Cybercrooks increasingly are anonymizing their malicious traffic by routing it through residential broadband and wireless data connections. Traditionally, those connections have been mainly hacked computers, mobile phones, or home routers. But this story is about so-called “bulletproof residential VPN services” that appear to be built by purchasing or otherwise acquiring discrete chunks of Internet addresses from some of the world’s largest ISPs and mobile data providers.

In late April 2019, KrebsOnSecurity received a tip from an online retailer who’d seen an unusual number of suspicious transactions originating from a series of Internet addresses assigned to a relatively new Internet provider based in Maryland called Residential Networking Solutions LLC.

Now, this in itself isn’t unusual; virtually every provider has the occasional customers who abuse their access for fraudulent purposes. But upon closer inspection, several factors caused me to look more carefully at this company, also known as “Resnet.”

An examination of the IP address ranges assigned to Resnet shows that it maintains an impressive stable of IP blocks — totaling almost 70,000 IPv4 addresses — many of which had until quite recently been assigned to someone else.

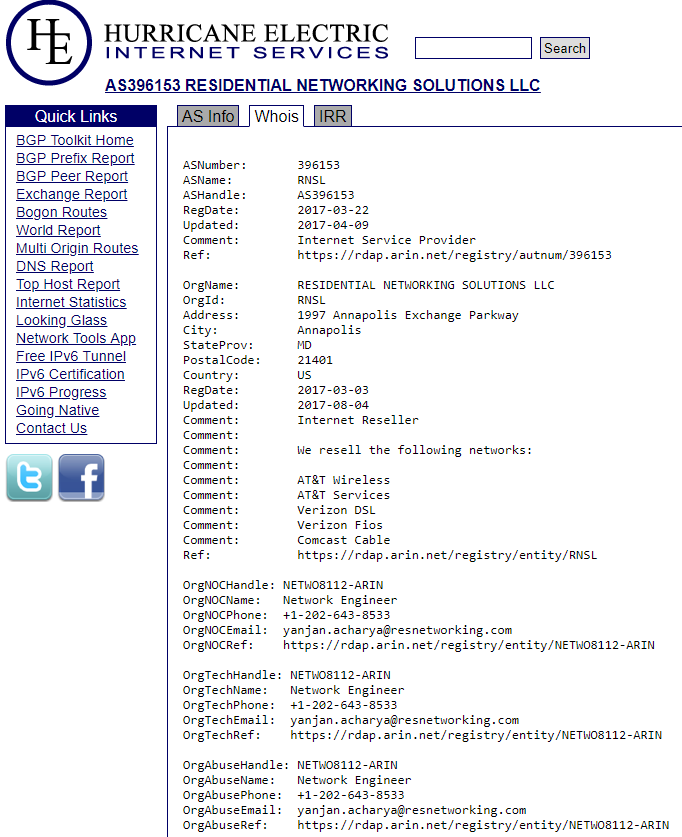

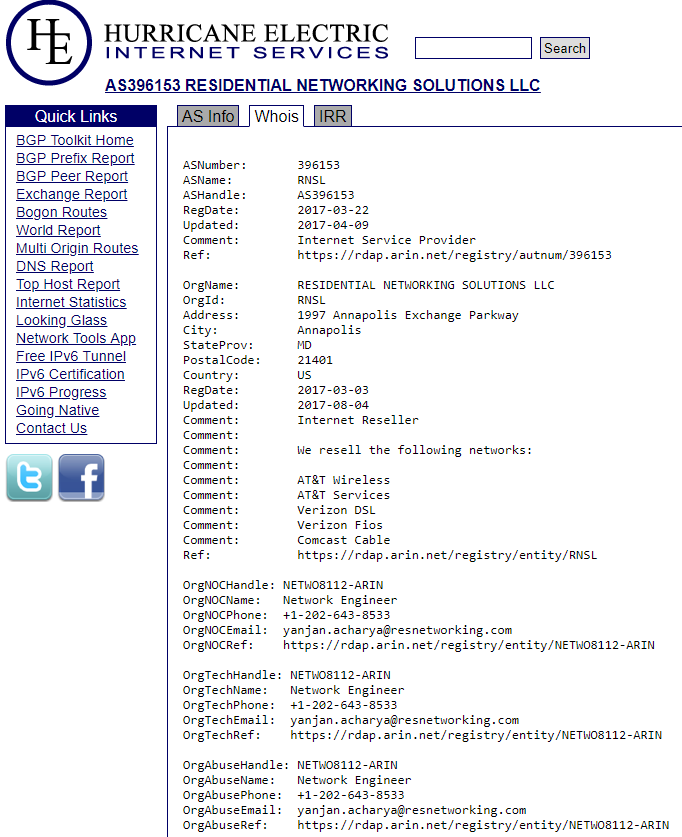

Most interestingly, about ten percent of those IPs — more than 7,000 of them — had until late 2018 been under the control of AT&T Mobility. Additionally, the WHOIS registration records for each of these mobile data blocks suggest Resnet has been somehow reselling data services for major mobile and broadband providers, including AT&T, Verizon, and Comcast Cable.

The WHOIS records for one of several networks associated with Residential Networking Solutions LLC.

Drilling down into the tracts of IPs assigned to Resnet’s core network indicates those 7,000+ mobile IP addresses under Resnet’s control were given the label “Service Provider Corporation” — mostly those beginning with IPs in the range 198.228.x.x.

