Reporting on the exposure of some 26 million stolen credit cards leaked from a top underground cybercrime store highlighted some persistent and hard truths. Most notably, that the world’s largest financial institutions tend to have a much better idea of which merchants and bank cards have been breached than do the thousands of smaller banks and credit unions across the United States. Also, a great deal of cybercrime seems to be perpetrated by a relatively small number of people.

![]()

In September, an anonymous source sent KrebsOnSecurity a link to a nearly 10 gb set of files that included data for approximately 26 million credit and debit cards stolen from hundreds — if not thousands — of hacked online and brick-and-mortar businesses over the past four years.

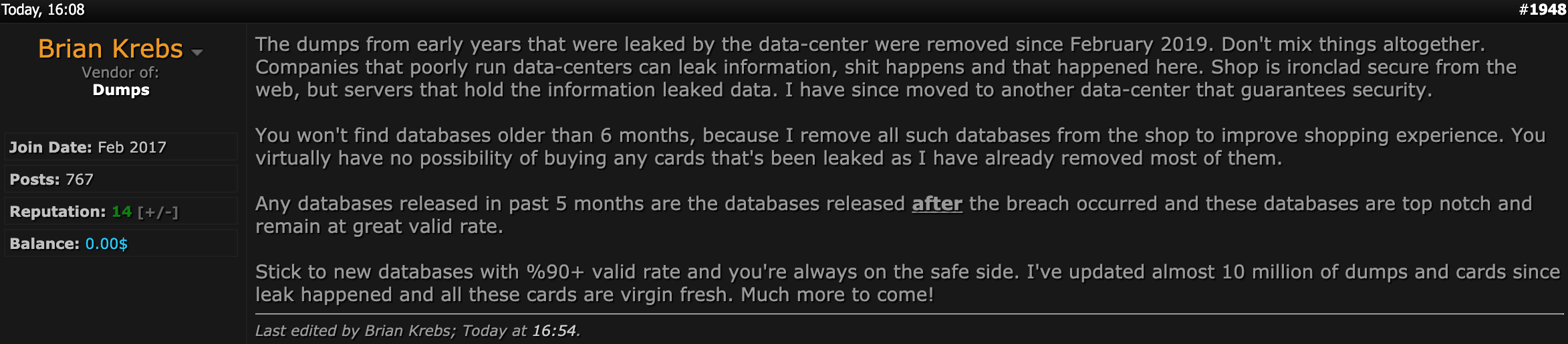

The data was taken from BriansClub, an underground “carding” store that has (ab)used this author’s name, likeness and reputation in its advertising since 2015. The card accounts were stolen by hackers or “resellers” who make a living breaking into payment card systems online and in the real world. Those resellers then share the revenue from any cards sold through BriansClub.

KrebsOnSecurity shared a copy of the BriansClub card database with Gemini Advisory, a New York-based company that monitors BriansClub and dozens of other carding shops to learn when new cards are added.

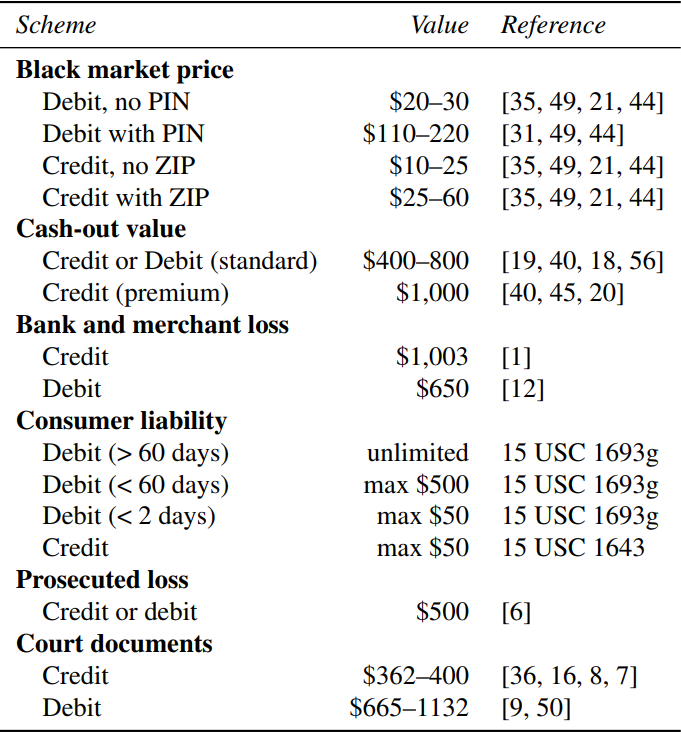

Gemini estimates that the 26 million cards — 46 percent credit cards and 54 percent debit cards — represent almost one-third of the existing 87 million credit and debit card accounts currently for sale in the underground.

“While many of these cards were added in previous years, more than 21.6 million will not expire until after October 2019, offering cybercriminal buyers ample opportunity to cash out these records,” Gemini wrote in an analysis of the BriansClub data shared with this author.

