An alleged top boss of a Romanian crime syndicate that U.S. authorities say is responsible for deploying card-skimming devices at Automated Teller Machines (ATMs) throughout North America was arrested in Mexico last week on firearms charges. The arrest comes months after the accused allegedly ordered the execution of a former bodyguard who was trying to help U.S. authorities bring down the group’s lucrative skimming operations.

On Mar. 31, police in Cancun, Mexico arrested two Romanian men, identified only as 42-year-old “Florian N” and 37-year-old “Adrian Nicholae N,” 37, for the possession of an illegal firearm and cash totaling nearly 500,000 pesos (~USD $26,000) in both American and Mexican denominations.

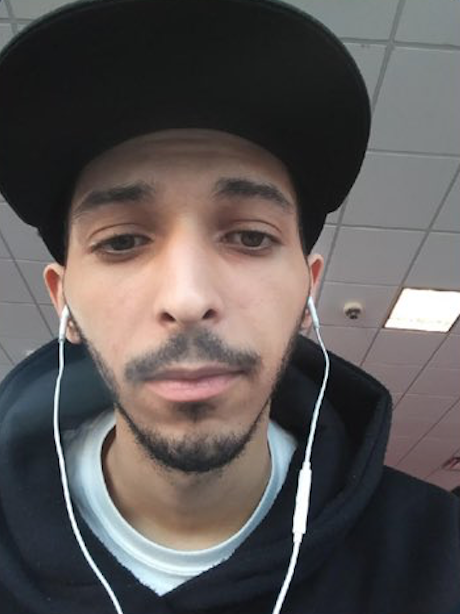

An uncaptioned photo published by the Mexican police. According to multiple sources, the individual on the left is Intacash boss Florian Tudor, along with his deputy Nicholae Cosmin.

The two men’s faces were partially obscured in the mugshots released to Mexican media. But according to multiple sources familiar with the investigation, the older man arrested (pictured on the left) is Florian “The Shark” Tudor, reputed to be in charge of a relatively new ATM company based in Mexico called Intacash. The man on the right has been identified as Nicolae Cosmin, Tudor’s deputy.

Intacash was the central focus of a three–part investigation KrebsOnSecurity published in September 2015. That story tracked the activities of a crime gang that was bribing and otherwise coercing ATM technicians to install sophisticated Bluetooth-based skimmers inside cash machines throughout popular tourist destinations in and around Mexico’s Yucatan Peninsula — including Cancun, Cozumel, Playa del Carmen and Tulum.

Meanwhile, Intcash’s machines were about the only ATMs in top tourist spots in Mexico that weren’t getting compromised with these bluetooth skimming devices.

Law enforcement and ATM industry sources cited in that story said they believe Intacash is controlled by Romanian nationals and that its key principals were the ones paying ATM technicians to compromise machines at competing ATM providers.

As I discovered in reporting that series, it was possible to tell which ATMs were compromised in Mexico’s top tourist spots just by approaching each with a smart phone and looking for the presence of a Bluetooth signal beaconing out a wireless network with the name “Free2Move”.

This functionality allowed the crime syndicate to siphon credit and debit card details and PINs from hacked ATMs wirelessly, without ever again having to touch the compromised machines (see the video below for more on that investigation).

In April 2018, KrebsOnSecurity heard from a Romanian person who claimed to have been working for Intacash. This individual seemed extremely concerned for their safety, but at the same time eager to share details about the company’s operations and owners.

The source shared photographs of Intacash’s chief deputies, as well as screenshots of card data allegedly hoovered up by the company’s various skimming operations. The source repeatedly told me the Romanian gang was paying large sums of money to Mexican authorities to stay off their radar.

The last time I heard from that source was June 2018, just after a like-minded associate at Intacash was found shot dead in his car. The associate, 44-year-old Sorinel Constantin Marcu, was already wanted on a warrant from Interpol, the international criminal police organization.

In 2014, a Romanian court issued a criminal warrant for Marcu on allegations of attempted murder back in his hometown of Craiova, Romanian’s 6th-largest city. But Marcu was able to flee to Mexico before he could be tried. The court later convicted Marcu in abstentia, leveling a sentence of eight years in prison.

On the evening of June 11, 2018, Marcu was shot in the head, reportedly while trying to kidnap a businessman in Mexico, according to multiple media accounts. A street surveillance video of the incident published by Romanian daily Gazeta de SUD shows a Dodge Nitro allegedly driven by Marcu hitting the businessman’s parked car.

The businessman manages to flee, and the passenger in Marcu’s vehicle briefly starts after him, before returning to the picture a few seconds later. Marcu’s passenger gets back in the vehicle, which then moves out of view of the security camera.

“Later, one of the businessman’s guards came out of the house and shot several gun shots in the car driven by Marcu, and he was killed on the spot,” Gazeta reported. Continue reading

One interesting patch from Microsoft this week comes in response to a

One interesting patch from Microsoft this week comes in response to a