A large number of French critical infrastructure firms were hacked as part of an extended malware campaign that appears to have been orchestrated by at least one attacker based in Morocco, KrebsOnSecurity has learned. An individual thought to be involved has earned accolades from the likes of Apple, Dell, and Microsoft for helping to find and fix security vulnerabilities in their products.

In 2018, security intelligence firm HYAS discovered a malware network communicating with systems inside of a French national power company. The malware was identified as a version of the remote access trojan (RAT) known as njRAT, which has been used against millions of targets globally with a focus on victims in the Middle East.

Further investigation revealed the electricity provider was just one of many French critical infrastructure firms that had systems beaconing home to the malware network’s control center.

Other victims included one of France’s largest hospital systems; a French automobile manufacturer; a major French bank; companies that work with or manage networks for French postal and transportation systems; a domestic firm that operates a number of airports in France; a state-owned railway company; and multiple nuclear research facilities.

HYAS said it quickly notified the French national computer emergency team and the FBI about its findings, which pointed to a dynamic domain name system (DNS) provider on which the purveyors of this attack campaign relied for their various malware servers.

When it didn’t hear from French authorities after almost a week, HYAS asked the dynamic DNS provider to “sinkhole” the malware network’s control servers. Sinkholing is a practice by which researchers assume control over a malware network’s domains, redirecting any traffic flowing to those systems to a server the researchers control.

While sinkholing doesn’t clean up infected systems, it can prevent the attackers from continuing to harvest data from infected PCs or sending them new commands and malware updates. HYAS found that despite its notifications to the French authorities, some of the apparently infected systems were still attempting to contact the sinkholed control networks up until late 2019.

“Due to our remote visibility it is impossible for us to determine if the malware infections have been contained within the [affected] organizations,” HYAS wrote in a report summarizing their findings. “It is possible that an infected computer is beaconing, but is unable to egress to the command and control due to outbound firewall restrictions.”

About the only French critical infrastructure vertical not touched by the Kasbah hackers was the water management sector.

HYAS said given the entities compromised — and that only a handful of known compromises occurred outside of France — there’s a strong possibility this was the result of an orchestrated phishing campaign targeting French infrastructure firms. It also concluded the domains associated with this campaign were very likely controlled by a group of adversaries based in Morocco.

“What caught our attention was the nature of the victims and the fact that there were no other observed compromises outside of France,” said Sasha Angus, vice president of intelligence for HYAS. “With the exception of water management, when looking at the organizations involved, each fell within one of the verticals in France’s critical infrastructure strategic plan. While we couldn’t rule out financial crime as the actor’s potential motive, it didn’t appear that the actor leveraged any normal financial crime tools.”

‘FATAL’ ERROR

HYAS said the dynamic DNS provider shared information showing that one of the email addresses used to register a key DNS server for the malware network was tied to a domain for a legitimate business based in Morocco.

According to historic records maintained by Domaintools.com [an advertiser on this site], that email address — ing.equipepro@gmail.com — was used in 2016 to register the Web site talainine.com, a now-defunct business that offered recreational vehicle-based camping excursions just outside of a city in southern Morocco called Guelmim.

Archived copies of talainine.com indicate the business was managed by two individuals, including someone named Yassine Algangaf. A Google search for that name reveals a similarly named individual has been credited by a number of major software companies — including Apple, Dell and Microsoft — with reporting security vulnerabilities in their products.

A search on this name at Facebook turned up a page for another now-defunct business called Yamosoft.com that lists Algangaf as an owner. A cached copy of Yamosoft.com at archive.org says it was a Moroccan computer security service that specialized in security audits, computer hacking investigations, penetration testing and source code review. Continue reading

A dozen of the vulnerabilities Microsoft patched today are rated “critical,” meaning malware or miscreants could exploit them remotely to gain complete control over an affected system with little to no help from the user.

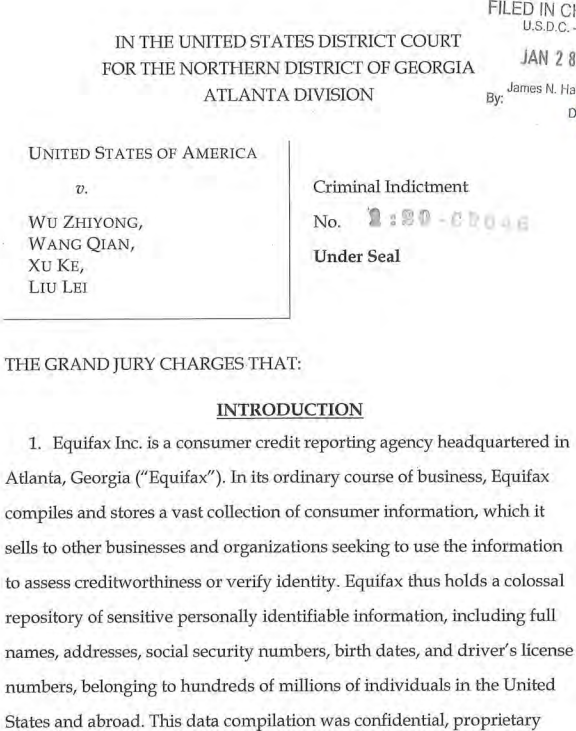

A dozen of the vulnerabilities Microsoft patched today are rated “critical,” meaning malware or miscreants could exploit them remotely to gain complete control over an affected system with little to no help from the user. The nine-count indictment names Wu Zhiyong (吴志勇), Wang Qian (王乾), Xu Ke (许可) and Liu Lei (刘磊) as members of the PLA’s 54th Research Institute, a component of the Chinese military. They are each charged with three counts of conspiracy to commit computer fraud, economic espionage and wire fraud.

The nine-count indictment names Wu Zhiyong (吴志勇), Wang Qian (王乾), Xu Ke (许可) and Liu Lei (刘磊) as members of the PLA’s 54th Research Institute, a component of the Chinese military. They are each charged with three counts of conspiracy to commit computer fraud, economic espionage and wire fraud.