Hackers Claim They Breached T-Mobile More Than 100 Times in 2022

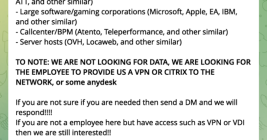

Three different cybercriminal groups claimed access to internal networks at communications giant T-Mobile in more than 100 separate incidents throughout 2022, new data suggests. In each case, the goal of the attackers was the same: Phish T-Mobile employees for access to internal company tools, and then convert that access into a cybercrime service that could be hired to divert any T-Mobile user’s text messages and phone calls to another device.