In late December 2019, fuel and convenience store chain Wawa Inc. said a nine-month-long breach of its payment card processing systems may have led to the theft of card data from customers who visited any of its 850 locations nationwide. Now, fraud experts say the first batch of card data stolen from Wawa customers is being sold at one of the underground’s most popular crime shops, which claims to have 30 million records to peddle from a new nationwide breach.

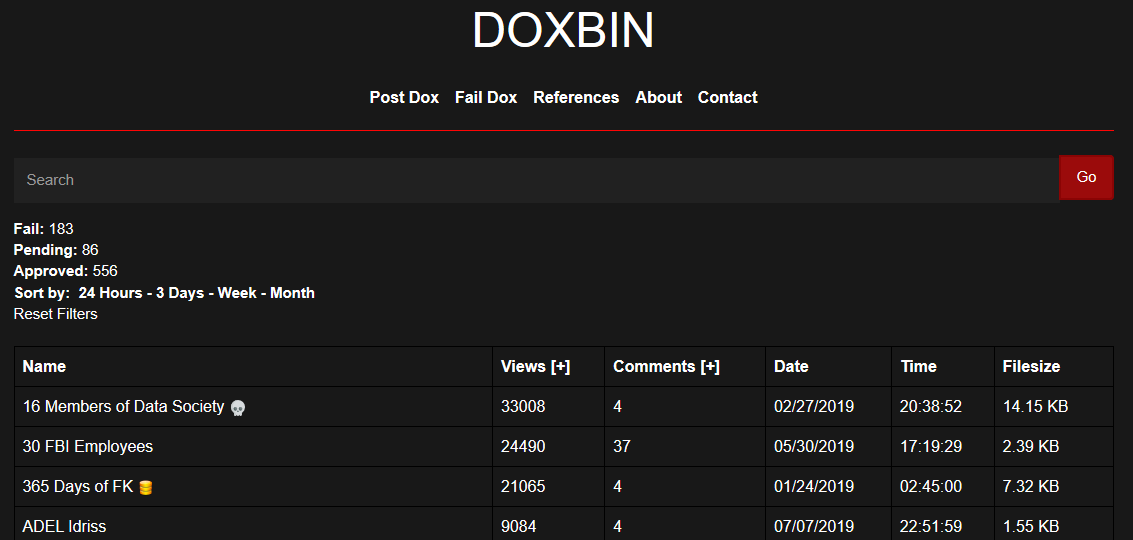

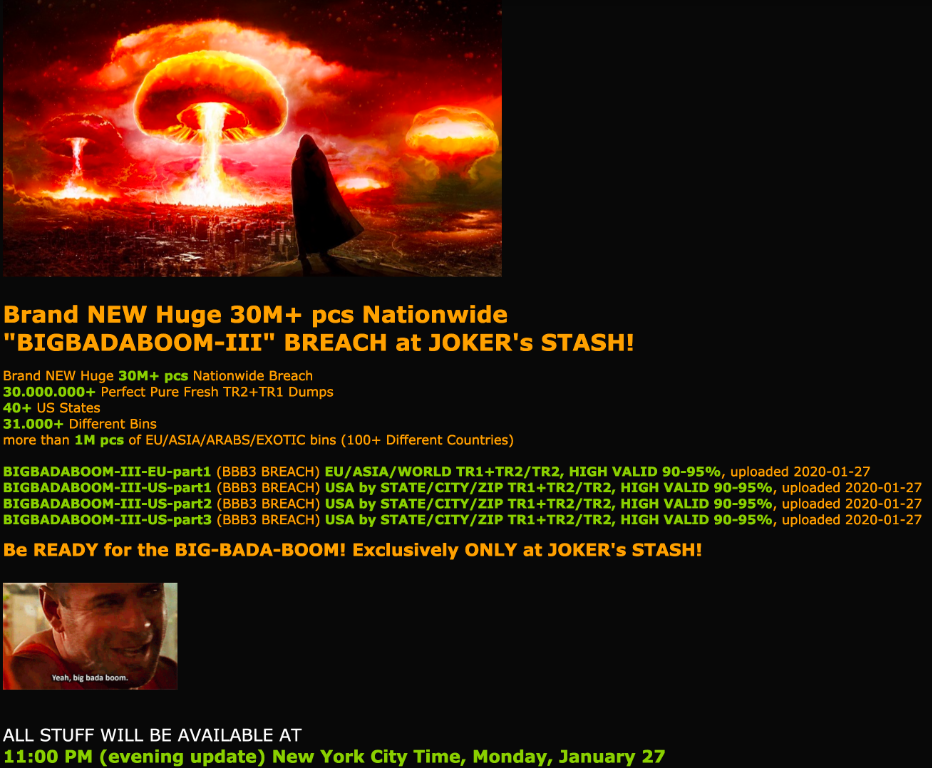

On the evening of Monday, Jan. 27, a popular fraud bazaar known as Joker’s Stash began selling card data from “a new huge nationwide breach” that purportedly includes more than 30 million card accounts issued by thousands of financial institutions across 40+ U.S. states.

