Facebook has built some of the most advanced algorithms for tracking users, but when it comes to acting on user abuse reports about Facebook groups and content that clearly violate the company’s “community standards,” the social media giant’s technology appears to be woefully inadequate.

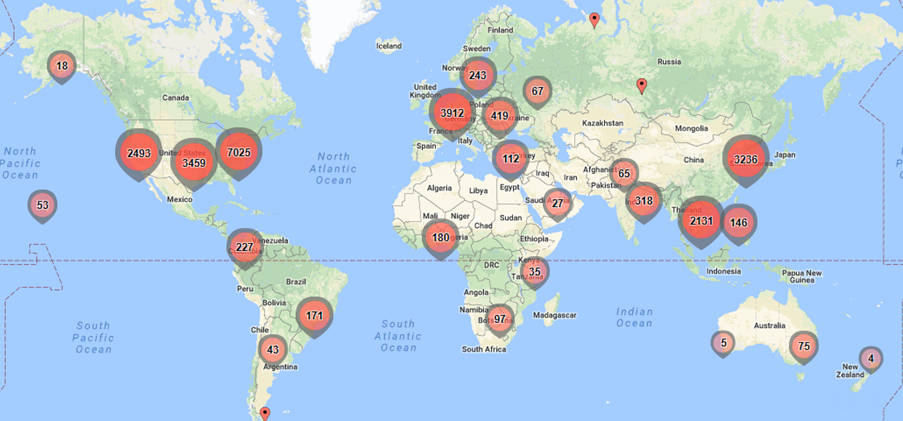

Last week, Facebook deleted almost 120 groups totaling more than 300,000 members. The groups were mostly closed — requiring approval from group administrators before outsiders could view the day-to-day postings of group members.

Last week, Facebook deleted almost 120 groups totaling more than 300,000 members. The groups were mostly closed — requiring approval from group administrators before outsiders could view the day-to-day postings of group members.

