It is now free in every U.S. state to freeze and unfreeze your credit file and that of your dependents, a process that blocks identity thieves and others from looking at private details in your consumer credit history. If you’ve been holding out because you’re not particularly worried about ID theft, here’s another reason to reconsider: The credit bureaus profit from selling copies of your file to others, so freezing your file also lets you deny these dinosaurs a valuable revenue stream.

Enacted in May 2018, the Economic Growth, Regulatory Relief and Consumer Protection Act rolls back some of the restrictions placed on banks in the wake of the Great Recession of the last decade. But it also includes a silver lining. Previously, states allowed the bureaus to charge a confusing range of fees for placing, temporarily thawing or lifting a credit freeze. Today, those fees no longer exist.

A security freeze essentially blocks any potential creditors from being able to view or “pull” your credit file, unless you affirmatively unfreeze or thaw your file beforehand. With a freeze in place on your credit file, ID thieves can apply for credit in your name all they want, but they will not succeed in getting new lines of credit in your name because few if any creditors will extend that credit without first being able to gauge how risky it is to loan to you (i.e., view your credit file).

And because each credit inquiry caused by a creditor has the potential to lower your credit score, the freeze also helps protect your score, which is what most lenders use to decide whether to grant you credit when you truly do want it and apply for it.

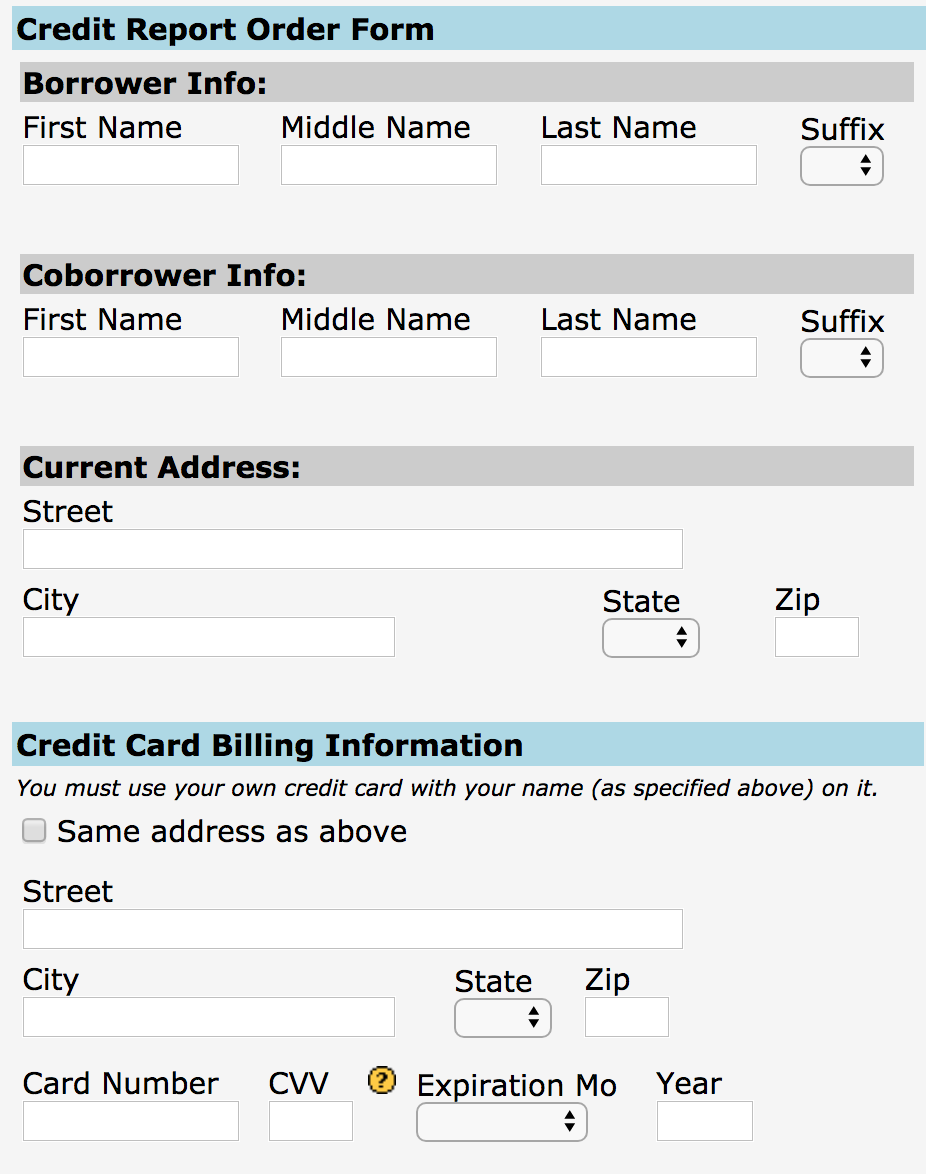

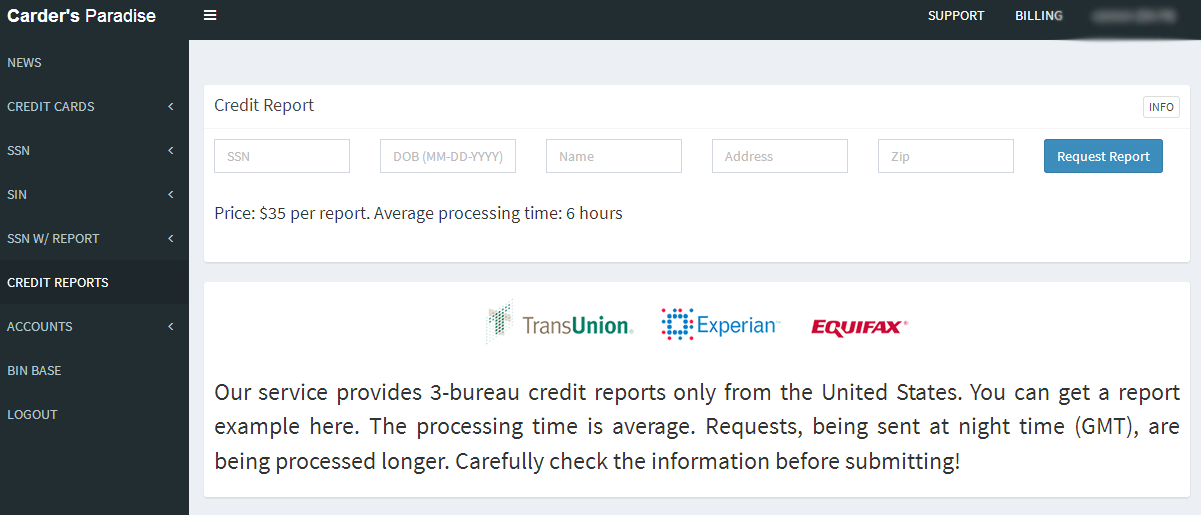

To file a freeze, consumers must contact each of the three major credit bureaus online, by phone or by mail. Here’s the updated contact information for the big three:

Online: Equifax Freeze Page

By phone: 800-685-1111

By Mail: Equifax Security Freeze

P.O. Box 105788

Atlanta, Georgia 30348-5788

Online: Experian

By phone: 888-397-3742

By Mail: Experian Security Freeze

