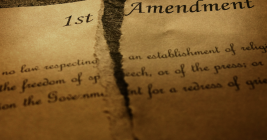

How Each Pillar of the 1st Amendment is Under Attack

In an address to Congress this month, President Trump claimed he had “brought free speech back to America.” But barely two months into his second term, the president has waged an unprecedented attack on the First Amendment rights of journalists, students, universities, government workers, lawyers and judges.

This story explores a slew of recent actions by the Trump administration that threaten to undermine all five pillars of the First Amendment to the U.S. Constitution, which guarantees freedoms concerning speech, religion, the media, the right to assembly, and the right to petition the government and seek redress for wrongs.