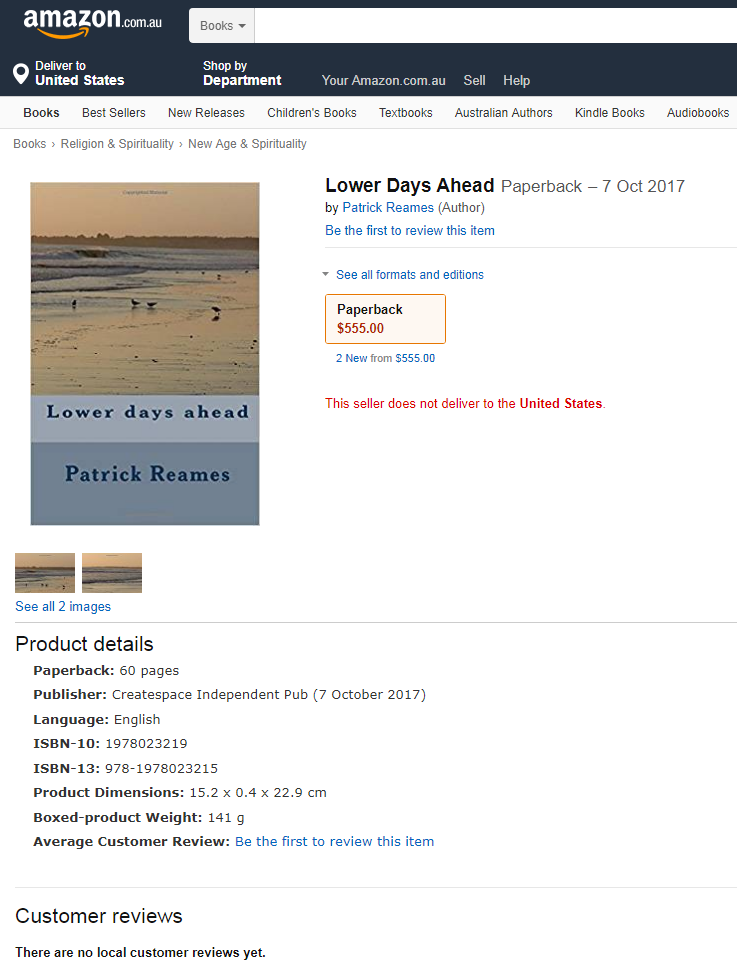

Patrick Reames had no idea why Amazon.com sent him a 1099 form saying he’d made almost $24,000 selling books via Createspace, the company’s on-demand publishing arm. That is, until he searched the site for his name and discovered someone has been using it to peddle a $555 book that’s full of nothing but gibberish.

The phony $555 book sold more than 60 times on Amazon using Patrick Reames’ name and Social Security number.

Reames is a credited author on Amazon by way of several commodity industry books, although none of them made anywhere near the amount Amazon is reporting to the Internal Revenue Service. Nor does he have a personal account with Createspace.

But that didn’t stop someone from publishing a “novel” under his name. That word is in quotations because the publication appears to be little more than computer-generated text, almost like the gibberish one might find in a spam email.

“Based on what I could see from the ‘sneak peak’ function, the book was nothing more than a computer generated ‘story’ with no structure, chapters or paragraphs — only lines of text with a carriage return after each sentence,” Reames said in an interview with KrebsOnSecurity.

The impersonator priced the book at $555 and it was posted to multiple Amazon sites in different countries. The book — which as been removed from most Amazon country pages as of a few days ago — is titled “Lower Days Ahead,” and was published on Oct 7, 2017.

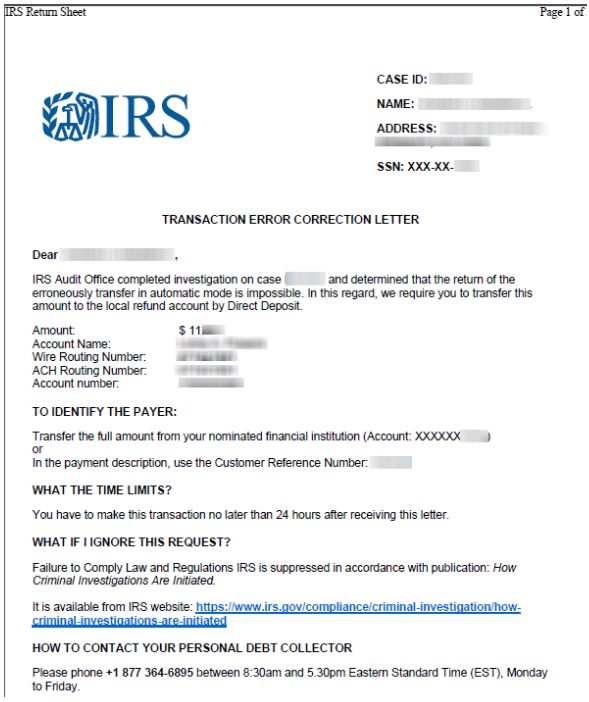

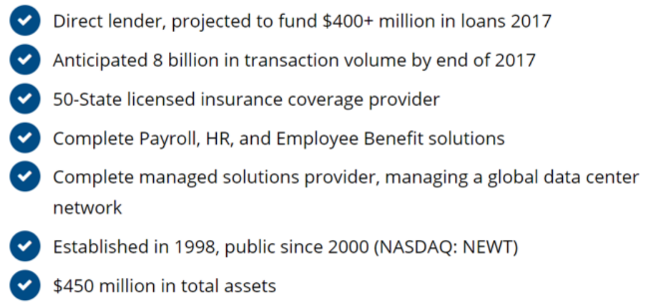

Reames said he suspects someone has been buying the book using stolen credit and/or debit cards, and pocketing the 60 percent that Amazon gives to authors. At $555 a pop, it would only take approximately 70 sales over three months to rack up the earnings that Amazon said he made.

