xAI Dev Leaks API Key for Private SpaceX, Tesla LLMs

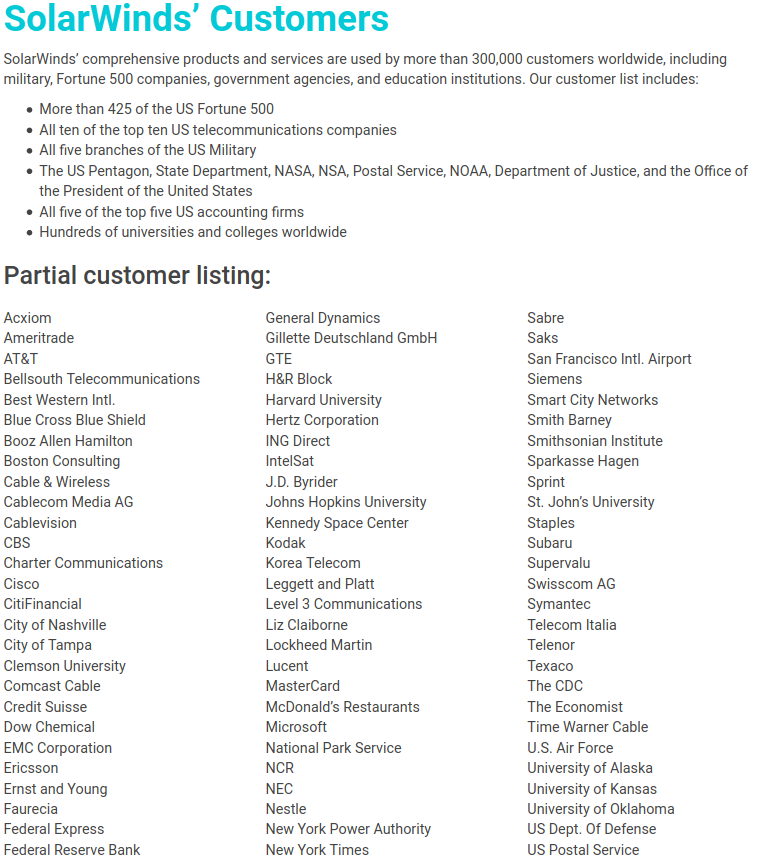

A employee at Elon Musk’s artificial intelligence company xAI leaked a private key on GitHub that for the past two months could have allowed anyone to query private xAI large language models (LLMs) which appear to have been custom made for working with internal data from Musk’s companies, including SpaceX, Tesla and Twitter/X, KrebsOnSecurity has learned.