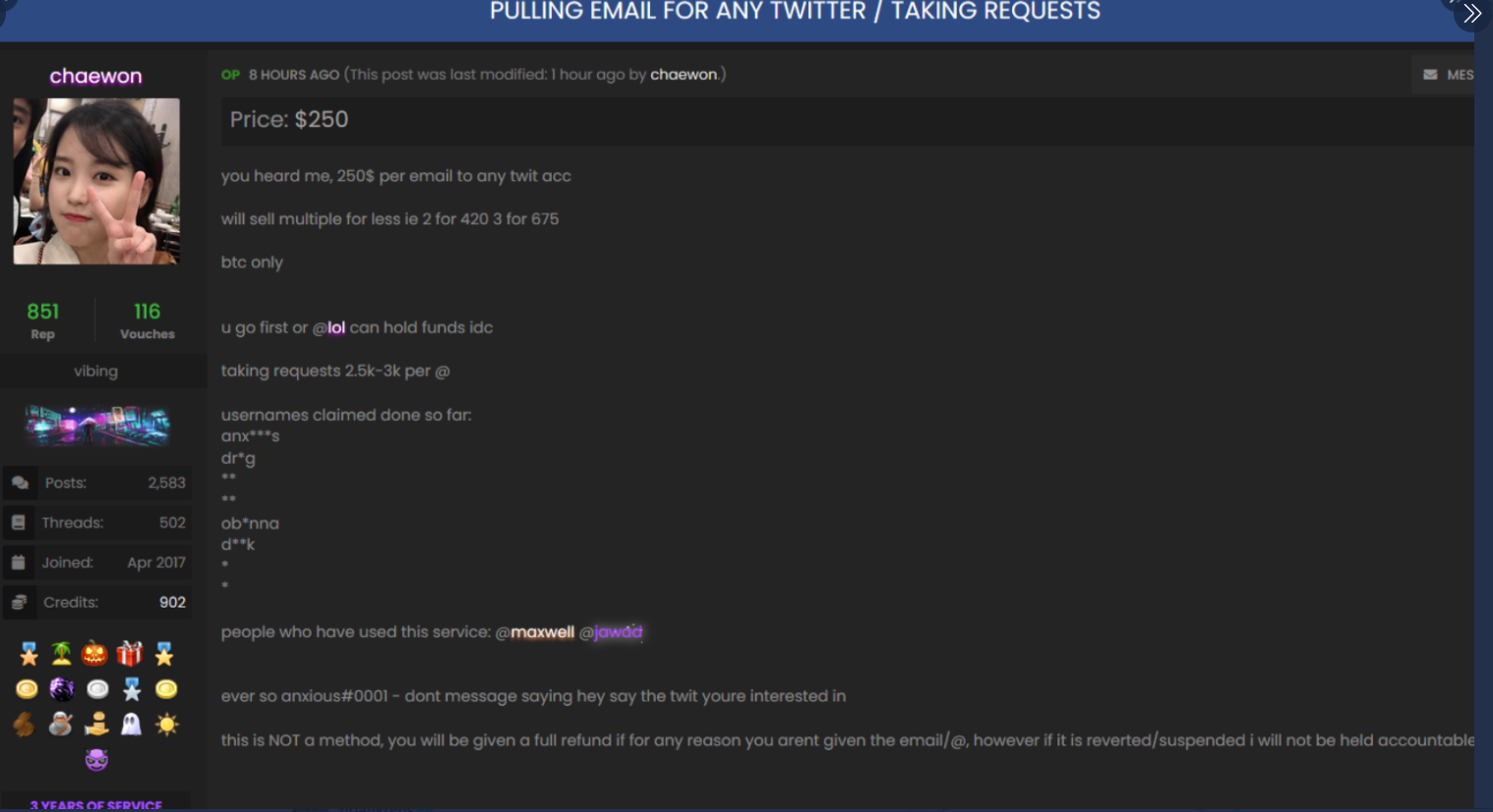

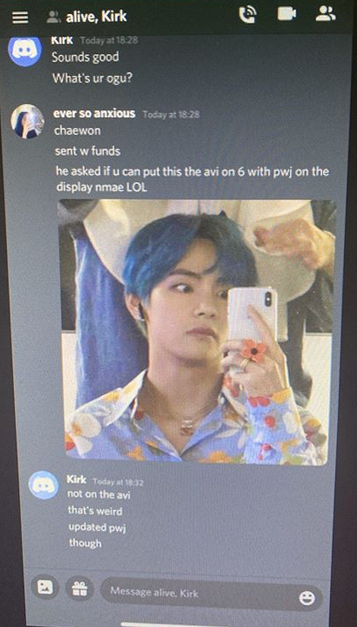

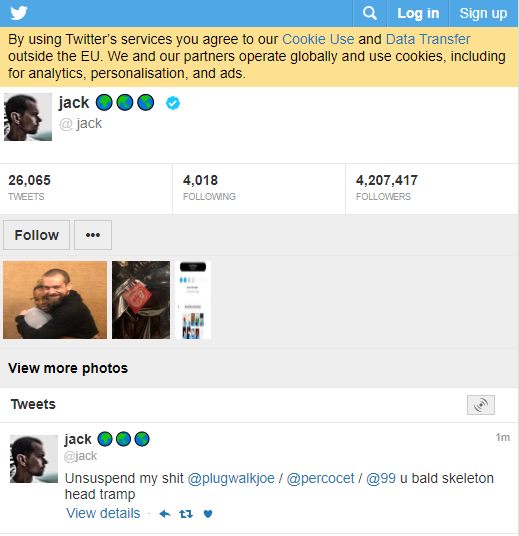

A screenshot of a Discord discussion between the key Twitter hacker “Kirk” and several people seeking to hijack high-value Twitter accounts.

Known as “original gangster” or “OG” accounts, short-character profile names confer a measure of status and wealth in certain online communities, and such accounts can often fetch thousands of dollars when resold in the underground.

The people involved in obtaining those OG accounts on July 15 said they got them from a person identified only as “Kirk,” who claimed to be a Twitter employee. According to The Times, Kirk first reached out to the group through a hacker who used the screen name “lol” on OGusers, a forum dedicated to helping users hijack and resell OG accounts from Twitter and other social media platforms. From The Times’s story:

“The hacker ‘lol’ and another one he worked with, who went by the screen name ‘ever so anxious,’ told The Times that they wanted to talk about their work with Kirk in order to prove that they had only facilitated the purchases and takeovers of lesser-known Twitter addresses early in the day. They said they had not continued to work with Kirk once he began more high-profile attacks around 3:30 p.m. Eastern time on Wednesday.

‘lol’ did not confirm his real-world identity, but said he lived on the West Coast and was in his 20s. “ever so anxious” said he was 19 and lived in the south of England with his mother.

Kirk connected with “lol” late Tuesday and then “ever so anxious” on Discord early on Wednesday, and asked if they wanted to be his middlemen, selling Twitter accounts to the online underworld where they were known. They would take a cut from each transaction.”

Twice in the past year, the OGUsers forum was hacked, and both times its database of usernames, email addresses and private messages was leaked online. A review of the private messages for “lol” on OGUsers provides a glimpse into the vibrant market for the resale of prized OG accounts.

On OGUsers, lol was known to other members as someone who had a direct connection to one or more people working at Twitter who could be used to help fellow members gain access to Twitter profiles, including those that had been suspended for one reason or another. In fact, this was how lol introduced himself to the OGUsers community when he first joined.

