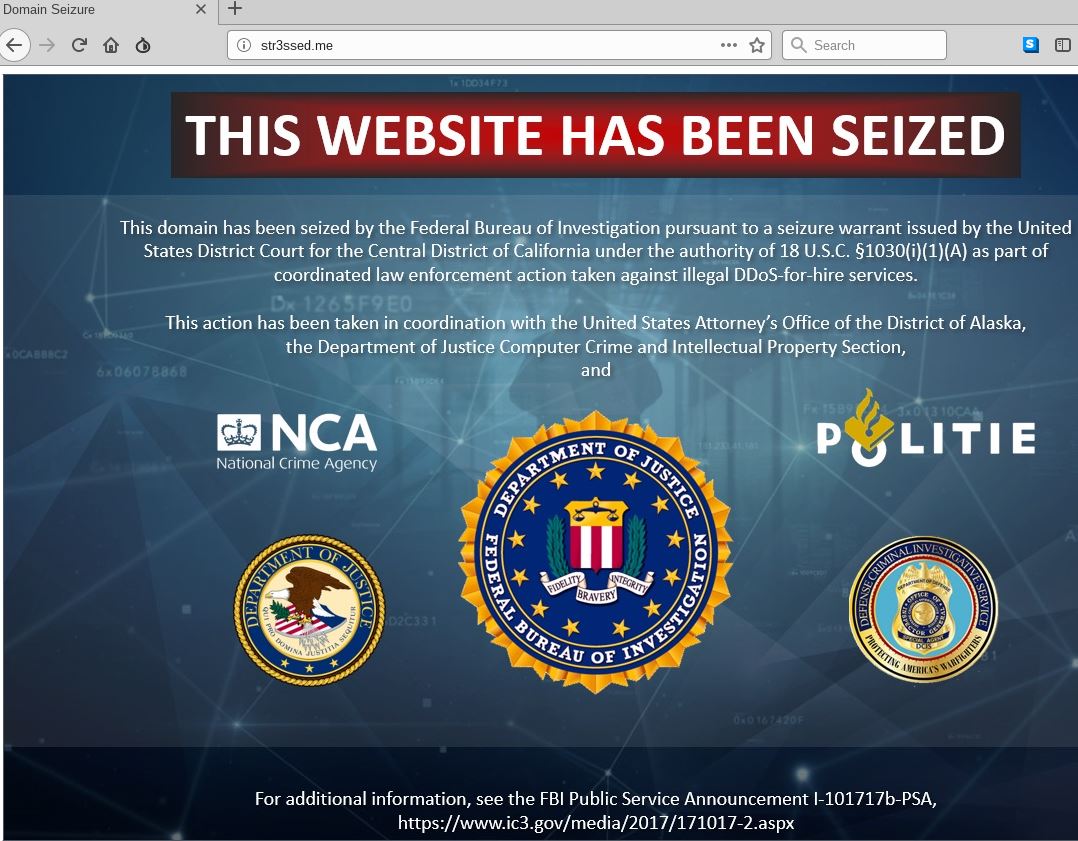

Authorities in the United States this week brought criminal hacking charges against three men as part of an unprecedented, international takedown targeting 15 different “booter” or “stresser” sites — attack-for-hire services that helped paying customers launch tens of thousands of digital sieges capable of knocking Web sites and entire network providers offline.