An Internet search reveals this IP range is administered by the Wireless Data Service Provider Corporation (WDSPC), a non-profit formed in the 1990s to manage IP address ranges that could be handed out to various licensed mobile carriers in the United States.

Back when the WDSPC was first created, there were quite a few mobile wireless data companies. But today the vast majority of the IP space managed by the WDSPC is leased by AT&T Mobility and Verizon Wireless — which have gradually acquired most of their competing providers over the years.

A call to the WDSPC revealed the nonprofit hadn’t leased any new wireless data IP space in more than 10 years. That is, until the organization received a communication at the beginning of this year that it believed was from AT&T, which recommended Resnet as a customer who could occupy some of the company’s mobile data IP address blocks.

“I’m afraid we got duped,” said the person answering the phone at the WDSPC, while declining to elaborate on the precise nature of the alleged duping or the medium that was used to convey the recommendation.

AT&T declined to discuss its exact relationship with Resnet — or if indeed it ever had one to begin with. It responded to multiple questions about Resnet with a short statement that said, “We have taken steps to terminate this company’s services and have referred the matter to law enforcement.”

Why exactly AT&T would forward the matter to law enforcement remains unclear. But it’s not unheard of for hosting providers to forge certain documents in their quest for additional IP space, and anyone caught doing so via email, phone or fax could be charged with wire fraud, which is a federal offense that carries punishments of up to $500,000 in fines and as much as 20 years in prison.

WHAT IS RESNET?

The WHOIS registration records for Resnet’s main Web site, resnetworking[.]com, are hidden behind domain privacy protection. However, a cursory Internet search on that domain turned up plenty of references to it on Hackforums[.]net, a sprawling community that hosts a seemingly never-ending supply of up-and-coming hackers seeking affordable and anonymous ways to monetize various online moneymaking schemes.