“I have a twitter contact who I can get users from (to an extent) and I believe I can get verification from,” lol explained.

In a direct message exchange on OGUsers from November 2019, lol is asked for help from another OGUser member whose Twitter account had been suspended for abuse.

“hello saw u talking about a twitter rep could you please ask if she would be able to help unsus [unsuspend] my main and my friends business account will pay 800-1k for each,” the OGUusers profile inquires of lol.

Lol says he can’t promise anything but will look into it. “I sent her that, not sure if I will get a reply today bc its the weekend but ill let u know,” Lol says.

In another exchange, an OGUser denizen quizzes lol about his Twitter hookup.

“Does she charge for escalations? And how do you know her/what is her department/job. How do you connect with them if I may ask?”

“They are in the Client success team,” lol replies. “No they don’t charge, and I know them through a connection.”

As for how he got access to the Twitter employee, lol declines to elaborate, saying it’s a private method. “It’s a lil method, sorry I cant say.”

In another direct message, lol asks a fellow OGUser member to edit a comment in a forum discussion which included the Twitter account “@tankska,” saying it was his IRL (in real life) Twitter account and that he didn’t want to risk it getting found out or suspended (Twitter says this account doesn’t exist, but a simple text search on Twitter shows the profile was active until late 2019).

“can u edit that comment out, @tankska is a gaming twitter of mine and i dont want it to be on ogu :D’,” lol wrote. “just dont want my irl getting sus[pended].”

Still another OGUser member would post lol’s identifying information into a forum thread, calling lol by his first name — “Josh” — in a post asking lol what he might offer in an auction for a specific OG name.

“Put me down for 100, but don’t note my name in the thread please,” lol wrote.

WHO IS LOL?

The information in lol’s OGUsers registration profile indicates he was probably being truthful with The Times about his location. The hacked forum database shows a user “tankska” registered on OGUsers back in July 2018, but only made one post asking about the price of an older Twitter account for sale.

The person who registered the tankska account on OGUsers did so with the email address jperry94526@gmail.com, and from an Internet address tied to the San Ramon Unified School District in Danville, Calif.