P.O. Box 9554, Allen, TX 75013

Online: TransUnion

By Phone: 888-909-8872

By Mail: TransUnion LLC

P.O. Box 2000 Chester, PA 19016

Spouses may request freezes for each other by phone as long as they pass authentication.

The new law also makes it free to place, thaw and lift freezes for dependents under the age of 16, or for incapacitated adult family members. However, this process is not currently available online or by phone, as it requires parents/guardians to submit written documentation (“sufficient proof of authority”), such as a copy of a birth certificate and copy of a Social Security card issued by the Social Security Administration, or — in the case of an incapacitated family member — proof of power of attorney.

In addition, the law requires the big three bureaus to offer free electronic credit monitoring services to all active duty military personnel. It also changes the rules for “fraud alerts,” which currently are free but only last for 90 days. With a fraud alert on your credit file, lenders or service providers should not grant credit in your name without first contacting you to obtain your approval — by phone or whatever other method you specify when you apply for the fraud alert.

Another important change: Fraud alerts now last for one year (previously they lasted just 90 days) but consumers can renew them each year. Bear in mind, however, that while lenders and service providers are supposed to seek and obtain your approval before granting credit in your name if you have a fraud alert on your file, they’re not legally required to do this. Continue reading

As per usual, the bulk of the fixes from Microsoft tackle security weaknesses in the company’s Web browsers, Internet Explorer and Edge. Patches also are available for Windows, Office, Sharepoint, and the .NET Framework, among other components.

As per usual, the bulk of the fixes from Microsoft tackle security weaknesses in the company’s Web browsers, Internet Explorer and Edge. Patches also are available for Windows, Office, Sharepoint, and the .NET Framework, among other components.