On Sept. 11, 2019, two security experts at a company that had been hired by the state of Iowa to test the physical and network security of its judicial system were arrested while probing the security of an Iowa county courthouse, jailed in orange jumpsuits, charged with burglary, and held on $100,000 bail. On Thursday Jan. 30, prosecutors in Iowa announced they had dropped the criminal charges. The news came while KrebsOnSecurity was conducting a video interview with the two accused (featured below).

The courthouse in Dallas County, Iowa. Image: Wikipedia.

Gary DeMercurio, 43 of Seattle, and Justin Wynn, 29 of Naples, Fla., are both professional penetration testers employed by Coalfire Labs, a security firm based in Westminster, Colo. Iowa’s State Court Administration had hired the company to test the security of its judicial buildings.

Under the terms of their contract (PDF), DeMercurio and Wynn were permitted to impersonate staff and contractors, provide false pretenses to gain physical access to facilities, “tailgate” employees into buildings, and access restricted areas of those facilities. The contract said the men could not attempt to subvert alarm systems, force-open doors, or access areas that require protective equipment.

When the duo’s early-morning Sept. 11 test of the security at the courthouse in Dallas County, Iowa set off an audible security alarm, they followed procedure and waited on-site for the police. DeMercurio and Wynn said when the county’s sheriff deputies arrived on the scene just a few minutes later, they told the officers who they were and why they were there, and that they’d obtained entry to the premises via an unlocked door.

“They said they found a courthouse door unlocked, so they closed it from the outside and let it lock,” Dan Goodin of Ars Technica wrote of the ordeal in November. “Then they slipped a plastic cutting board through a crack in the door and manipulated its locking mechanism. (Pentesters frequently use makeshift or self-created tools in their craft to flip latches, trigger motion-detected mechanisms, and test other security systems.) The deputies seemed impressed.”

To assuage concerns they might be burglars, DeMercurio and Wynn produced an authorization letter detailing the job they’d been hired to do and listing the names and mobile phone numbers of Iowa state employees who could verify their story.

After contacting some of the court officials listed in the letter, the deputies seemed satisfied that the men weren’t thieves. That is, until Dallas County Sheriff Chad Leonard showed up.

“The pentesters had already said they used a tool to open the front door,” Goodin recounted. “Leonard took that to mean the men had violated the restriction against forcing doors open. Leonard also said the men attempted to turn off the alarm—something Coalfire officials vehemently deny. In Leonard’s mind that was a second violation. Another reason for doubt: one of the people listed as a contact on the get-out-of-jail-free letter didn’t answer the deputies’ calls, while another said he didn’t believe the men had permission to conduct physical intrusions.”

DeMercurio and Wynn were arrested, jailed, and held for nearly 24 hours before being released on a $100,000 bail. Initially they were charged with felony third-degree burglary and possessing burglary tools, although those charges were later downgraded to misdemeanor trespass.

What initially seemed to Coalfire as a momentary lapse of judgment by Iowa authorities quickly morphed into the surreal when state lawmakers held hearings questioning why and how someone in the state’s employ could have so recklessly endangered the safety and security of its citizens.

