We learned some remarkable new details this week about the recent supply-chain attack on VoIP software provider 3CX. The lengthy, complex intrusion has all the makings of a cyberpunk spy novel: North Korean hackers using legions of fake executive accounts on LinkedIn to lure people into opening malware disguised as a job offer; malware targeting Mac and Linux users working at defense and cryptocurrency firms; and software supply-chain attacks nested within earlier supply chain attacks.

Researchers at ESET say this job offer from a phony HSBC recruiter on LinkedIn was North Korean malware masquerading as a PDF file.

In late March 2023, 3CX disclosed that its desktop applications for both Windows and macOS were compromised with malicious code that gave attackers the ability to download and run code on all machines where the app was installed. 3CX says it has more than 600,000 customers and 12 million users in a broad range of industries, including aerospace, healthcare and hospitality.

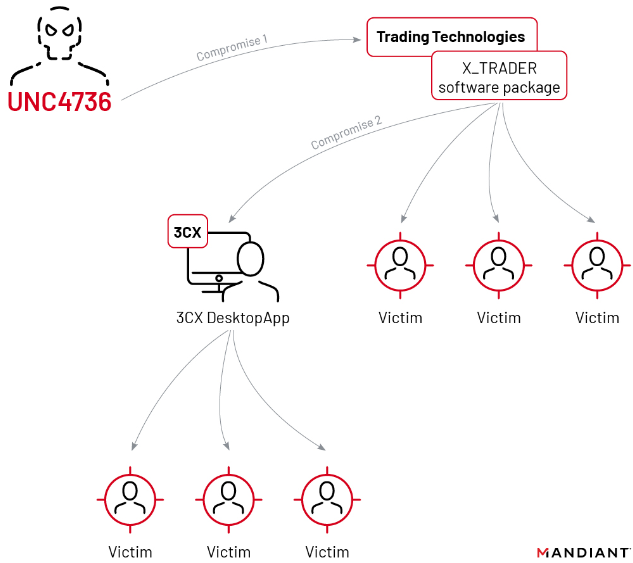

3CX hired incident response firm Mandiant, which released a report on Wednesday that said the compromise began in 2022 when a 3CX employee installed a malware-laced software package distributed via an earlier software supply chain compromise that began with a tampered installer for X_TRADER, a software package provided by Trading Technologies.

“This is the first time Mandiant has seen a software supply chain attack lead to another software supply chain attack,” reads the April 20 Mandiant report.

Mandiant found the earliest evidence of compromise uncovered within 3CX’s network was through the VPN using the employee’s corporate credentials, two days after the employee’s personal computer was compromised.

“Eventually, the threat actor was able to compromise both the Windows and macOS build environments,” 3CX said in an April 20 update on their blog.

Mandiant concluded that the 3CX attack was orchestrated by the North Korean state-sponsored hacking group known as Lazarus, a determination that was independently reached earlier by researchers at Kaspersky Lab and Elastic Security.

