Authorities in the U.S., U.K. and the Netherlands on Tuesday took down popular online attack-for-hire service WebStresser.org and arrested its alleged administrators. Investigators say that prior to the takedown, the service had more than 136,000 registered users and was responsible for launching somewhere between four and six million attacks over the past three years.

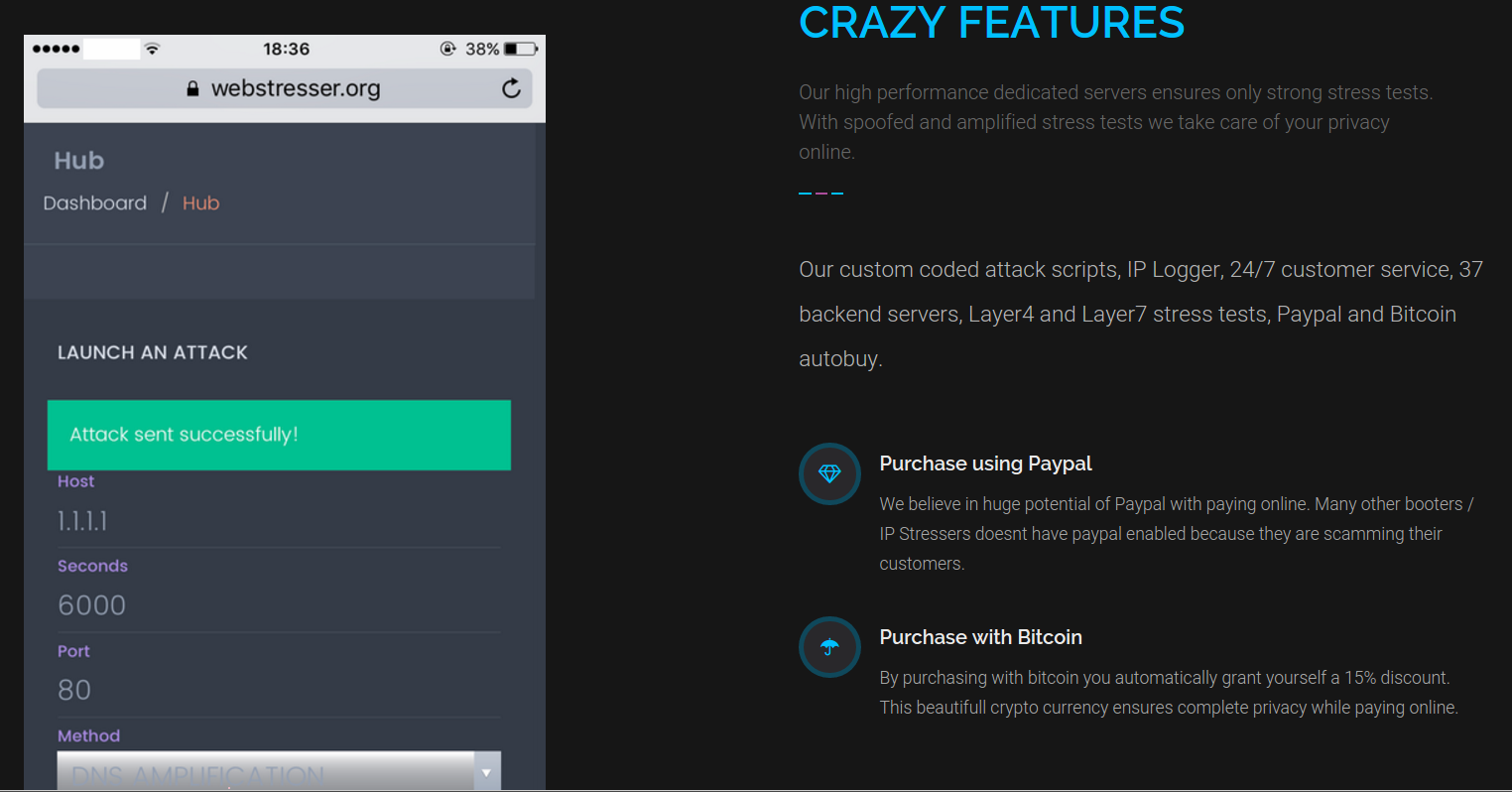

The action, dubbed “Operation Power Off,” targeted WebStresser.org (previously Webstresser.co), one of the most active services for launching point-and-click distributed denial-of-service (DDoS) attacks. WebStresser was one of many so-called “booter” or “stresser” services — virtual hired muscle that anyone can rent to knock nearly any website or Internet user offline.

