Earlier this month, employees at more than 1,000 companies saw one or two paycheck’s worth of funds deducted from their bank accounts after the CEO of their cloud payroll provider absconded with $35 million in payroll and tax deposits from customers. On Monday, the CEO was arrested and allegedly confessed that the diversion was the last desperate gasp of a financial shell game that earned him $70 million over several years.

Michael T. Mann, the 49-year-old CEO of Clifton Park, NY-based MyPayrollHR, was arrested this week and charged with bank fraud. In court filings, FBI investigators said Mann admitted under questioning that in early September — on the eve of a big payroll day — he diverted to his own bank account some $35 million in funds sent by his clients to cover their employee payroll deposits and tax withholdings.

After that stunt, two different banks that work with Mann’s various companies froze those corporate accounts to keep the funds from being moved or withdrawn. That action set off a chain of events that led another financial institution that helps MyPayrollHR process payments to briefly pull almost $26 million out of checking accounts belonging to employees at more than 1,000 companies that use MyPayrollHR.

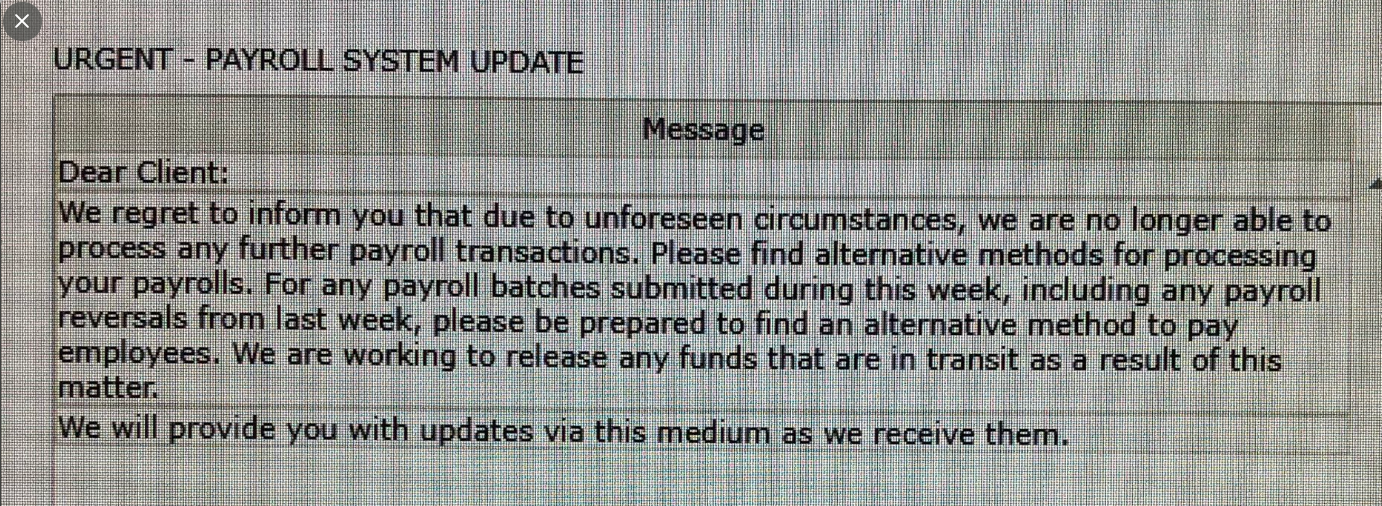

At the same time, MyPayrollHR sent a message (see screenshot above) to clients saying it was shutting down and that customers should find alternative methods for paying employees and for processing payroll going forward.

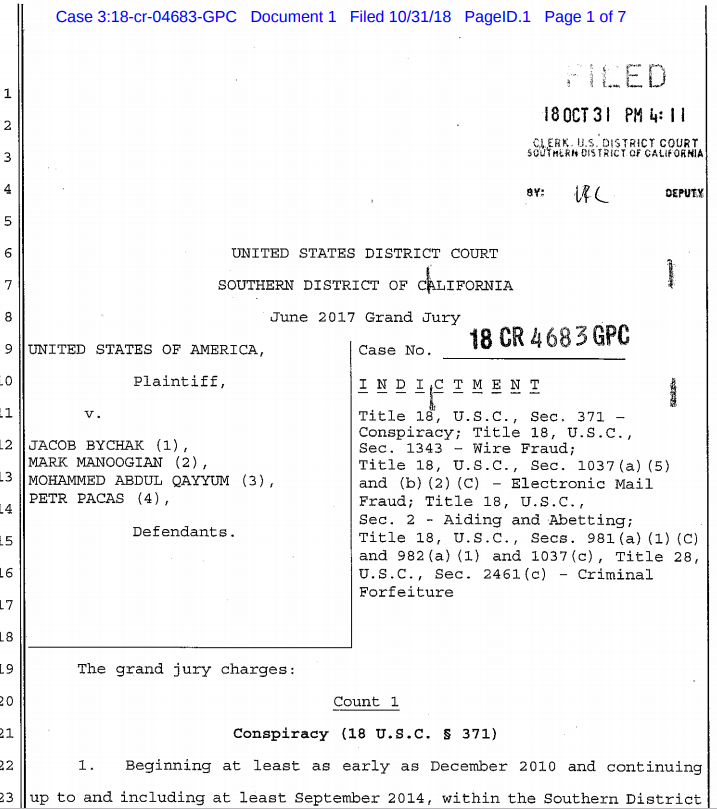

In the criminal complaint against Mann (PDF), a New York FBI agent said the CEO admitted that starting in 2010 or 2011 he began borrowing large sums of money from banks and financing companies under false pretenses.

“While stating that MyPayroll was legitimate, he admitted to creating other companies that had no purpose other than to be used in the fraud; fraudulently representing to banks and financing companies that his fake businesses had certain receivables that they did not have; and obtaining loans and lines of credit by borrowing against these non-existent receivables.”

“Mann estimated that he fraudulently obtained about $70 million that he has not paid back. He claimed that he committed the fraud in response to business and financial pressures, and that he used almost all of the fraudulently obtained funds to sustain certain businesses, and purchase and start new ones. He also admitted to kiting checks between Bank of America and Pioneer [Savings Bank], as part of the fraudulent scheme.”

Check-kiting is the illegal act of writing a check from a bank account without sufficient funds and depositing it into another bank account, explains MagnifyMoney.com. “Then, you withdraw the money from that second account before the original check has been cleared.”

Kiting also is known as taking advantage of the “float,” which is the amount of time between when an individual submits a check as payment and when the individual’s bank is instructed to move the funds from the account. Continue reading

Two of the bugs quashed in this month’s patch batch (

Two of the bugs quashed in this month’s patch batch (