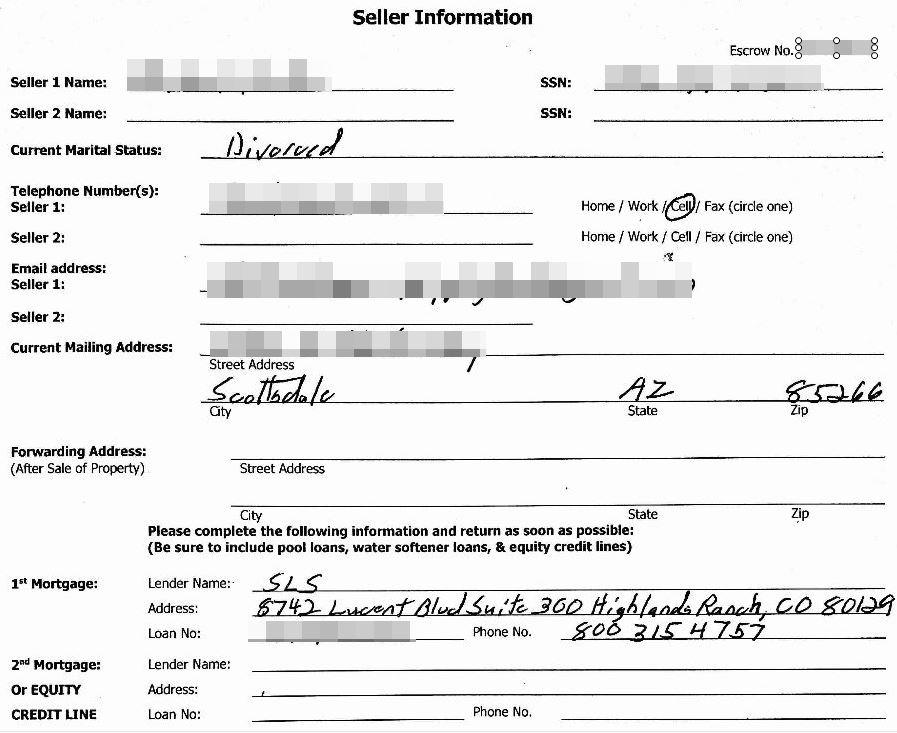

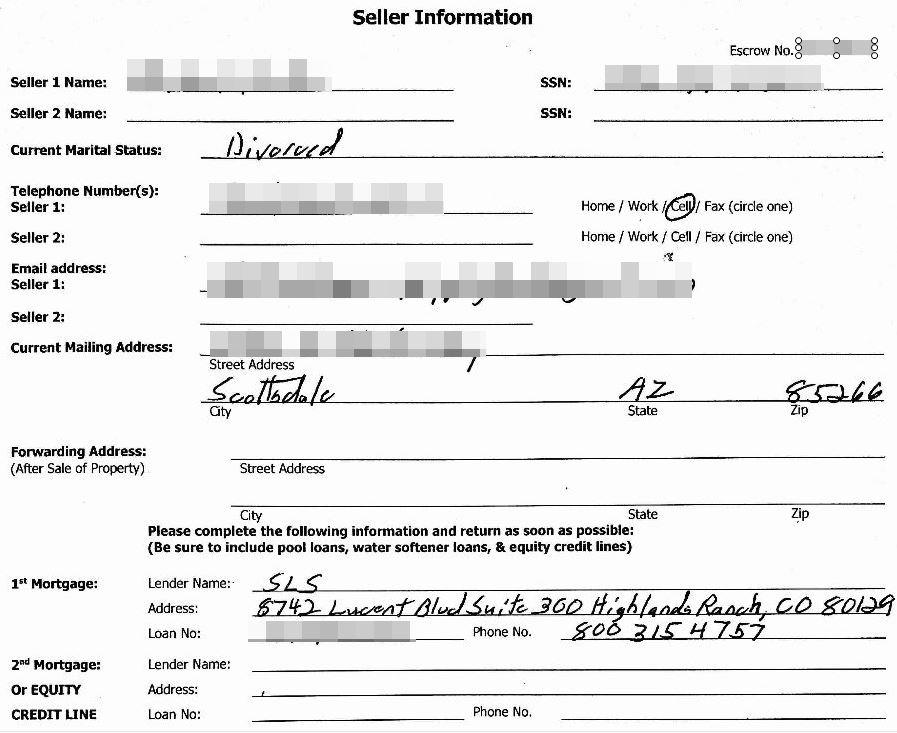

The Web site for Fortune 500 real estate title insurance giant First American Financial Corp. [NYSE:FAF] leaked hundreds of millions of documents related to mortgage deals going back to 2003, until notified this week by KrebsOnSecurity. The digitized records — including bank account numbers and statements, mortgage and tax records, Social Security numbers, wire transaction receipts, and drivers license images — were available without authentication to anyone with a Web browser.

