Normally, if one wishes to buy stolen account credentials for paid online services like Netflix, Hulu, XBox Live or Spotify, the buyer needs to visit a cybercrime forum or drop into a dark Web marketplace that only accepts Bitcoin as payment. Increasingly, however, these accounts are showing up for sale at Payivy[dot]com, an open Web marketplace that happily accepts PayPal in exchange for a variety of stolen accounts.

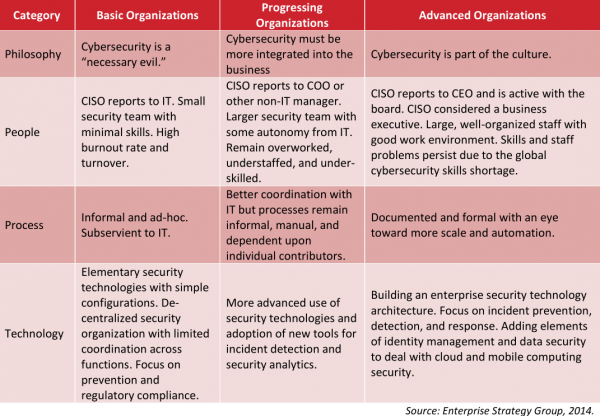

A PayIvy seller advertising Netflix accounts for a dollar apiece. Unlike most sites selling hacked accounts, this one takes PayPal.

Marketed and sold by a Hackforums user named “Sh1eld” as a supposed method of selling ebooks and collecting payments for affiliate marketers, PayIvy has instead become a major conduit for hawking stolen accounts and credentials for a range of top Web services.

There is no central index of items for sale via PayIvy per se, but this catalog of cached sales threads offers a fairly representative glimpse: License keys for Adobe and Microsoft software products, user account credentials in bulk for services like Hulu, Netflix, Spotify, DirecTV and HBO Go, as well as a raft of gaming accounts at Origin, Steam, PlayStation and XBox Live. Other indexes at archive.is and PayIvy’s page at Reddit reveal similar results.

It’s not clear how or why PayPal isn’t shutting down most of these merchants, but some of the sellers clearly are testing things to see how far they can push it: In just five minutes of searching online, I found several PayIvy sellers who were accepting PayPal payments via PayIvy for…wait for it…hijacked PayPal accounts! The fact that PayIvy takes PayPal as payment means that buyers can purchase hacked accounts with [stolen] credit cards — or, worse yet, stolen PayPal accounts.

Jack Christin, Jr., associate general counsel at PayPal, said while the site itself is not in violation of its Acceptable Use Policies (AUP), there have been cases where PayPal has identified accounts selling goods that violate its policy and in those cases, the company has exited those merchants from its system. Continue reading