Hospitals that have been hit by a data breach or ransomware attack can expect to see an increase in the death rate among heart patients in the following months or years because of cybersecurity remediation efforts, a new study posits. Health industry experts say the findings should prompt a larger review of how security — or the lack thereof — may be impacting patient outcomes.

Researchers at Vanderbilt University‘s Owen Graduate School of Management took the Department of Health and Human Services (HHS) list of healthcare data breaches and used it to drill down on data about patient mortality rates at more than 3,000 Medicare-certified hospitals, about 10 percent of which had experienced a data breach.

As PBS noted in its coverage of the Vanderbilt study, after data breaches as many as 36 additional deaths per 10,000 heart attacks occurred annually at the hundreds of hospitals examined.

The researchers found that for care centers that experienced a breach, it took an additional 2.7 minutes for suspected heart attack patients to receive an electrocardiogram.

“Breach remediation efforts were associated with deterioration in timeliness of care and patient outcomes,” the authors found. “Remediation activity may introduce changes that delay, complicate or disrupt health IT and patient care processes.”

Leo Scanlon, former deputy chief information security officer at the HHS, said the findings in this report practically beg for a similar study to be done in the United Kingdom, whose healthcare system was particularly disrupted by the Wannacry virus, a global contagion in May 2017 that spread through a Microsoft Windows vulnerability prevalent in older healthcare systems.

“The exploitation of cybersecurity vulnerabilities is killing people,” Scanlon told KrebsOnSecurity. “There is a lot of possible research that might be unleashed by this study. I believe that nothing less than a congressional investigation will give the subject the attention it deserves.”

A post-mortem on the impact of WannaCry found the outbreak cost U.K. hospitals almost $100 million pounds and caused significant disruption to patient care, such as the cancellation of some 19,000 appointments — including operations — and the disruption of IT systems for at least a third of all U.K. National Health Service (NHS) hospitals and eight percent of general practitioners. In several cases, hospitals in the U.K. were forced to divert emergency room visitors to other hospitals.

But what isn’t yet known is how Wannacry affected mortality rates among heart attack and stroke patients whose ambulances were diverted to other hospitals because of IT system outages related to the malware. Or how many hospitals and practices experienced delays in getting test results back needed to make critical healthcare decisions.

Scanlon said although he’s asked around quite a bit over the years to see if any researchers have taken up the challenge of finding out, and that so far he hasn’t found anyone doing that analysis.

“A colleague who is familiar with large scale healthcare data sets told me that unless you are associated with a research institution, it would be almost impossible to pry that kind of data out of the institutions that have it,” Scanlon said. “The problem is this data is hard to come by — nobody likes to admit that death can be attributable to a non-natural cause like this — and is otherwise considered sensitive at a very high and proprietary level by the institutions that have the facts.”

A study published in the April 2017 edition of The New England Journal of Medicine would seem to suggest applying the approach used by the Vanderbilt researchers to measuring patient outcomes at U.K. hospitals in the wake of Wannacry might be worth carrying out.

In the NEJM study, morbidity and mortality data was used to show that there is a measurable impact when ambulances and emergency response teams are removed from normal service and redirected to standby during public events like marathons and other potential targets of terrorism.

The study found that “medicare beneficiaries who were admitted to marathon-affected hospitals with acute myocardial infarction or cardiac arrest on marathon dates had longer ambulance transport times before noon (4.4 minutes longer) and higher 30-day mortality than beneficiaries who were hospitalized on nonmarathon dates.” Continue reading →

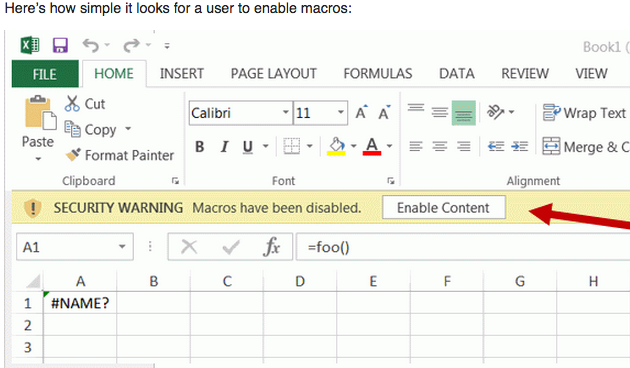

More than a dozen of the flaws tackled in this month’s release are rated “critical,” meaning they involve weaknesses that could be exploited to install malware without any action on the part of the user, except for perhaps browsing to a hacked or malicious Web site or opening a booby-trapped file attachment.

More than a dozen of the flaws tackled in this month’s release are rated “critical,” meaning they involve weaknesses that could be exploited to install malware without any action on the part of the user, except for perhaps browsing to a hacked or malicious Web site or opening a booby-trapped file attachment.

With more than 550 employees, Lawrence Township, N.J.-based Billtrust is a cloud-based service that lets customers view invoices, pay, or request bills via email or fax. In an email sent to customers today, Billtrust said it was consulting with law enforcement officials and with an outside security firm to determine the extent of the breach.

With more than 550 employees, Lawrence Township, N.J.-based Billtrust is a cloud-based service that lets customers view invoices, pay, or request bills via email or fax. In an email sent to customers today, Billtrust said it was consulting with law enforcement officials and with an outside security firm to determine the extent of the breach. Based in the Czech Republic, Avast bills itself as the most popular antivirus vendor on the market, with over 435 million users. In

Based in the Czech Republic, Avast bills itself as the most popular antivirus vendor on the market, with over 435 million users. In