Google has not had any of its 85,000+ employees successfully phished on their work-related accounts since early 2017, when it began requiring all employees to use physical Security Keys in place of passwords and one-time codes, the company told KrebsOnSecurity.

A YubiKey Security Key made by Yubico. The basic model featured here retails for $20.

Security Keys are inexpensive USB-based devices that offer an alternative approach to two-factor authentication (2FA), which requires the user to log in to a Web site using something they know (the password) and something they have (e.g., a mobile device).

A Google spokesperson said Security Keys now form the basis of all account access at Google.

“We have had no reported or confirmed account takeovers since implementing security keys at Google,” the spokesperson said. “Users might be asked to authenticate using their security key for many different apps/reasons. It all depends on the sensitivity of the app and the risk of the user at that point in time.”

The basic idea behind two-factor authentication is that even if thieves manage to phish or steal your password, they still cannot log in to your account unless they also hack or possess that second factor.

The most common forms of 2FA require the user to supplement a password with a one-time code sent to their mobile device via text message or an app. Indeed, prior to 2017 Google employees also relied on one-time codes generated by a mobile app — Google Authenticator.

In contrast, a Security Key implements a form of multi-factor authentication known as Universal 2nd Factor (U2F), which allows the user to complete the login process simply by inserting the USB device and pressing a button on the device. The key works without the need for any special software drivers.

Once a device is enrolled for a specific Web site that supports Security Keys, the user no longer needs to enter their password at that site (unless they try to access the same account from a different device, in which case it will ask the user to insert their key).

U2F is an emerging open source authentication standard, and as such only a handful of high-profile sites currently support it, including Dropbox, Facebook, Github (and of course Google’s various services). Most major password managers also now support U2F, including Dashlane, and Keepass. Duo Security [full disclosure: an advertiser on this site] also can be set up to work with U2F.

With any luck, more sites soon will begin incorporating the Web Authentication API — also known as “WebAuthn” — a standard put forth by the World Wide Web Consortium in collaboration with the FIDO Alliance. The beauty of WebAuthn is that it eliminates the need for users to constantly type in their passwords, which negates the threat from common password-stealing methods like phishing and man-in-the-middle attacks.

Currently, U2F is supported by Chrome, Mozilla Firefox, and Opera. In both Firefox and Quantum (the newer, faster version of Firefox), U2F is not enabled by default. To turn it on, type “about:config” in the browser bar, type or paste “security.webauth.u2f” and double-click the resulting entry to change the preference’s value from “false” to “true.”

Microsoft says it expects to roll out updates to its flagship Edge browser to support U2F later this year. According to a recent article at 9to5Mac.com, Apple has not yet said when or if it will support the standard in its Safari browser. Continue reading

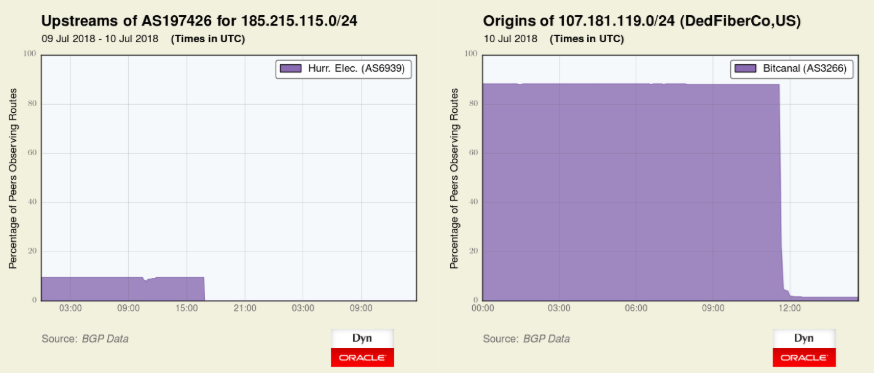

According to security firm

According to security firm