According to 4iq.com, a service that indexes account details like usernames and passwords exposed in Web site data breaches, the jperry94526 email address was used to register accounts at several other sites over the years, including one at the apparel store Stockx.com under the profile name Josh Perry.

Tankska was active only briefly on OGUsers, but the hacked OGUsers database shows that “lol” changed his username three times over the years. Initially, it was “freej0sh,” followed by just “j0sh.”

lol did not respond to requests for comment sent to email addresses tied to his various OGU profiles and Instagram accounts.

ALWAYS IN DISCORD

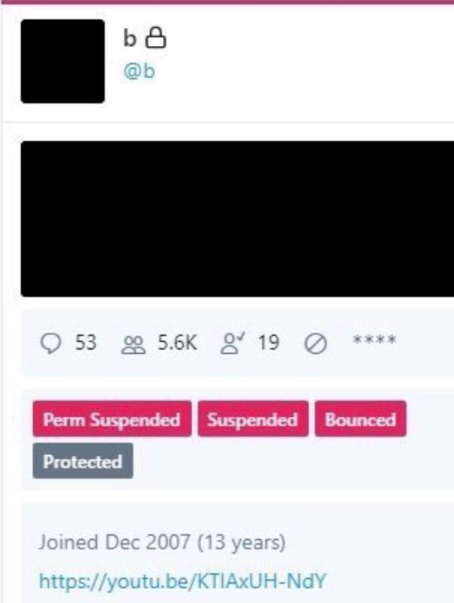

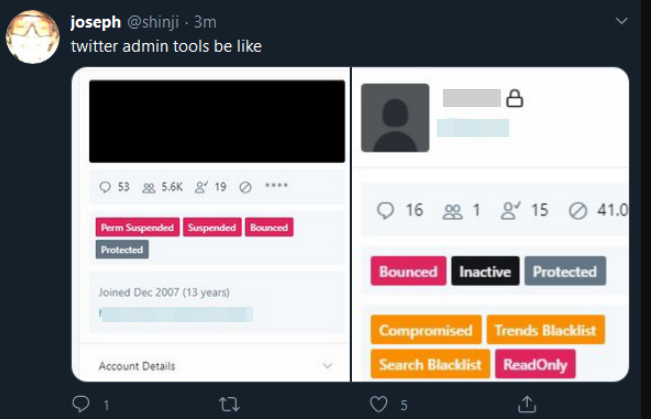

Last week’s story on the Twitter compromise noted that just before the bitcoin scam tweets went out, several OG usernames changed hands. The story traced screenshots of Twitter tools posted online back to a moniker that is well-known in the OGUsers circle: PlugWalkJoe, a 21-year-old from the United Kingdom.

Speaking with The Times, PlugWalkJoe — whose real name is Joseph O’Connor — said while he acquired a single OG Twitter account (@6) through one of the hackers in direct communication with Kirk, he was otherwise not involved in the conversation.

“I don’t care,” O’Connor told The Times. “They can come arrest me. I would laugh at them. I haven’t done anything.”

In an interview with KrebsOnSecurity, O’Connor likewise asserted his innocence, suggesting at least a half dozen other hacker handles that may have been Kirk or someone who worked with Kirk on July 15, including “Voku,” “Crim/Criminal,” “Promo,” and “Aqua.”

“That twit screenshot was the first time in a while I joke[d], and evidently I shouldn’t have,” he said. “Joking is what got me into this mess.”

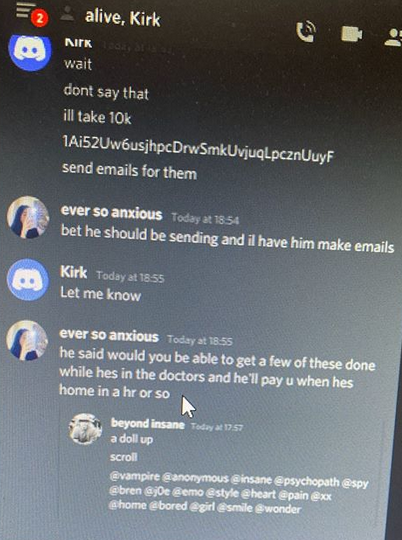

O’Connor shared a number of screenshots from a Discord chat conversation on the day of the Twitter hack between Kirk and two others: “Alive,” which is another handle used by lol, and “Ever So Anxious.” Both were described by The Times as middlemen who sought to resell OG Twitter names obtained from Kirk. O’Connor is referenced in these screenshots as both “PWJ” and by his Discord handle, “Beyond Insane.”

The negotiations over highly-prized OG Twitter usernames took place just prior to the hijacked celebrity accounts tweeting out bitcoin scams.