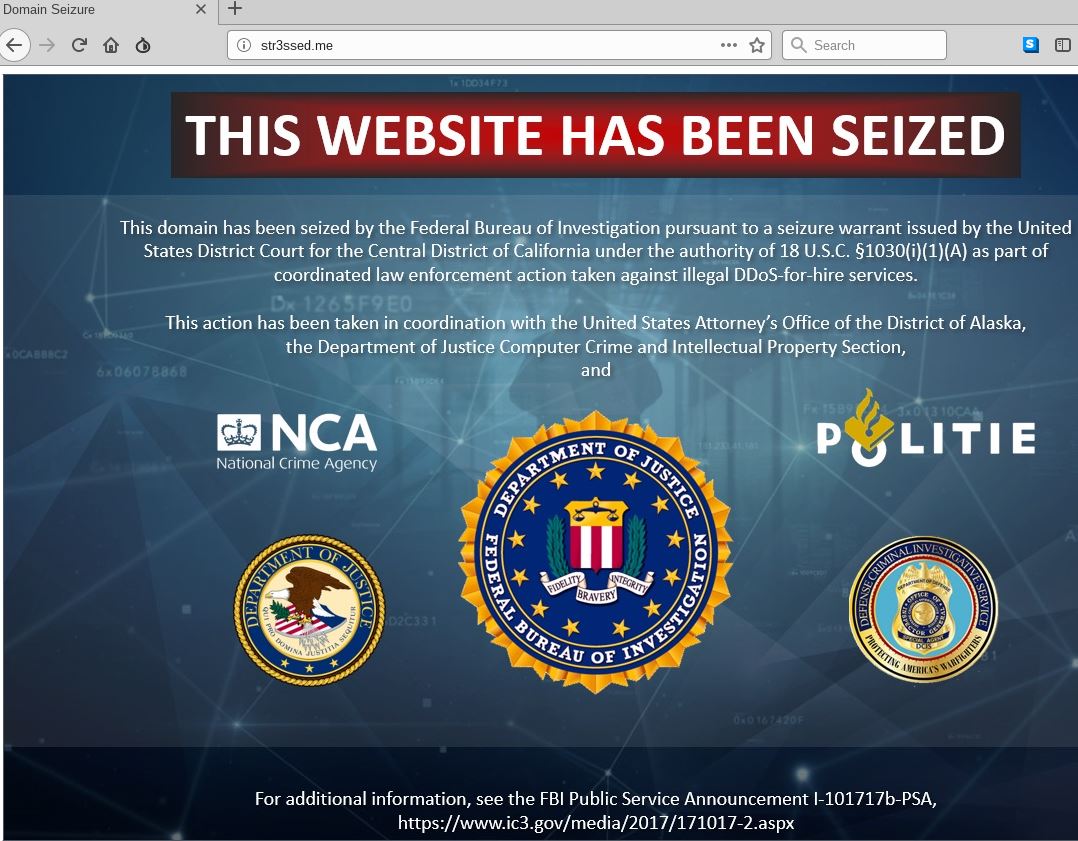

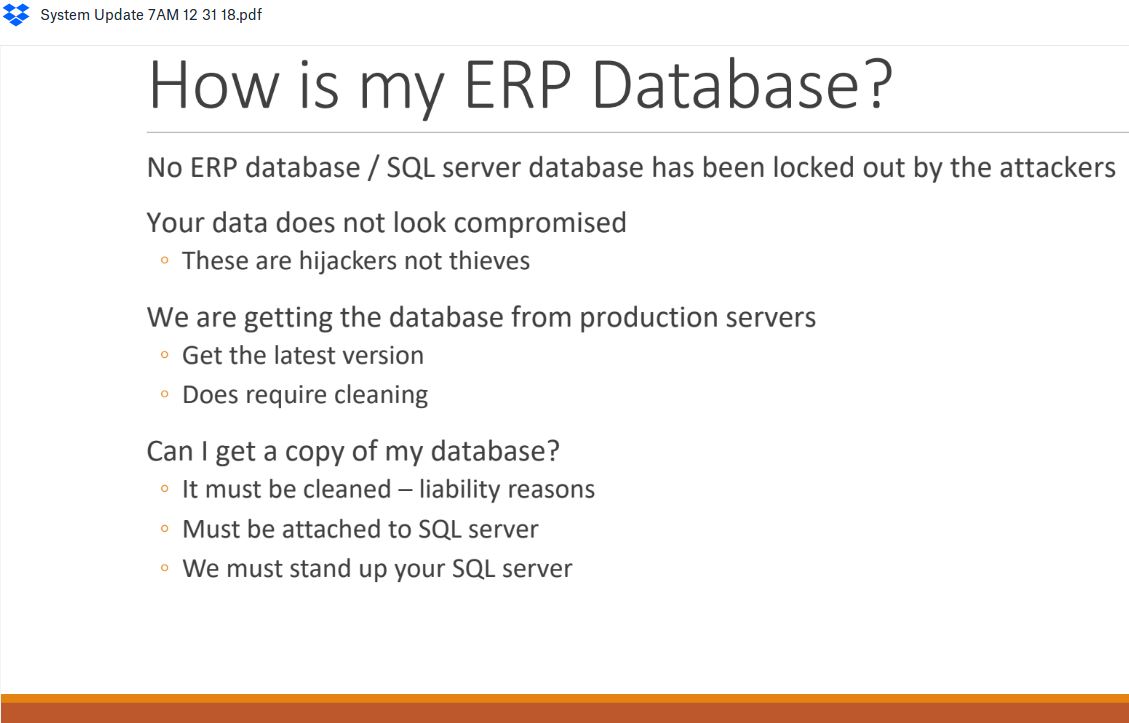

The seizure notice appearing on the homepage this week of more than a dozen popular “booter” or “stresser” DDoS-for-hire Web sites.

As of Thursday morning, a seizure notice featuring the seals of the U.S. Justice Department, FBI and other law enforcement agencies appeared on the booter sites, including:

anonsecurityteam[.]com

booter[.]ninja

bullstresser[.]net

critical-boot[.]com

defcon[.]pro

defianceprotocol[.]com

downthem[.]org

layer7-stresser[.]xyz

netstress[.]org

quantumstress[.]net

ragebooter[.]com

request[.]rip

str3ssed[.]me

torsecurityteam[.]org

vbooter[.]org

Booter sites are dangerous because they help lower the barriers to cybercrime, allowing even complete novices to launch sophisticated and crippling attacks with the click of a button.

Cameron Schroeder, assistant U.S. attorney for the Central District of California, called this week’s action the largest simultaneous seizure of booter service domains ever.