“This book is very unlikely to ever sell on its own, much less sell enough copies in 12 weeks to generate that level of revenue,” Reames said. “As such, I assume it was used for money laundering, in addition to tax fraud/evasion by using my Social Security number. Amazon refuses to issue a corrected 1099 or provide me with any information I can use to determine where or how they were remitting the royalties.”

Reames said the books he has sold on Amazon under his name were done through his publisher, not directly via a personal account (the royalties for those books accrue to his former employer) so he’d never given Amazon his Social Security number. But the fraudster evidently had, and that was apparently enough to convince Amazon that the imposter was him.

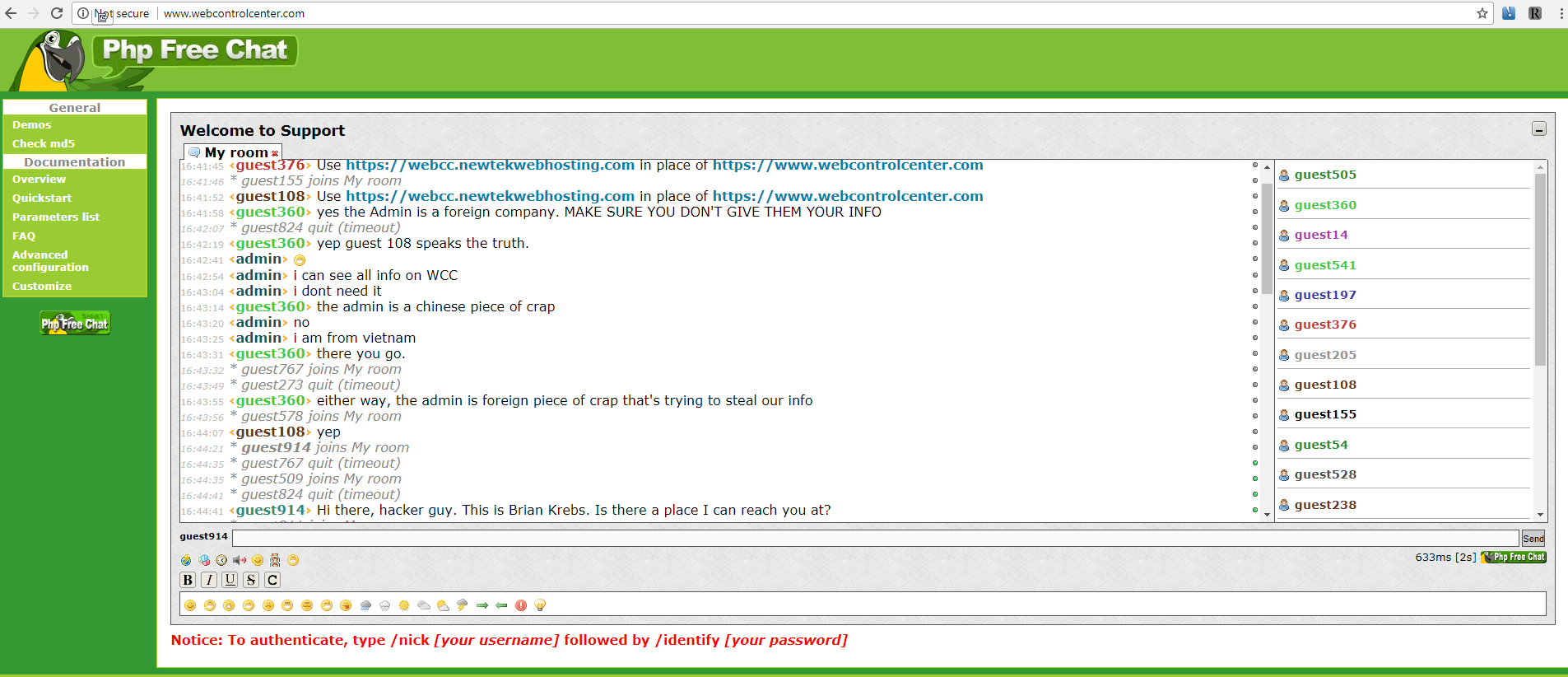

Reames said after learning of the impersonation, he got curious enough to start looking for other examples of author oddities on Amazon’s Createspace platform.

“I have reviewed numerous Createspace titles and its clear to me that there may be hundreds if not thousands of similar fraudulent books on their site,” Reames said. “These books contain no real content, only dozens of pages of gibberish or computer generated text.” Continue reading

February’s Patch Tuesday batch includes fixes for at least 55 security holes. Some of the scarier bugs include vulnerabilities in Microsoft Outlook, Edge and Office that could let bad guys or bad code into your Windows system just by getting you to click on a booby trapped link, document or visit a compromised/hacked Web page.

February’s Patch Tuesday batch includes fixes for at least 55 security holes. Some of the scarier bugs include vulnerabilities in Microsoft Outlook, Edge and Office that could let bad guys or bad code into your Windows system just by getting you to click on a booby trapped link, document or visit a compromised/hacked Web page.

Adobe said a critical vulnerability (CVE-2018-4878) exists in Adobe Flash Player 28.0.0.137 and earlier versions. Successful exploitation could allow an attacker to take control of the affected system.

Adobe said a critical vulnerability (CVE-2018-4878) exists in Adobe Flash Player 28.0.0.137 and earlier versions. Successful exploitation could allow an attacker to take control of the affected system.