The fraud bazaar Joker’s Stash on Monday began selling some 30 million stolen payment card accounts that experts say have been tied back to a breach at Wawa in 2019.

Two sources that work closely with financial institutions nationwide tell KrebsOnSecurity the new batch of cards that went on sale Monday evening — dubbed “BIGBADABOOM-III” by Joker’s Stash — map squarely back to cardholder purchases at Wawa.

On Dec. 19, 2019, Wawa sent a notice to customers saying the company had discovered card-stealing malware installed on in-store payment processing systems and fuel dispensers at potentially all Wawa locations.

Pennsylvania-based Wawa says it discovered the intrusion on Dec. 10 and contained the breach by Dec. 12, but that the malware was thought to have been installed more than nine months earlier, around March 4. The exposed information includes debit and credit card numbers, expiration dates, and cardholder names. Wawa said the breach did not expose personal identification numbers (PINs) or CVV records (the three-digit security code printed on the back of a payment card).

A spokesperson for Wawa confirmed that the company today became aware of reports of criminal attempts to sell some customer payment card information potentially involved in the data security incident announced by Wawa on December 19, 2019.

“We have alerted our payment card processor, payment card brands, and card issuers to heighten fraud monitoring activities to help further protect any customer information,” Wawa said in a statement released to KrebsOnSecurity. “We continue to work closely with federal law enforcement in connection with their ongoing investigation to determine the scope of the disclosure of Wawa-specific customer payment card data.”

“We continue to encourage our customers to remain vigilant in reviewing charges on their payment card statements and to promptly report any unauthorized use to the bank or financial institution that issued their payment card by calling the number on the back of the card,” the statement continues. “Under federal law and card company rules, customers who notify their payment card issuer in a timely manner of fraudulent charges will not be responsible for those charges. In the unlikely event any individual customer who has promptly notified their card issuer of fraudulent charges related to this incident is not reimbursed, Wawa will work with them to reimburse them for those charges.”

Gemini Advisory, a New York-based fraud intelligence company, said the biggest concentrations of stolen cards for sale in the BIGBADABOOM-III batch map back to Wawa customer card use in Florida and Pennsylvania, the two most populous states where Wawa operates. Wawa also has locations in Delaware, Maryland, New Jersey, Virginia and the District of Columbia.

According to Gemini, Joker’s Stash has so far released only a small portion of the claimed 30 million. However, this is not an uncommon practice: Releasing too many stolen cards for sale at once tends to have the effect of depressing the overall price of stolen cards across the underground market.

“Based on Gemini’s analysis, the initial set of bases linked to “BIGBADABOOM-III” consisted of nearly 100,000 records,” Gemini observed. “While the majority of those records were from US banks and were linked to US-based cardholders, some records also linked to cardholders from Latin America, Europe, and several Asian countries. Non-US-based cardholders likely fell victim to this breach when traveling to the United States and utilizing Wawa gas stations during the period of exposure.”

Gemini’s director of research Stas Alforov stressed that some of the 30 million cards advertised for sale as part of this BIGBADABOOM batch may in fact be sourced from breaches at other retailers, something Joker’s Stash has been known to do in previous large batches.

Gemini monitors multiple carding sites like Joker’s Stash. The company found the median price of U.S.-issued records in the new Joker’s Stash batch is currently $17, with some of the international records priced as high as $210 per card.

“Apart from banks with a nationwide presence, only financial institutions along the East Coast had significant exposure,” Gemini concluded.

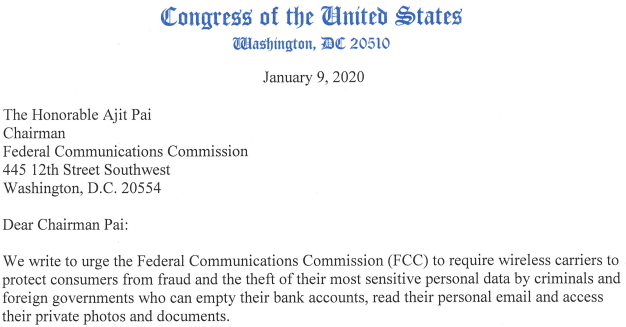

Representatives from MasterCard did not respond to requests for comment. Visa declined to comment for this story, but pointed to a series of alerts it issued in November and December 2019 about cybercrime groups increasingly targeting fuel dispenser merchants. Continue reading

As

As