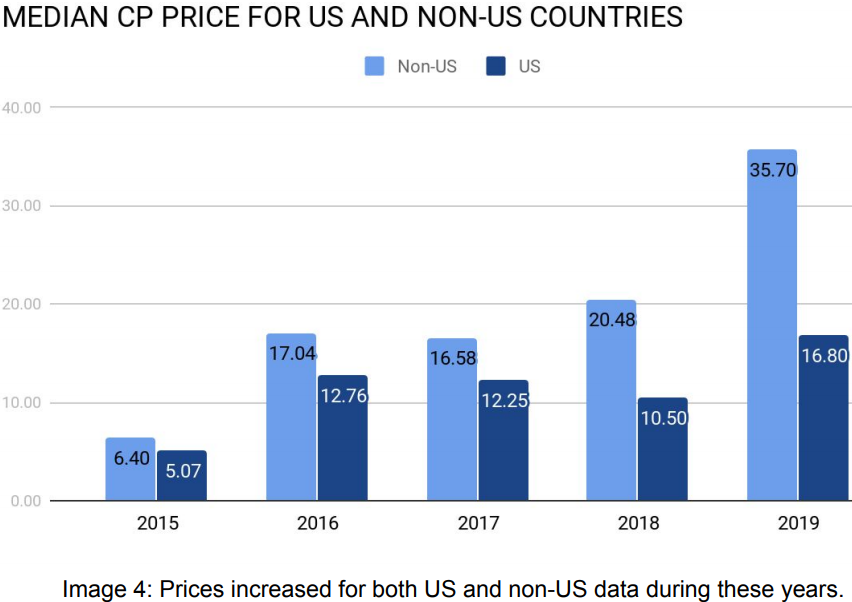

Cards stolen from U.S. residents made up the bulk of the data set (~24 million of the 26+ million cards), and as a result these far more plentiful cards were priced much lower than cards from banks outside the U.S. Between 2016 and 2019, cards stolen from U.S.-based bank customers fetched between $12.76 and $16.80 apiece, while non-U.S. cards were priced between $17.04 and $35.70 during the same period.

Image: Gemini Advisory.

Unfortunately for cybercrime investigators, the person who hacked BriansClub has not released (at least not to this author) any information about the BriansClub users, payments, vendors or resellers. [Side note: This hasn’t stopped an unscrupulous huckster from approaching several of my financial industry sources with unlikely offers of said data in exchange for bitcoin].

But the database does have records of which cards were sold and which resellers (identified only by a unique number) supplied those cards, Gemini found.

“While neither the vendor nor the buyer usernames appeared in this database, they were each assigned ID numbers,” Gemini wrote. “This allowed analysts to determine how prolific certain threat actors were on BriansClub and derive relevant metrics from this data.”

According to Gemini, there were 142 resellers and more than 50,000 buyers of the card data sold through BriansClub. These buyers purchased at least 9 million of the 27.2 million cards available. Continue reading

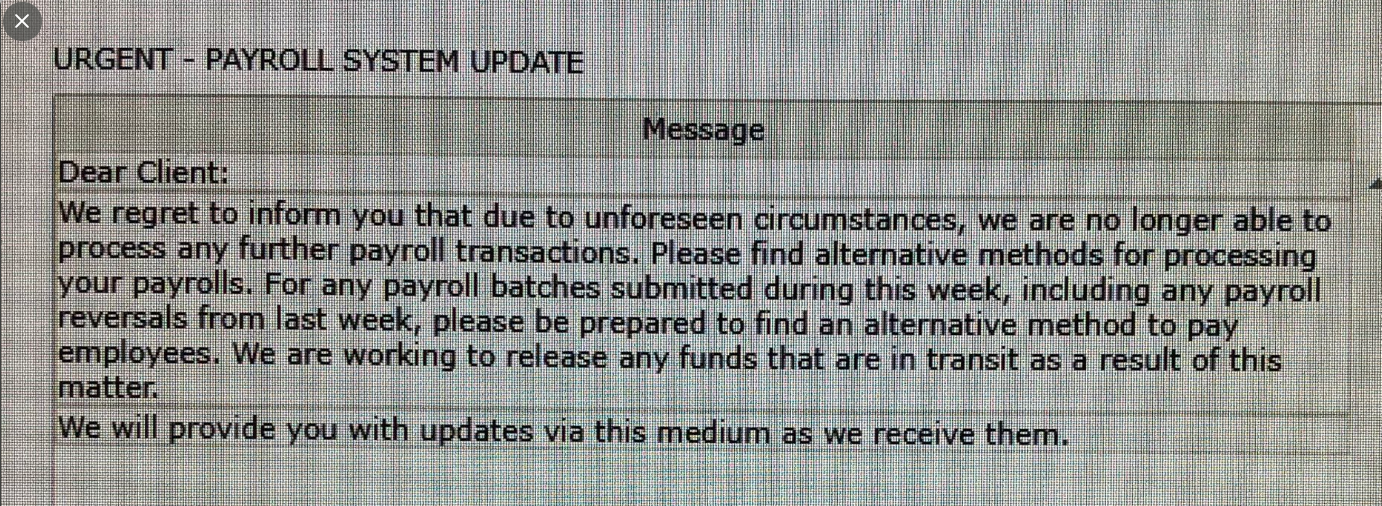

With more than 550 employees, Lawrence Township, N.J.-based Billtrust is a cloud-based service that lets customers view invoices, pay, or request bills via email or fax. In an email sent to customers today, Billtrust said it was consulting with law enforcement officials and with an outside security firm to determine the extent of the breach.

With more than 550 employees, Lawrence Township, N.J.-based Billtrust is a cloud-based service that lets customers view invoices, pay, or request bills via email or fax. In an email sent to customers today, Billtrust said it was consulting with law enforcement officials and with an outside security firm to determine the extent of the breach. Based in the Czech Republic, Avast bills itself as the most popular antivirus vendor on the market, with over 435 million users. In

Based in the Czech Republic, Avast bills itself as the most popular antivirus vendor on the market, with over 435 million users. In

Happily, only about 15 percent of the bugs patched this week earned Microsoft’s most dire “critical” rating. Microsoft labels flaws critical when they could be exploited by miscreants or malware to seize control over a vulnerable system without any help from the user.

Happily, only about 15 percent of the bugs patched this week earned Microsoft’s most dire “critical” rating. Microsoft labels flaws critical when they could be exploited by miscreants or malware to seize control over a vulnerable system without any help from the user.