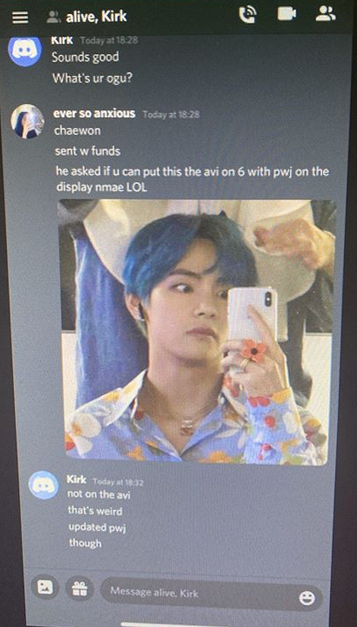

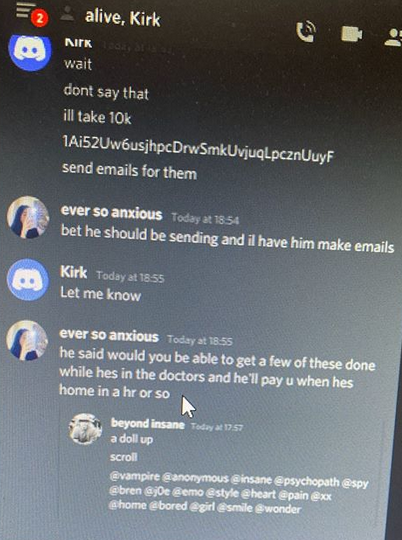

Ever So Anxious told Kirk his OGU nickname was “Chaewon,” which corresponds to a user in the United Kingdom. Just prior to the Twitter compromise, Chaewon advertised a service on the forum that could change the email address tied to any Twitter account for around $250 worth of bitcoin. O’Connor said Chaewon also operates under the hacker alias “Mason.”

“Ever So Anxious” tells Kirk his OGUsers handle is “Chaewon,” and asks Kirk to modify the display names of different OG Twitter handles to read “lol” and “PWJ”.

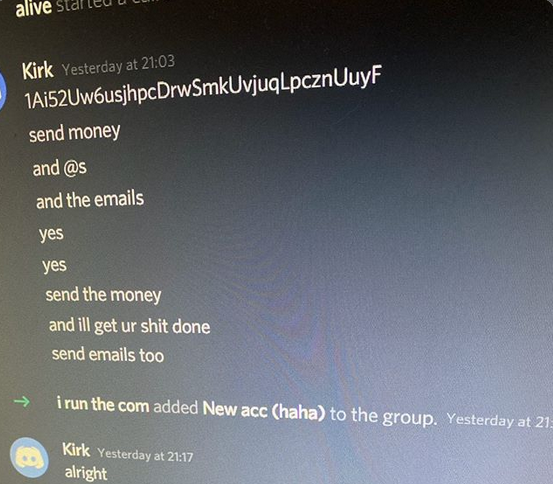

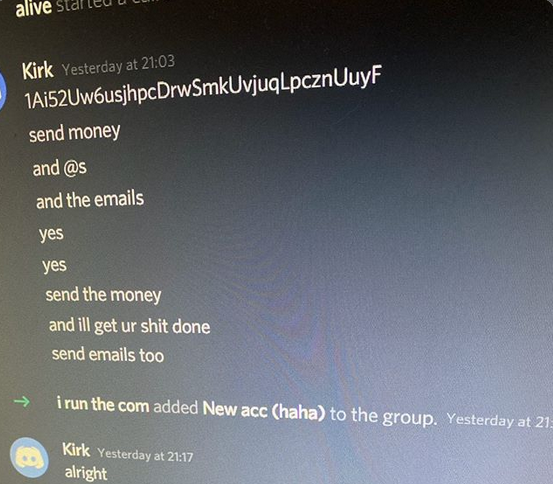

At one point in the conversation, Kirk tells Alive and Ever So Anxious to send funds for any OG usernames they want to this bitcoin address. The payment history of that address shows that it indeed also received approximately $180,000 worth of bitcoin from the wallet address tied to the scam messages tweeted out on July 15 by the compromised celebrity accounts.

The Twitter hacker “Kirk” telling lol/Alive and Chaewon/Mason/Ever So Anxious where to send the funds for the OG Twitter accounts they wanted.

Continue reading →

The leaked Blacklist customer database points to various companies you might expect to see using automated calling systems to generate business, including real estate and life insurance providers, credit repair companies and a long list of online advertising firms and individual digital marketing specialists.

The leaked Blacklist customer database points to various companies you might expect to see using automated calling systems to generate business, including real estate and life insurance providers, credit repair companies and a long list of online advertising firms and individual digital marketing specialists.

Top of the heap this month in terms of outright scariness is

Top of the heap this month in terms of outright scariness is