‘Operation Endgame’ Hits Malware Delivery Platforms

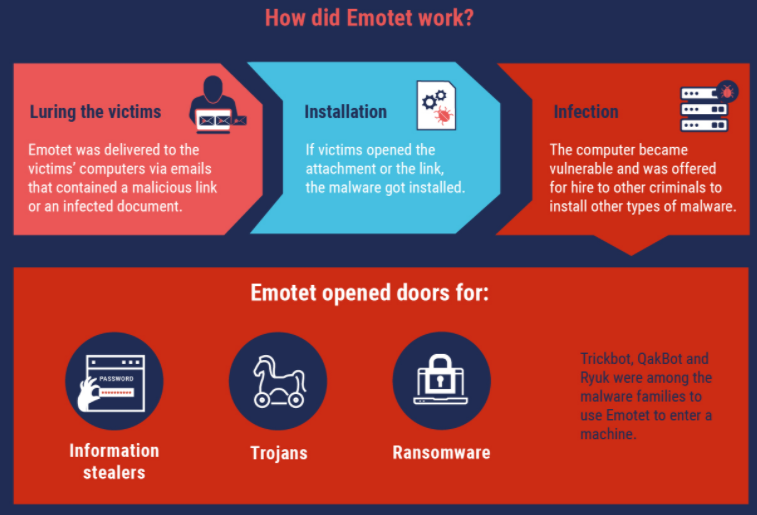

Law enforcement agencies in the United States and Europe today announced Operation Endgame, a coordinated action against some of the most popular cybercrime platforms for delivering ransomware and data-stealing malware. Dubbed “the largest ever operation against botnets,” the international effort is being billed as the opening salvo in an ongoing campaign targeting advanced malware “droppers” or “loaders” like IcedID, Smokeloader and Trickbot.