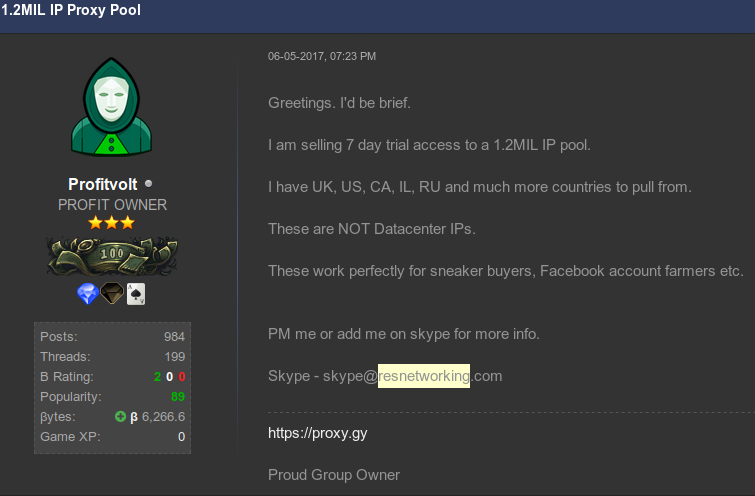

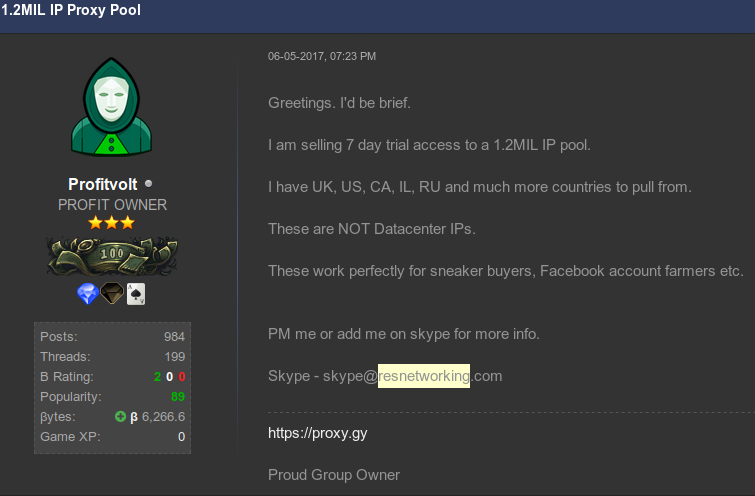

One user in particular — a Hackforums member who goes by the nickname “Profitvolt” — has spent several years advertising resnetworking[.]com and a number of related sites and services, including “unlimited” AT&T 4G/LTE data services, and the immediate availability of more than 1 million residential IPs that he suggested were “perfect for botting, shoe buying.”

The Hackforums user “Profitvolt” advertising residential proxies.

Profitvolt advertises his mobile and residential data services as ideal for anyone who wishes to run “various bots,” or “advertising campaigns.” Those services are meant to provide anonymity when customers are doing things such as automating ad clicks on platforms like Google Adsense and Facebook; generating new PayPal accounts; sneaker bot activity; credential stuffing attacks; and different types of social media spam.

For readers unfamiliar with this term, “shoe botting” or “sneaker bots” refers to the use of automated bot programs and services that aid in the rapid acquisition of limited-release, highly sought-after designer shoes that can then be resold at a profit on secondary markets. All too often, it seems, the people who profit the most in this scheme are using multiple sets of compromised credentials from consumer accounts at online retailers, and/or stolen payment card data.

To say shoe botting has become a thorn in the side of online retailers and regular consumers alike would be a major understatement: A recent State of The Internet Security Report (PDF) from Akamai (an advertiser on this site) noted that such automated bot activity now accounts for almost half of the Internet bandwidth directed at online retailers. The prevalance of shoe botting also might help explain Footlocker‘s recent $100 million investment in goat.com, the largest secondary shoe resale market on the Web.

In other discussion threads, Profitvolt advertises he can rent out an “unlimited number” of so-called “residential proxies,” a term that describes home or mobile Internet connections that can be used to anonymously relay Internet traffic for a variety of dodgy deals.

From a ne’er-do-well’s perspective, the beauty of routing one’s traffic through residential IPs is that few online businesses will bother to block malicious or suspicious activity emanating from them.

That’s because in general the pool of IP addresses assigned to residential or mobile wireless connections cycles intermittently from one user to the next, meaning that blacklisting one residential IP for abuse or malicious activity may only serve to then block legitimate traffic (and e-commerce) from the next user who gets assigned that same IP. Continue reading →

Okay, maybe a trip to the dentist’s office is still preferable. In any case, today is the second Tuesday of the month, which means it’s once again Patch Tuesday (or — depending on your setup and when you’re reading this post — Reboot Wednesday). Microsoft today released patches to fix some 93 vulnerabilities in Windows and related software, 35 of which affect various Server versions of Windows, and another 70 that apply to the Windows 10 operating system.

Okay, maybe a trip to the dentist’s office is still preferable. In any case, today is the second Tuesday of the month, which means it’s once again Patch Tuesday (or — depending on your setup and when you’re reading this post — Reboot Wednesday). Microsoft today released patches to fix some 93 vulnerabilities in Windows and related software, 35 of which affect various Server versions of Windows, and another 70 that apply to the Windows 10 operating system.