“This is the biggest action U.S. law enforcement has taken against booter services, and we’re doing this in cooperation with a large number of industry and foreign law enforcement partners,” Schroeder said.

Booter services are typically advertised through a variety of methods, including Dark Web forums, chat platforms and even youtube.com. They accept payment via PayPal, Google Wallet, and/or cryptocurrencies, and subscriptions can range in price from just a few dollars to several hundred per month. The services are priced according to the volume of traffic to be hurled at the target, the duration of each attack, and the number of concurrent attacks allowed.

Purveyors of stressers and booters claim they are not responsible for how customers use their services, and that they aren’t breaking the law because — like most security tools — stresser services can be used for good or bad purposes. For example, all of the above-mentioned booter sites contained wordy “terms of use” agreements that required customers to agree they will only stress-test their own networks — and that they won’t use the service to attack others.

But experts say today’s announcement shreds that virtual fig leaf, and marks several important strategic shifts in how authorities intend to prosecute booter service operators going forward.

“This action is predicated on the fact that running a booter service itself is illegal,” said Allison Nixon, director of security research at Flashpoint, a security firm based in New York City. “That’s a slightly different legal argument than has been made in the past against other booter owners.”

For one thing, the booter services targeted in this takedown advertised the ability to “resolve” or determine the true Internet address of a target. This is especially useful for customers seeking to harm targets whose real address is hidden behind mitigation services like Cloudflare (ironically, the same provider used by some of these booter services to withstand attacks by competing booter services).

Some resolvers also allowed customers to determine the Internet address of a target using nothing more than the target’s Skype username.

“You don’t need to use a Skype resolver just to attack yourself,” assistant U.S. Attorney Schroeder said. “Clearly, the people running these booter services know their services are being used not by people targeting their own infrastructure, and have built in capabilities that specifically allow customers to attack others.”

Another important distinction between this week’s coordinated action and past booter site takedowns was that the government actually tested each service it dismantled to validate claims about attack firepower and to learn more about how each service conducted assaults.

In a complaint unsealed today, the Justice Department said that although FBI agents identified at least 60 different booter services operating between June and December 2018, they discovered not all were fully operational and capable of launching attacks. Hence, the 15 services seized this week represent those that the government was able to use to conduct successful, high-volume attacks against their own test sites.

“This is intended to send a very clear message to all booter operators that they’re not going to be allowed to operate openly anymore,” Nixon said. “The message is that if you’re running a DDoS-for-hire service that can attack an Internet address in such a way that the FBI can purchase an attack against their own test servers, you’re probably going to get in trouble.” Continue reading →

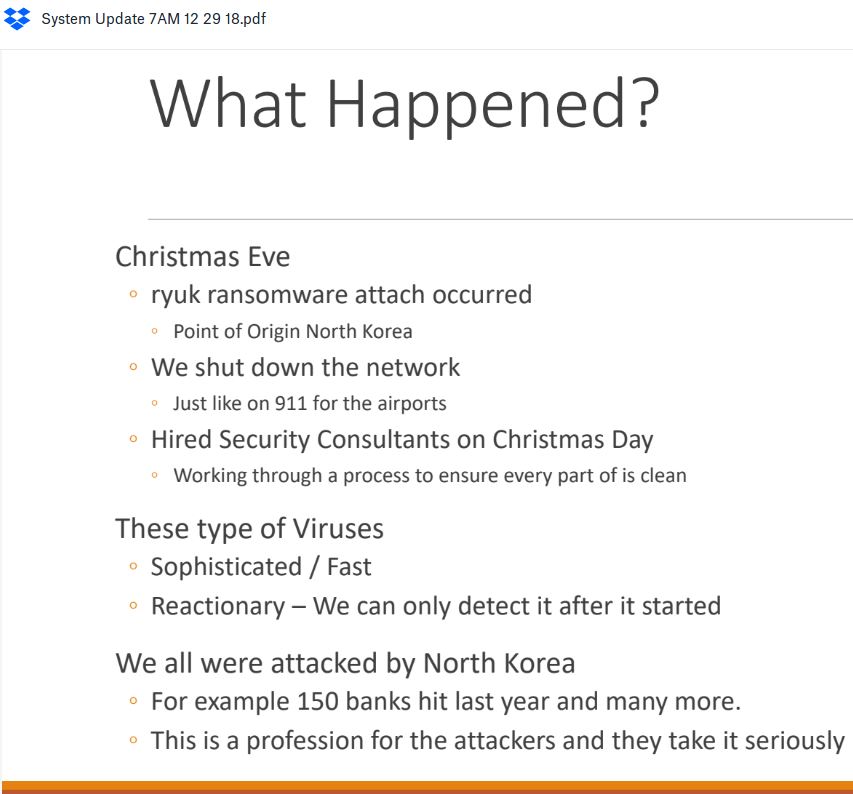

This past year featured some

This past year featured some

The software giant

The software giant