New research into a notorious Eastern European organized cybercrime gang accused of stealing more than $100 million from banks and businesses worldwide provides an unprecedented, behind-the-scenes look at an exclusive “business club” that dabbled in cyber espionage and worked closely with phantom Chinese firms on Russia’s far eastern border.

In the summer of 2014, the U.S. Justice Department joined multiple international law enforcement agencies and security firms in taking down the Gameover ZeuS botnet, an ultra-sophisticated, global crime machine that infected upwards of a half-million PCs.

Thousands of freelance cybercrooks have used a commercially available form of the ZeuS banking malware for years to siphon funds from Western bank accounts and small businesses. Gameover ZeuS, on the other hand, was a closely-held, customized version secretly built by the ZeuS author himself (following a staged retirement) and wielded exclusively by a cadre of hackers that used the systems in countless online extortion attacks, spam and other illicit moneymaking schemes.

Last year’s takedown of the Gameover ZeuS botnet came just months after the FBI placed a $3 million bounty on the botnet malware’s alleged author — a Russian programmer named Evgeniy Mikhailovich Bogachev who used the hacker nickname “Slavik.” But despite those high-profile law enforcement actions, little has been shared about the day-to-day operations of this remarkably resourceful cybercrime gang.

That changed today with the release of a detailed report from Fox-IT, a security firm based in the Netherlands that secretly gained access to a server used by one of the group’s members. That server, which was rented for use in launching cyberattacks, included chat logs between and among the crime gang’s core leaders, and helped to shed light on the inner workings of this elite group.

The alleged ZeuS Trojan author, Yevgeniy Bogachev, Evgeniy Mikhaylovich Bogachev, a.k.a. “lucky12345”, “slavik”, “Pollingsoon”. Source: FBI.gov “most wanted, cyber.

THE ‘BUSINESS CLUB’

The chat logs show that the crime gang referred to itself as the “Business Club,” and counted among its members a core group of a half-dozen people supported by a network of more than 50 individuals. In true Oceans 11 fashion, each Business Club member brought a cybercrime specialty to the table, including 24/7 tech support technicians, third-party suppliers of ancillary malicious software, as well as those engaged in recruiting “money mules” — unwitting or willing accomplices who could be trained or counted on to help launder stolen funds.

“To become a member of the business club there was typically an initial membership fee and also typically a profit sharing agreement,” Fox-IT wrote. “Note that the customer and core team relationship was entirely built on trust. As a result not every member would directly get full access, but it would take time until all the privileges of membership would become available.”

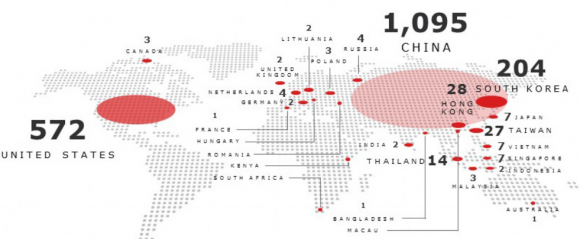

Michael Sandee, a principal security expert at Fox-IT and author of the report, said although Bogachev and several other key leaders of the group were apparently based in or around Krasnodar — a temperate area of Russia on the Black Sea — the crime gang had members that spanned most of Russia’s 11 time zones.

Geographic diversity allowed the group — which mainly worked regular 9-5 hour days Monday through Friday — to conduct their cyberheists against banks by following the rising sun across the globe — emptying accounts at Australia and Asian banks in the morning there, European banks in the afternoon, before handing the operations over to a part of the late afternoon team based in Eastern Europe that would attempt to siphon funds from banks that were just starting their business day in the United States.

“They would go along with the time zone, starting with banks in Australia, then continuing in Asia and following the business day wherever it was, ending the day with [attacks against banks in] the United States,” Sandee said.

![The Web site exposed[dot]su featured the personal data of celebrities and public figures.](https://krebsonsecurity.com/wp-content/uploads/2013/09/ssndob-tor-600x380.png)