Virtually all companies like to say they take their customers’ privacy and security seriously, make it a top priority, blah blah. But you’d be forgiven if you couldn’t tell this by studying the executive leadership page of each company’s Web site. That’s because very few of the world’s biggest companies list any security executives in their highest ranks. Even among top tech firms, less than half list a chief technology officer (CTO). This post explores some reasons why this is the case, and why it can’t change fast enough.

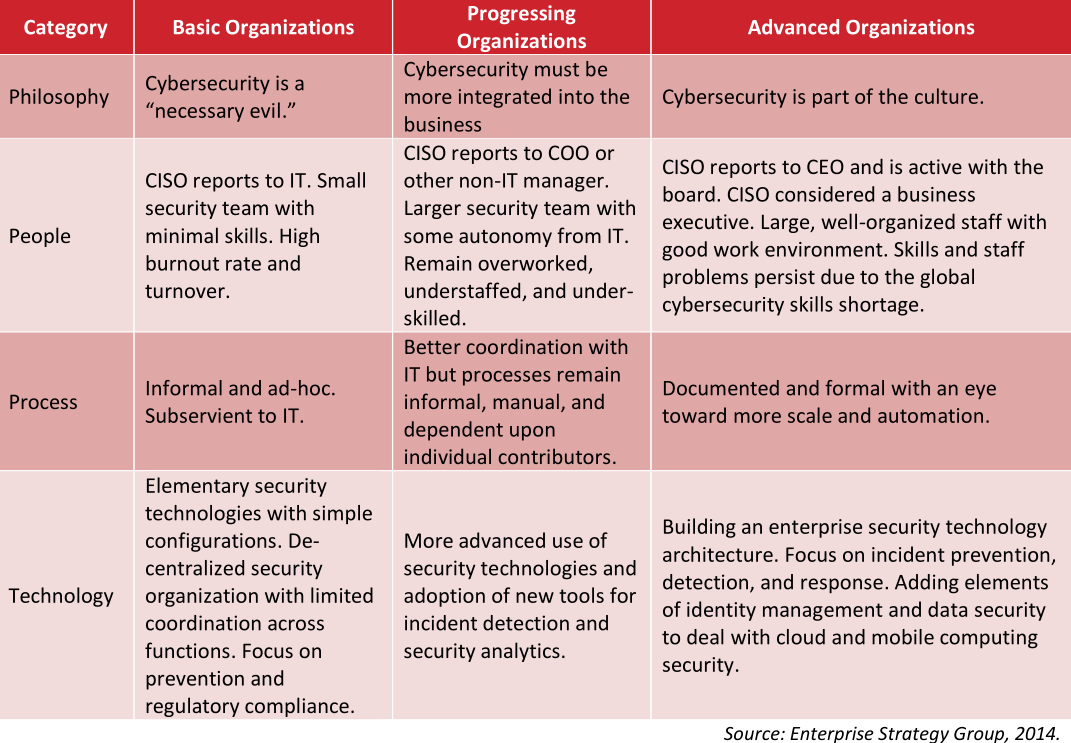

KrebsOnSecurity reviewed the Web sites for the global top 100 companies by market value, and found just five percent of top 100 firms listed a chief information security officer (CISO) or chief security officer (CSO). Only a little more than a third even listed a CTO in their executive leadership pages.

The reality among high-tech firms that make up the top 50 companies in the NASDAQ market was even more striking: Fewer than half listed a CTO in their executive ranks, and I could find only three that featured a person with a security title.

Nobody’s saying these companies don’t have CISOs and/or CSOs and CTOs in their employ. A review of LinkedIn suggests that most of them in fact do have people in those roles (although I suspect the few that aren’t present or easily findable on LinkedIn have made a personal and/or professional decision not to be listed as such).

But it is interesting to note which roles companies consider worthwhile publishing in their executive leadership pages. For example, 73 percent of the top 100 companies listed a chief of human resources (or “chief people officer”), and about one-third included a chief marketing officer.

Not that these roles are somehow more or less important than that of a CISO/CSO within the organization. Nor is the average pay hugely different among all three roles. Yet, considering how much marketing (think consumer/customer data) and human resources (think employee personal/financial data) are impacted by your average data breach, it’s somewhat remarkable that more companies don’t list their chief security personnel among their top ranks.

Julie Conroy, research director at the market analyst firm Aite Group, said she initially hypothesized that companies with a regulatory mandate for strong cybersecurity controls (e.g. banks) would have this role in their executive leadership team.

“But a quick look at Bank of America and Chase’s websites proved me wrong,” Conroy said. “It looks like the CISO in those firms is one layer down, reporting to the executive leadership.”

Conroy says this dynamic reflects the fact that revenue centers like human capital and the ability to drum up new business are still prioritized and valued by businesses more than cost centers — including loss prevention and cybersecurity.

“Marketing and digital strategy roles drive top line revenue for firms—the latter is particularly important in retail and banking businesses as so much commerce moves online,” Conroy said. “While you and I know that cybersecurity and loss prevention are critical functions for all types of businesses, I don’t think that reality is reflected in the organizational structure of many businesses still. A common theme in my discussions with executives in cost center roles is how difficult it is for them to get budget to fund the tech they need for loss prevention initiatives.” Continue reading

At least nine of the bugs in the Microsoft patches address flaws the company deems “critical,” meaning they can be exploited by malware or ne’er-do-wells to install malicious software with little or no help from users, save for perhaps browsing to a hacked or booby-trapped site.

At least nine of the bugs in the Microsoft patches address flaws the company deems “critical,” meaning they can be exploited by malware or ne’er-do-wells to install malicious software with little or no help from users, save for perhaps browsing to a hacked or booby-trapped site.