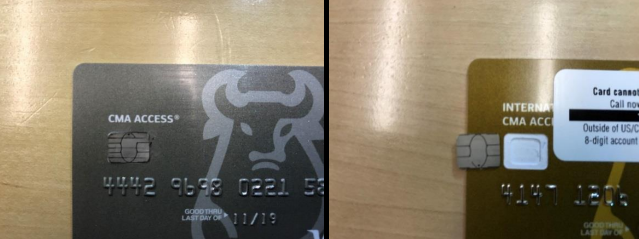

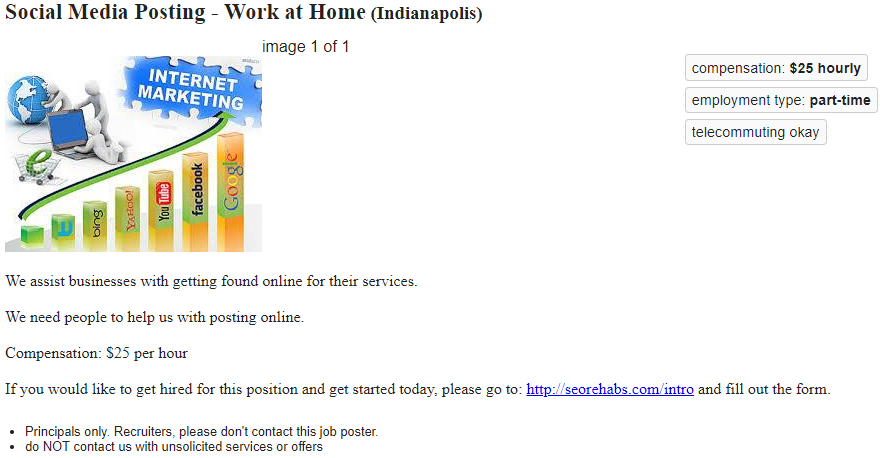

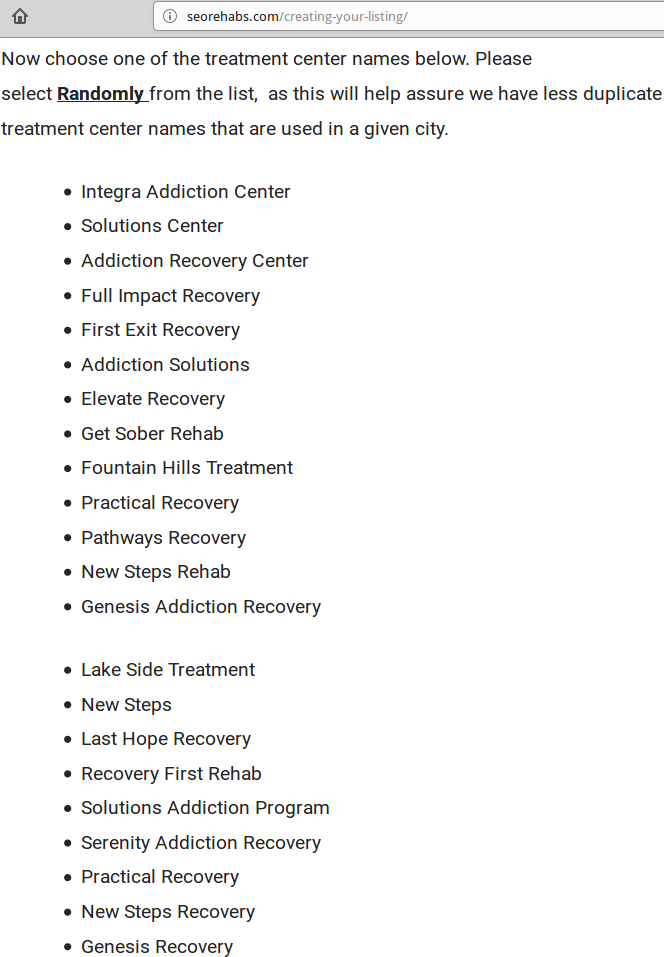

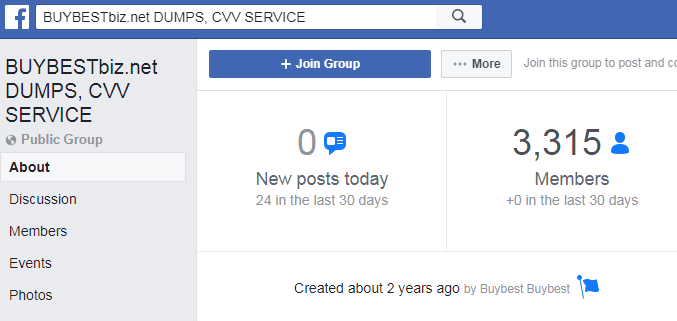

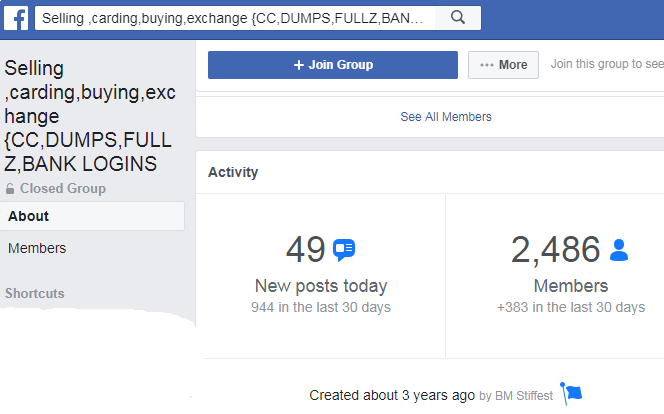