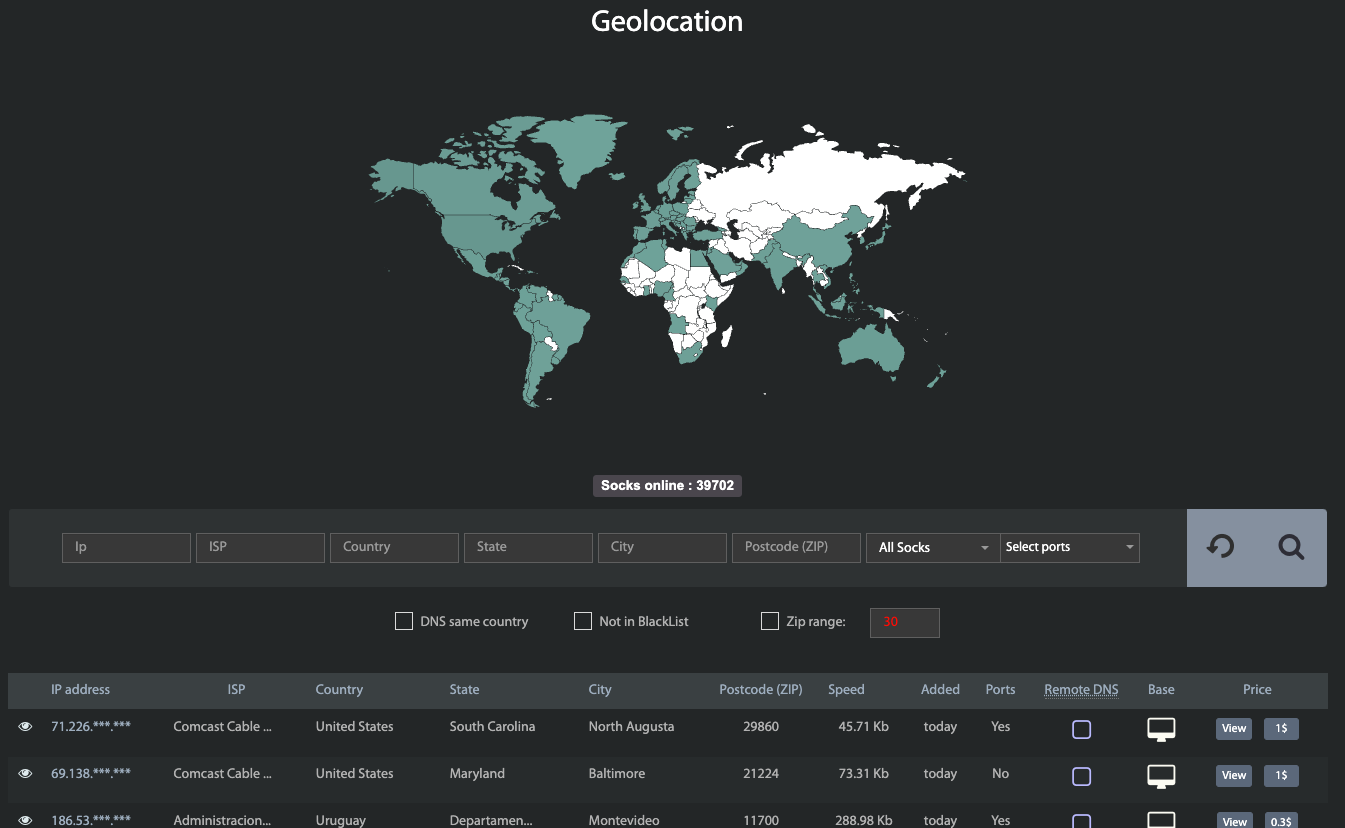

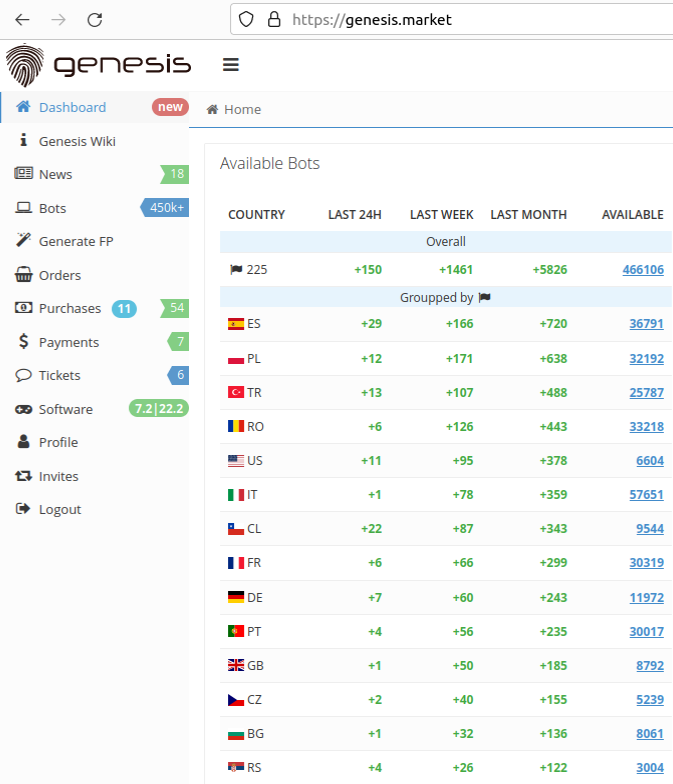

Mandiant found the compromised 3CX software would download malware that sought out new instructions by consulting encrypted icon files hosted on GitHub. The decrypted icon files revealed the location of the malware’s control server, which was then queried for a third stage of the malware compromise — a password stealing program dubbed ICONICSTEALER.

The double supply chain compromise that led to malware being pushed out to some 3CX customers. Image: Mandiant.