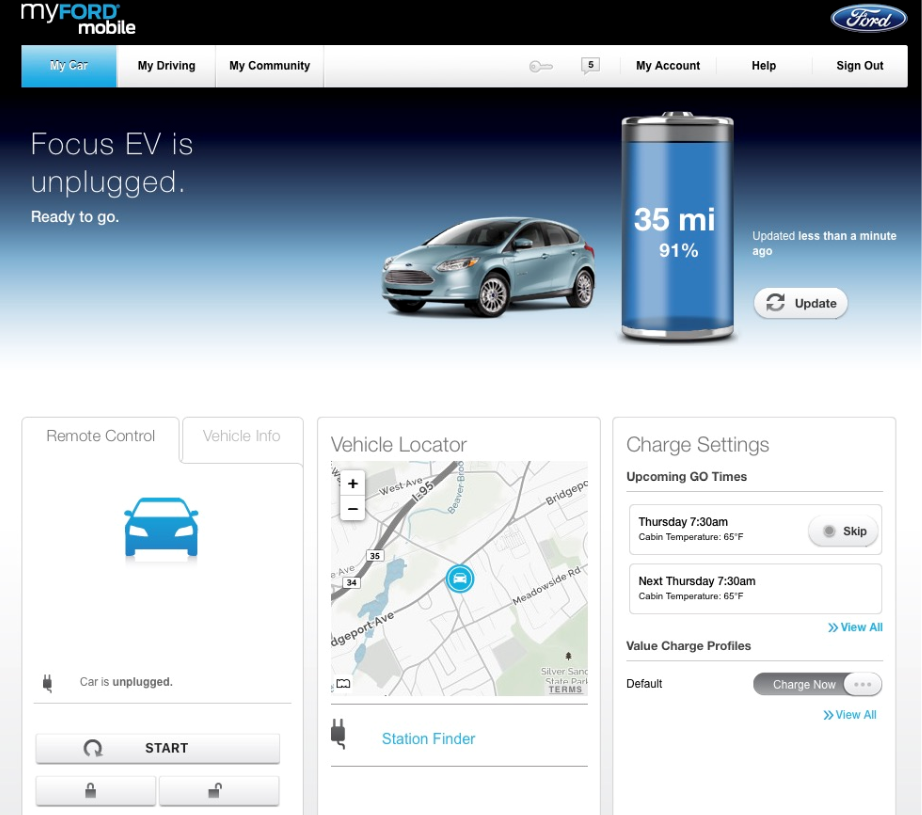

DeMercurio and Wynn, minus the orange jumpsuits.

Judicial Branch officials in Dallas County said in response to this grilling that they didn’t expect Coalfire’s physical penetration testing to be conducted outside of business hours. State Sen. Amy Sinclair was quoted as telling her colleagues that “the hiring of an outside company to break into the courthouses in September created ‘significant danger, not only to the contractors, but to local law enforcement, and members of the public.'”

“Essentially a branch of government has contracted with a company to commit crimes, and that’s very troubling,” lamented Iowa state Sen. Zach Whiting. “I want to find out who needs to be held accountable for this and how we can do that.”

Those strong words clashed with a joint statement released Thursday by Coalfire and Dallas County Attorney Charles Sinnard:

“Ultimately, the long-term interests of justice and protection of the public are not best served by continued prosecution of the trespass charges,” the statement reads. “Those interests are best served by all the parties working together to ensure that there is clear communication on the actions to be taken to secure the sensitive information maintained by the judicial branch, without endangering the life or property of the citizens of Iowa, law enforcement or the persons carrying out the testing.

Matthew Linholm, an attorney representing DeMercurio and Wynn in the case, said the justice system ceases to serve its crucial function and loses credibility when criminal accusations are used to advance personal or political agendas.

“Such a practice endangers the effective administration of justice and our confidence in the criminal justice system,” Linholm told The Des Moines Register, which broke the news of the dropped charges. Continue reading →

A dozen of the vulnerabilities Microsoft patched today are rated “critical,” meaning malware or miscreants could exploit them remotely to gain complete control over an affected system with little to no help from the user.

A dozen of the vulnerabilities Microsoft patched today are rated “critical,” meaning malware or miscreants could exploit them remotely to gain complete control over an affected system with little to no help from the user.

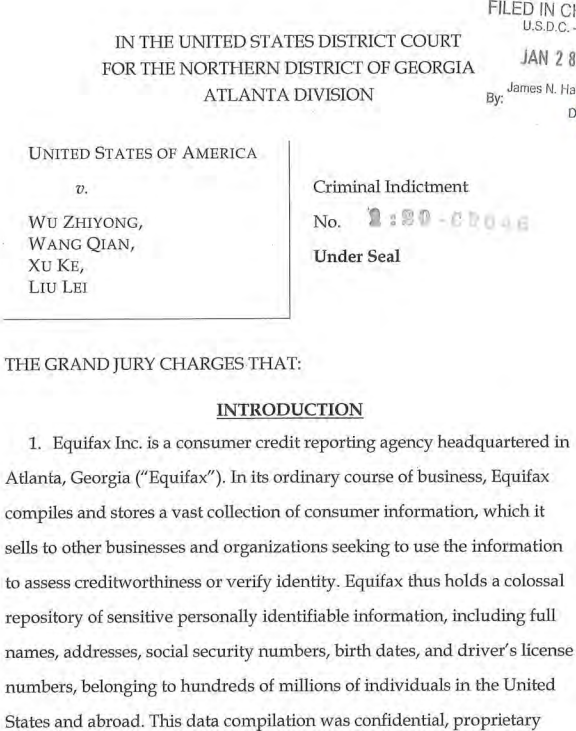

The nine-count indictment names Wu Zhiyong (吴志勇), Wang Qian (王乾), Xu Ke (许可) and Liu Lei (刘磊) as members of the PLA’s 54th Research Institute, a component of the Chinese military. They are each charged with three counts of conspiracy to commit computer fraud, economic espionage and wire fraud.

The nine-count indictment names Wu Zhiyong (吴志勇), Wang Qian (王乾), Xu Ke (许可) and Liu Lei (刘磊) as members of the PLA’s 54th Research Institute, a component of the Chinese military. They are each charged with three counts of conspiracy to commit computer fraud, economic espionage and wire fraud.