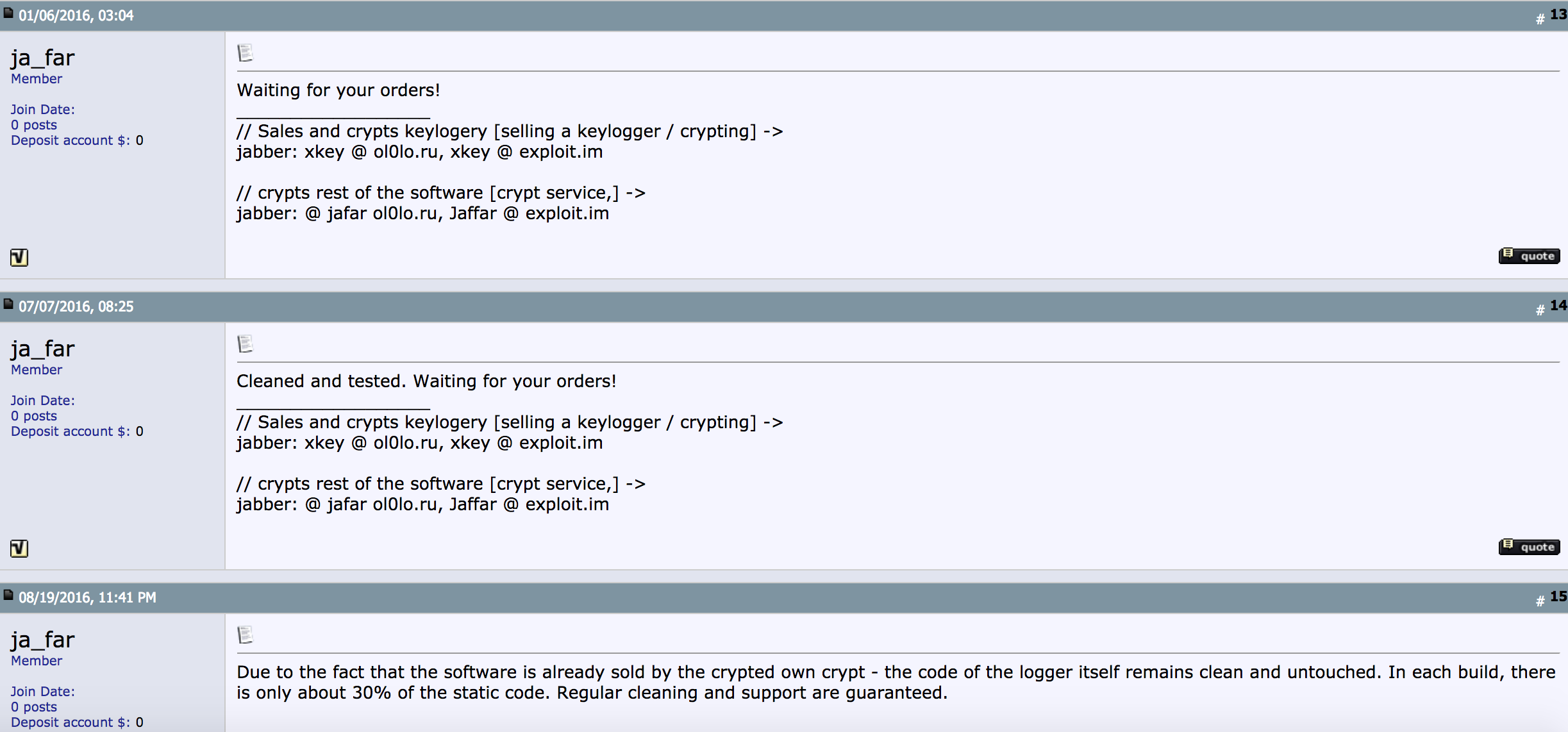

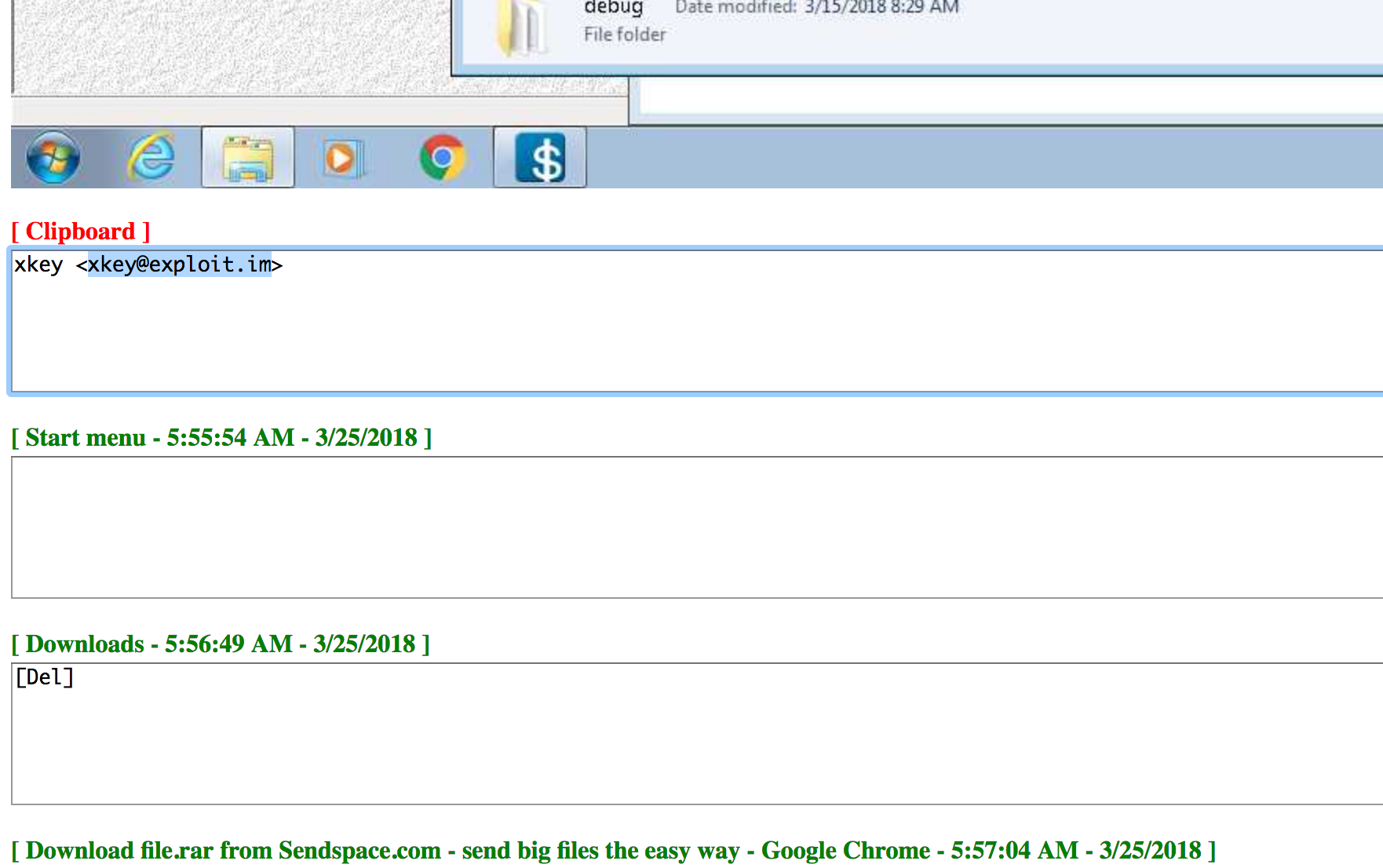

However, the titles, images and postings available on each group’s front page left little doubt about their true purpose: Selling everything from stolen credit cards, identities and hacked accounts to services that help automate things like spamming, phishing and denial-of-service attacks for hire.