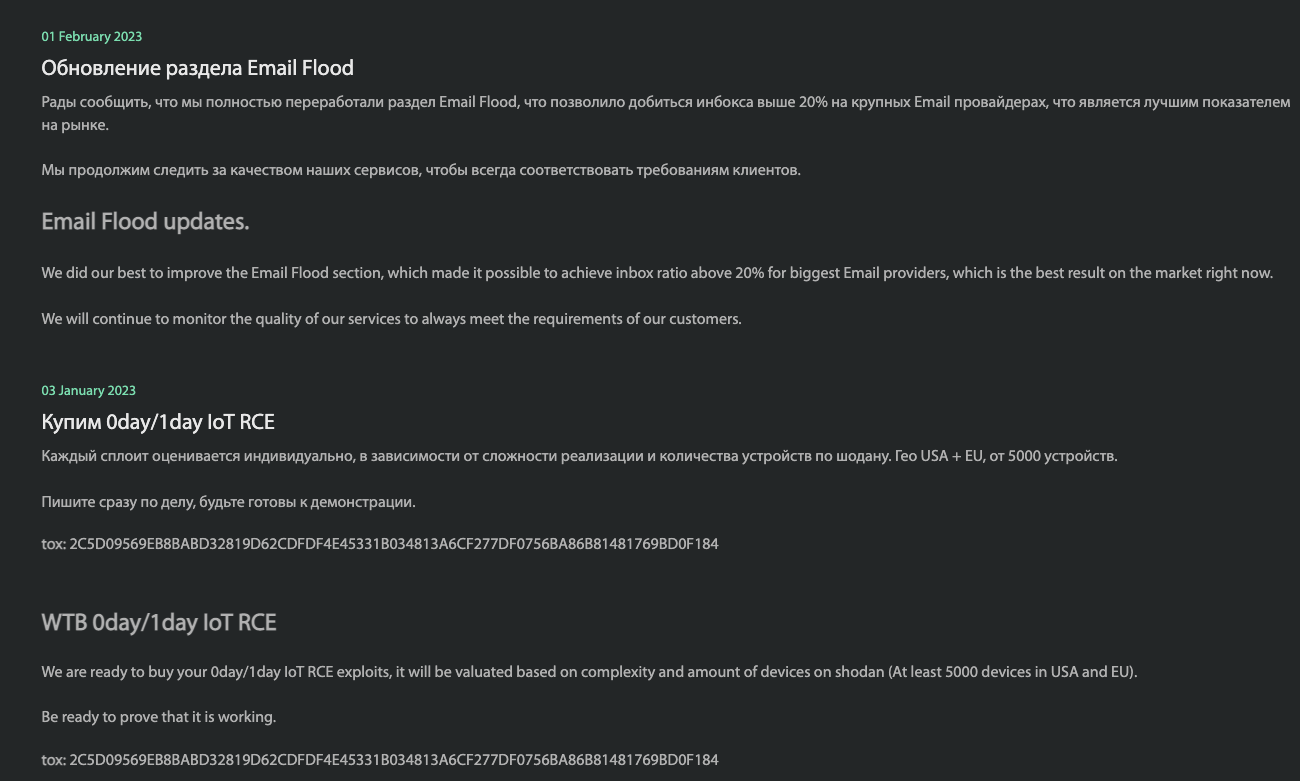

Meanwhile, the security firm ESET today published research showing remarkable similarities between the malware used in the 3CX supply chain attack and Linux-based malware that was recently deployed via fake job offers from phony executive profiles on LinkedIn. The researchers said this was the first time Lazarus had been spotted deploying malware aimed at Linux users.

As reported in a series last summer here, LinkedIn has been inundated this past year by fake executive profiles for people supposedly employed at a range of technology, defense, energy and financial companies. In many cases, the phony profiles spoofed chief information security officers at major corporations, and some attracted quite a few connections before their accounts were terminated.

Mandiant, Proofpoint and other experts say Lazarus has long used these bogus LinkedIn profiles to lure targets into opening a malware-laced document that is often disguised as a job offer. This ongoing North Korean espionage campaign using LinkedIn was first documented in August 2020 by ClearSky Security, which said the Lazarus group operates dozens of researchers and intelligence personnel to maintain the campaign globally.

Microsoft Corp., which owns LinkedIn, said in September 2022 that it had detected a wide range of social engineering campaigns using a proliferation of phony LinkedIn accounts. Microsoft said the accounts were used to impersonate recruiters at technology, defense and media companies, and to entice people into opening a malicious file. Microsoft found the attackers often disguised their malware as legitimate open-source software like Sumatra PDF and the SSH client Putty.

Microsoft attributed those attacks to North Korea’s Lazarus hacking group, although they’ve traditionally referred to this group as “ZINC“. That is, until earlier this month, when Redmond completely revamped the way it names threat groups; Microsoft now references ZINC as “Diamond Sleet.” Continue reading