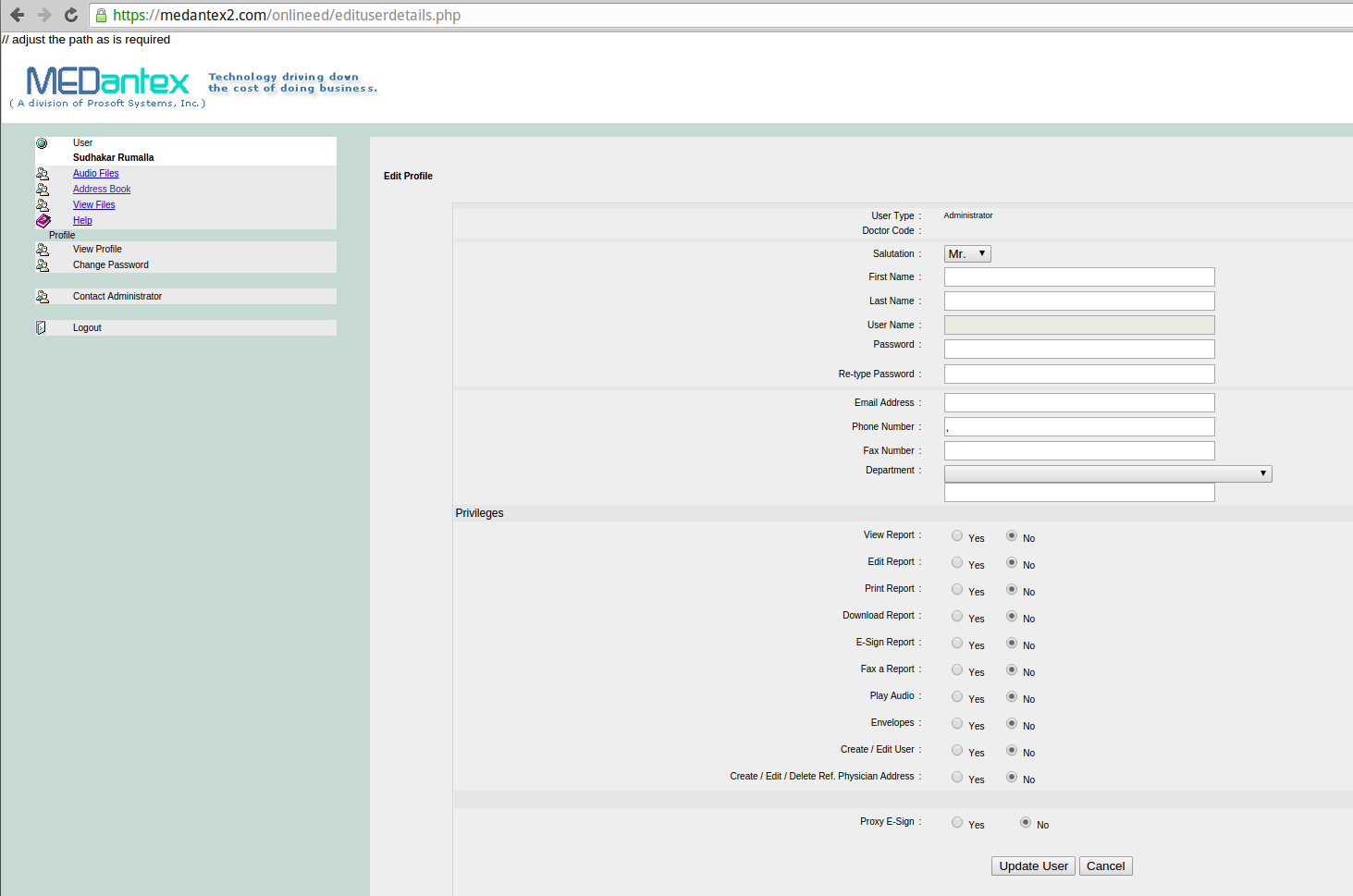

Webstresser.org (formerly Webstresser.co), as it appeared in 2017.