To its credit, Facebook deleted the groups within just a few hours of KrebsOnSecurity sharing via email a spreadsheet detailing each group, which concluded that the average length of time the groups had been active on Facebook was two years. But I suspect that the company took this extraordinary step mainly because I informed them that I intended to write about the proliferation of cybercrime-based groups on Facebook.

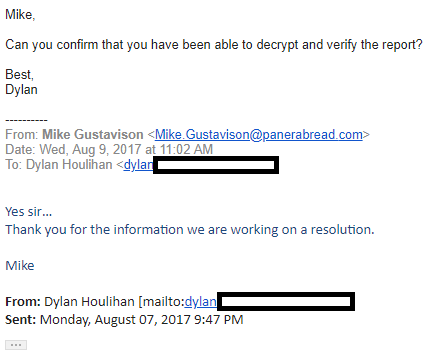

That story, Deleted Facebook Cybercrime Groups had 300,000 Members, ended with a statement from Facebook promising to crack down on such activity and instructing users on how to report groups that violate it its community standards.

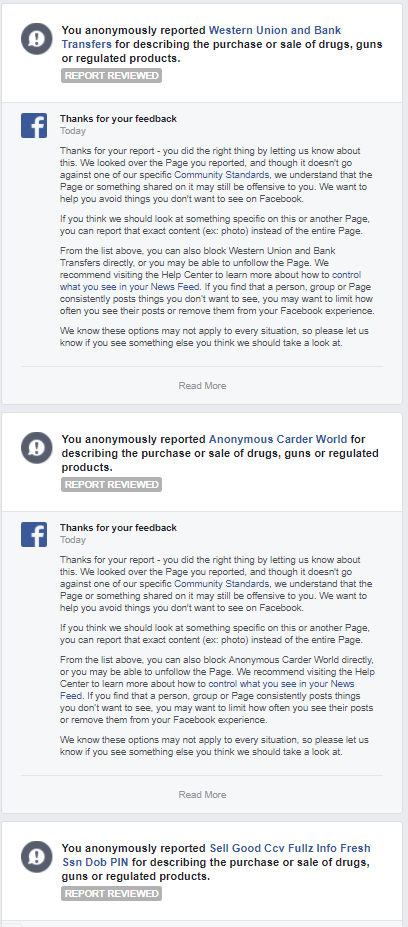

In short order, some of the groups I reported that were removed re-established themselves within hours of Facebook’s action. I decided instead of contacting Facebook’s public relations arm directly that I would report those resurrected groups and others using Facebook’s stated process. Roughly two days later I received a series replies saying that Facebook had reviewed my reports but that none of the groups were found to have violated its standards. Here’s a snippet from those replies:

Perhaps I should give Facebook the benefit of the doubt: Maybe my multiple reports one after the other triggered some kind of anti-abuse feature that is designed to throttle those who would seek to abuse it to get otherwise legitimate groups taken offline — much in the way that pools of automated bot accounts have been known to abuse Twitter’s reporting system to successfully sideline accounts of specific targets.

Or it could be that I simply didn’t click the proper sequence of buttons when reporting these groups. The closest match I could find in Facebook’s abuse reporting system were, “Doesn’t belong on Facebook,” and “Purchase or sale of drugs, guns or regulated products.” There was/is no option for “selling hacked accounts, credit cards and identities,” or anything of that sort.

In any case, one thing seems clear: Naming and shaming these shady Facebook groups via Twitter seems to work better right now for getting them removed from Facebook than using Facebook’s own formal abuse reporting process. So that’s what I did on Thursday. Here’s an example: Continue reading

The Microsoft updates impact many core Windows components, including the built-in browsers Internet Explorer and Edge, as well as Office, the Microsoft Malware Protection Engine, Microsoft Visual Studio and Microsoft Azure.

The Microsoft updates impact many core Windows components, including the built-in browsers Internet Explorer and Edge, as well as Office, the Microsoft Malware Protection Engine, Microsoft Visual Studio and Microsoft Azure.