First American Financial Corp. Image: Linkedin.

Santa Ana, Calif.-based First American is a leading provider of title insurance and settlement services to the real estate and mortgage industries. It employs some 18,000 people and brought in more than $5.7 billion in 2018.

Earlier this week, KrebsOnSecurity was contacted by a real estate developer in Washington state who said he’d had little luck getting a response from the company about what he found, which was that a portion of its Web site (firstam.com) was leaking tens if not hundreds of millions of records. He said anyone who knew the URL for a valid document at the Web site could view other documents just by modifying a single digit in the link.

And this would potentially include anyone who’s ever been sent a document link via email by First American.

KrebsOnSecurity confirmed the real estate developer’s findings, which indicate that First American’s Web site exposed approximately 885 million files, the earliest dating back more than 16 years. No authentication was required to read the documents.

Many of the exposed files are records of wire transactions with bank account numbers and other information from home or property buyers and sellers. Ben Shoval, the developer who notified KrebsOnSecurity about the data exposure, said that’s because First American is one of the most widely-used companies for real estate title insurance and for closing real estate deals — where both parties to the sale meet in a room and sign stacks of legal documents.

“Closing agencies are supposed to be the only neutral party that doesn’t represent someone else’s interest, and you’re required to have title insurance if you have any kind of mortgage,” Shoval said.

“The title insurance agency collects all kinds of documents from both the buyer and seller, including Social Security numbers, drivers licenses, account statements, and even internal corporate documents if you’re a small business. You give them all kinds of private information and you expect that to stay private.”

Shoval shared a document link he’d been given by First American from a recent transaction, which referenced a record number that was nine digits long and dated April 2019. Modifying the document number in his link by numbers in either direction yielded other peoples’ records before or after the same date and time, indicating the document numbers may have been issued sequentially.

The earliest document number available on the site – 000000075 — referenced a real estate transaction from 2003. From there, the dates on the documents get closer to real time with each forward increment in the record number.

A redacted screenshot of one of many millions of sensitive records exposed by First American’s Web site.

As of the morning of May 24, firstam.com was returning documents up to the present day (885,000,000+), including many PDFs and post-dated forms for upcoming real estate closings. By 2 p.m. ET Friday, the company had disabled the site that served the records. It’s not yet clear how long the site remained in its promiscuous state, but archive.org shows documents available from the site dating back to at least March 2017.

First American wouldn’t comment on the overall number of records potentially exposed via their site, or how long those records were publicly available. But a spokesperson for the company did share the following statement:

“First American has learned of a design defect in an application that made possible unauthorized access to customer data. At First American, security, privacy and confidentiality are of the highest priority and we are committed to protecting our customers’ information. The company took immediate action to address the situation and shut down external access to the application. We are currently evaluating what effect, if any, this had on the security of customer information. We will have no further comment until our internal review is completed.”

I should emphasize that these documents were merely available from First American’s Web site; I do not have any information on whether this fact was known to fraudsters previously, nor do I have any information to suggest the documents were somehow mass-harvested (although a low-and-slow or distributed indexing of this data would not have been difficult for even a novice attacker). Continue reading →

Microsoft says it has so far seen no exploitation against any of the four flaws that were disclosed publicly prior to their patching this week — nor against any of the 88 bugs quashed in this month’s release. All four are privilege escalation flaws: CVE-2019-1064 and CVE-2019-1069 affect Windows 10 and later; CVE-2019-1053 and CVE-2019-0973 both affect all currently supported versions of Windows.

Microsoft says it has so far seen no exploitation against any of the four flaws that were disclosed publicly prior to their patching this week — nor against any of the 88 bugs quashed in this month’s release. All four are privilege escalation flaws: CVE-2019-1064 and CVE-2019-1069 affect Windows 10 and later; CVE-2019-1053 and CVE-2019-0973 both affect all currently supported versions of Windows.

Just a few days ago, the news was all about how Quest had suffered a major breach. But today’s disclosure by LabCorp. suggests we are nowhere near done hearing about other companies with millions of consumers victimized because of this incident: The AMCA is a New York company with a storied history of aggressively collecting debt for a broad range of businesses, including medical labs and hospitals, direct marketers, telecom companies, and state and local traffic/toll agencies.

Just a few days ago, the news was all about how Quest had suffered a major breach. But today’s disclosure by LabCorp. suggests we are nowhere near done hearing about other companies with millions of consumers victimized because of this incident: The AMCA is a New York company with a storied history of aggressively collecting debt for a broad range of businesses, including medical labs and hospitals, direct marketers, telecom companies, and state and local traffic/toll agencies.

John LaCour is founder and chief technology officer of

John LaCour is founder and chief technology officer of