“The damage of these attacks is substantial,” reads a statement from the Dutch National Police in a Reddit thread about the takedown. “Victims are out of business for a period of time, and spend money on mitigation and on (other) security measures.”

In a separate statement released this morning, Europol — the law enforcement agency of the European Union — said “further measures were taken against the top users of this marketplace in the Netherlands, Italy, Spain, Croatia, the United Kingdom, Australia, Canada and Hong Kong.” The servers powering WebStresser were located in Germany, the Netherlands and the United States, according to Europol.

The U.K.’s National Crime Agency said WebStresser could be rented for as little as $14.99, and that the service allowed people with little or no technical knowledge to launch crippling DDoS attacks around the world.

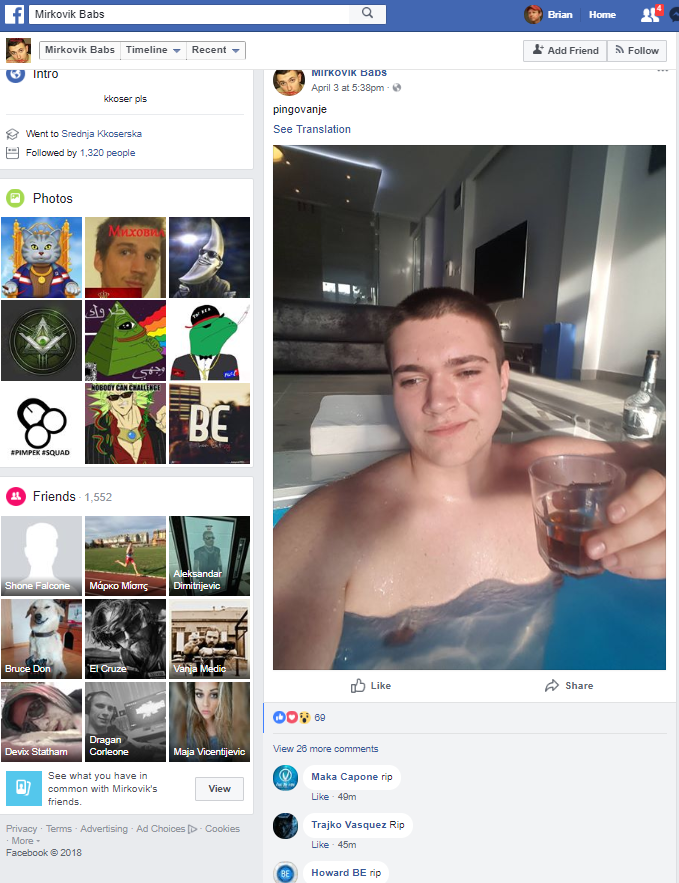

Neither the Dutch nor U.K. authorities would say who was arrested in connection with this takedown. But according to information obtained by KrebsOnSecurity, the administrator of WebStresser allegedly was a 19-year-old from Prokuplje, Serbia named Jovan Mirkovic.

Mirkovic, who went by the hacker nickname “m1rk,” also used the alias “Mirkovik Babs” on Facebook where for years he openly discussed his role in programming and ultimately running WebStresser. The last post on Mirkovic’s Facebook page, dated April 3 (the day before the takedown), shows the young hacker sipping what appears to be liquor while bathing. Below that image are dozens of comments left in the past few hours, most of them simply, “RIP.”

Last week, Facebook

Last week, Facebook

The Microsoft updates impact many core Windows components, including the built-in browsers Internet Explorer and Edge, as well as Office, the Microsoft Malware Protection Engine, Microsoft Visual Studio and Microsoft Azure.

The Microsoft updates impact many core Windows components, including the built-in browsers Internet Explorer and Edge, as well as Office, the Microsoft Malware Protection Engine, Microsoft Visual Studio and Microsoft Azure.